MOODENG Price Soars Post-Robinhood Listing: Breakout Potential?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MOODENG Price Soars Post-Robinhood Listing: Breakout Potential?

MOODENG's stock price has experienced a dramatic surge following its listing on the popular trading platform, Robinhood. This unexpected jump has investors buzzing, prompting questions about the company's future and the potential for further growth. The addition to Robinhood, known for its accessibility and user-friendly interface, has undoubtedly broadened MOODENG's reach to a significantly larger pool of retail investors. But is this price surge a sustainable trend, or just a fleeting moment of hype? Let's delve deeper.

Understanding the MOODENG Rally

The recent price increase isn't solely attributable to the Robinhood listing. While the increased accessibility undoubtedly played a significant role, several underlying factors likely contributed to the surge:

- Increased Market Interest: The addition to Robinhood has brought MOODENG to the attention of a broader, less sophisticated investor base. This newfound visibility translates into increased trading volume and heightened demand.

- Positive Analyst Sentiment: Several financial analysts have issued positive ratings for MOODENG, citing its strong growth potential and innovative business model. These optimistic forecasts further fueled investor enthusiasm.

- Strong Q[Insert Quarter] Earnings Report: [Optional: If applicable, include details about a recent strong earnings report. For example: "The company's recently released Q3 earnings report exceeded expectations, showcasing impressive revenue growth and a narrowing of net losses." This adds factual weight to the analysis.]

- Growing Sector: The [insert MOODENG's sector, e.g., fintech, biotech, renewable energy] sector is experiencing significant growth, providing a favorable tailwind for companies like MOODENG.

Breakout Potential: A Closer Look

While the recent price surge is undeniably exciting, it's crucial to approach any investment decisions with caution. The question remains: is this a genuine breakout, or a temporary bubble? Several factors need consideration:

- Valuation: Investors need to carefully assess MOODENG's current valuation against its future growth prospects. Is the current price justified by the company's fundamentals, or is it overvalued?

- Competition: MOODENG operates in a competitive market. Understanding its competitive advantages and its ability to maintain market share is crucial.

- Long-Term Strategy: A thorough analysis of MOODENG's long-term business strategy and its ability to execute its plans is essential for assessing its long-term viability.

Risks and Considerations for Investors

Investing in MOODENG, or any stock experiencing rapid growth, carries inherent risks. These include:

- Volatility: Rapid price movements are characteristic of volatile stocks. Investors should be prepared for potential losses.

- Market Corrections: Broader market downturns can significantly impact even the most promising companies.

- Regulatory Changes: Changes in regulations could negatively affect MOODENG's operations and profitability.

Conclusion: Proceed with Caution and Due Diligence

The MOODENG price surge post-Robinhood listing is undoubtedly noteworthy. However, investors should avoid impulsive decisions driven solely by hype. Thorough due diligence, including a careful analysis of the company's financials, competitive landscape, and long-term strategy, is paramount before making any investment decisions. While the potential for further growth exists, understanding the risks involved is crucial for responsible investing. Consult with a qualified financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MOODENG Price Soars Post-Robinhood Listing: Breakout Potential?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Margot Robbies Postpartum Transformation A Malibu Beach Display

May 25, 2025

Margot Robbies Postpartum Transformation A Malibu Beach Display

May 25, 2025 -

Llnls National Ignition Facility Funding Progress On The 2 6 Mj Laser Fusion Upgrade

May 25, 2025

Llnls National Ignition Facility Funding Progress On The 2 6 Mj Laser Fusion Upgrade

May 25, 2025 -

Breaking News The Wheel Of Time Future Uncertain Coen Brothers New Film And Cannes Winners Announced

May 25, 2025

Breaking News The Wheel Of Time Future Uncertain Coen Brothers New Film And Cannes Winners Announced

