Monday Market Update: Chinese Stocks Start The Week Down

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Monday Market Update: Chinese Stocks Start the Week Down

Shanghai and Shenzhen shed value, impacting global markets. Monday's Asian market open saw a significant downturn in Chinese stocks, sending ripples across global financial markets. The Shanghai Composite Index and the Shenzhen Component Index both experienced notable declines, prompting concerns about the health of the Chinese economy and its impact on international investors. This downturn comes amidst ongoing regulatory uncertainty and a slowing growth rate in the world's second-largest economy.

What Drove the Decline?

Several factors contributed to the slump in Chinese stocks on Monday. These include:

-

Regulatory Concerns: The ongoing regulatory crackdown on various sectors, particularly technology and education, continues to weigh heavily on investor sentiment. Uncertainty surrounding future regulations keeps many investors hesitant to commit significant capital. This regulatory uncertainty has been a persistent theme throughout 2023, impacting investor confidence and market stability.

-

Economic Slowdown: China's economic growth has slowed considerably in recent quarters, impacted by strict Covid-19 lockdowns earlier in the year and weakening global demand. Concerns about a potential hard landing are fueling investor anxieties, leading to a sell-off in riskier assets, including Chinese stocks. Economic data released last week further fueled these concerns, showing weaker-than-expected growth in key sectors.

-

Global Market Sentiment: The broader global economic outlook also plays a significant role. Rising inflation, interest rate hikes by major central banks, and geopolitical tensions are all contributing to a more cautious global investment environment. This negative sentiment spills over into emerging markets like China, exacerbating the sell-off.

Impact on Global Markets:

The decline in Chinese stocks had a noticeable impact on global markets. Other Asian markets also experienced declines, while European and US futures showed signs of weakness in anticipation of the opening bell. The interconnected nature of global finance means that significant movements in one major market can quickly influence others. This interconnectedness highlights the importance of keeping a close eye on developments in the Chinese market.

What to Watch For:

Investors will be closely monitoring several key indicators in the coming days and weeks to gauge the extent of the downturn and its potential longevity. These include:

-

Further Economic Data Releases: Any upcoming economic data releases from China will be scrutinized for clues about the health of the economy and the effectiveness of government stimulus measures.

-

Government Policy Responses: The response of the Chinese government to the slowing economy will be crucial. Further stimulus measures could help to boost investor confidence, while inaction could worsen the situation.

-

Global Market Trends: The overall global economic outlook will also continue to influence investor sentiment towards Chinese stocks.

Conclusion:

Monday's downturn in Chinese stocks serves as a reminder of the significant challenges facing the Chinese economy and the interconnectedness of global financial markets. While short-term volatility is to be expected, the underlying issues of regulatory uncertainty and economic slowdown require careful observation. Investors should adopt a cautious approach and closely monitor developments in the coming weeks. This market correction underscores the need for diversified investment portfolios and a long-term investment strategy that accounts for geopolitical and macroeconomic risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Monday Market Update: Chinese Stocks Start The Week Down. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

El Salvador Bitget Secures Key Operating License Bolsters Crypto Presence

Apr 07, 2025

El Salvador Bitget Secures Key Operating License Bolsters Crypto Presence

Apr 07, 2025 -

Bth Mbashr Hsry Brshlwnt Dd Ryal Bytys Aldwry Alisbany

Apr 07, 2025

Bth Mbashr Hsry Brshlwnt Dd Ryal Bytys Aldwry Alisbany

Apr 07, 2025 -

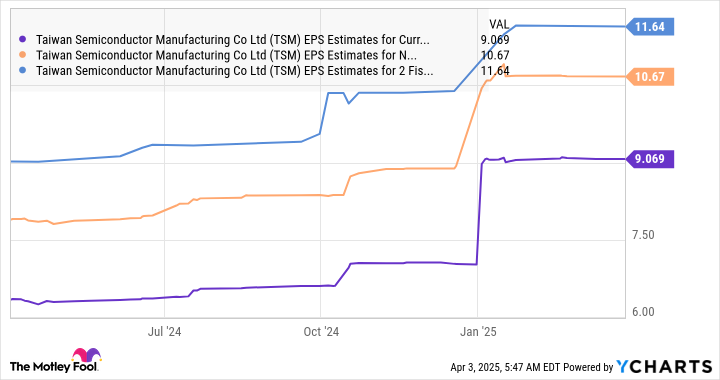

Ai Stock Plummets 25 Buy Before April 17

Apr 07, 2025

Ai Stock Plummets 25 Buy Before April 17

Apr 07, 2025 -

25 000 Tesla By 2025 Inside Teslas Factory Transformations

Apr 07, 2025

25 000 Tesla By 2025 Inside Teslas Factory Transformations

Apr 07, 2025 -

Real Madrid Vs Psg Champions League Quarterfinal Showdowns Loom

Apr 07, 2025

Real Madrid Vs Psg Champions League Quarterfinal Showdowns Loom

Apr 07, 2025