May 25, 2025 -

Billy Joels Brain Disorder Concerts Cancelled Fans React

May 25, 2025

Billy Joels Brain Disorder Concerts Cancelled Fans React

May 25, 2025 -

Birmingham Pride 2025 Essential Travel Information Road Closures Bus And Metro Services

May 25, 2025

Birmingham Pride 2025 Essential Travel Information Road Closures Bus And Metro Services

May 25, 2025

Latest Posts

-

Mukul Dev Former Model And Actor Passes Away At 54

May 25, 2025

Mukul Dev Former Model And Actor Passes Away At 54

May 25, 2025 -

Disney Passes On Ryan Reynolds R Rated Star Wars Vision

May 25, 2025

Disney Passes On Ryan Reynolds R Rated Star Wars Vision

May 25, 2025 -

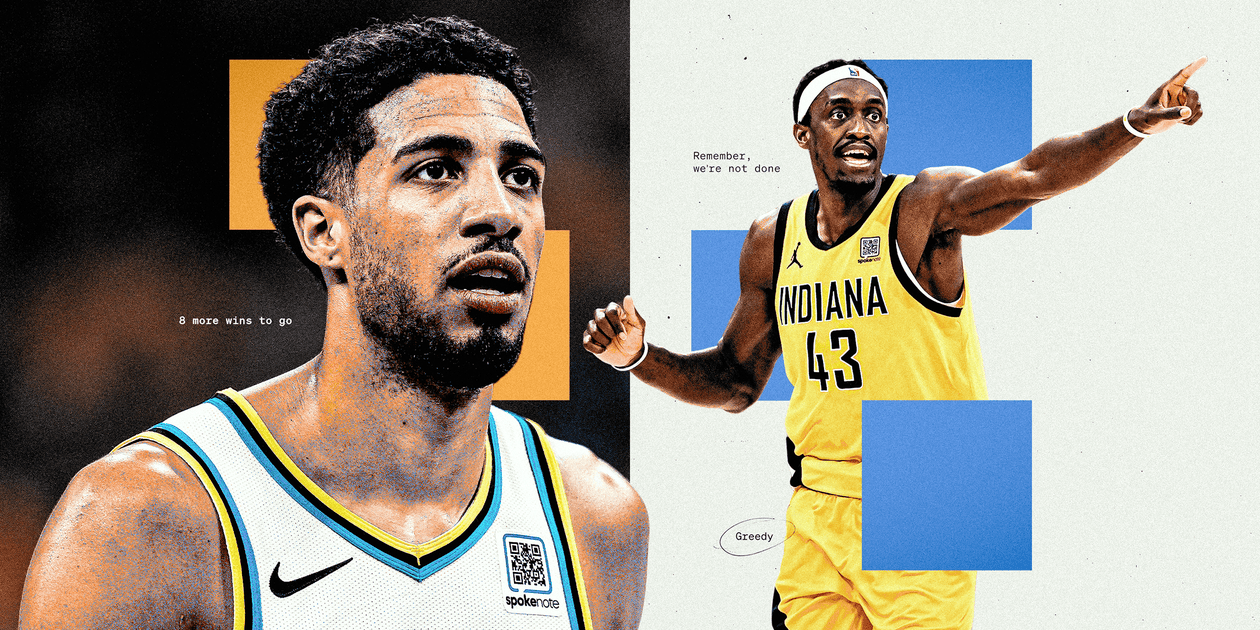

Nba Playoffs Pacers Drive For A Championship

May 25, 2025

Nba Playoffs Pacers Drive For A Championship

May 25, 2025 -

The Unexpected Comedy Of Mission Impossible Dead Reckoning Part One Review And Analysis

May 25, 2025

The Unexpected Comedy Of Mission Impossible Dead Reckoning Part One Review And Analysis

May 25, 2025 -

Claude 4 Anthropics Largest And Most Powerful Ai Models Yet

May 25, 2025

Claude 4 Anthropics Largest And Most Powerful Ai Models Yet

May 25, 2025