MSTR Stock: Outperforming Bitcoin? A February 2025 Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MSTR Stock: Outperforming Bitcoin? A February 2025 Market Analysis

MicroStrategy (MSTR) has become synonymous with Bitcoin investment, making headlines for its substantial BTC holdings. But in February 2025, is MSTR stock truly outperforming its flagship cryptocurrency? This analysis delves into the complexities of this relationship, examining recent market trends and future projections.

MSTR's Risky Bet on Bitcoin:

MicroStrategy's aggressive Bitcoin acquisition strategy, spearheaded by CEO Michael Saylor, has been both lauded and criticized. While the company's belief in Bitcoin as a long-term store of value is undeniable, the volatility of the cryptocurrency market has introduced significant risk. This strategy, while bold, has tied MSTR's stock performance intrinsically to Bitcoin's price fluctuations. This inherent correlation means that MSTR's success isn't solely dependent on its business operations, but largely on the crypto market's health.

February 2025: A Snapshot of the Market:

(Note: This section presents a hypothetical market analysis based on extrapolated trends. Actual market conditions in February 2025 may differ significantly.)

Let's assume a scenario where Bitcoin has experienced moderate growth since late 2024, settling around $60,000-$70,000. This positive trend would likely boost MSTR's stock price. However, other factors influencing MSTR's performance include:

- Overall Market Sentiment: A bullish market generally favors growth stocks, potentially benefiting MSTR. Conversely, a bearish market could dampen investor enthusiasm, regardless of Bitcoin's price.

- MicroStrategy's Business Performance: MSTR's core business activities – its analytics software – remain a crucial factor. Strong revenue growth and profitability in this sector would significantly contribute to positive stock valuation, independent of Bitcoin's performance.

- Regulatory Landscape: The evolving regulatory environment surrounding cryptocurrencies remains a key uncertainty. Favorable regulations could bolster Bitcoin's price and, consequently, MSTR's stock. Conversely, stricter regulations could have a negative impact.

- Competition: The business intelligence and analytics market is competitive. MSTR's ability to maintain its market share and innovate will impact its stock performance.

Is MSTR Stock Truly Outperforming Bitcoin?

Determining whether MSTR stock is "outperforming" Bitcoin requires a nuanced approach. A simple price comparison might be misleading. Consider these factors:

- Investment Returns: While Bitcoin might experience price appreciation, MSTR’s stock price incorporates not just the value of its Bitcoin holdings but also the performance of its core business operations. Calculating the total return on investment (ROI) for both needs a comparative analysis.

- Risk Tolerance: Investing directly in Bitcoin presents a higher degree of risk compared to investing in MSTR stock, which is diversified (albeit heavily weighted towards Bitcoin).

- Liquidity: Trading MSTR stock is generally easier and more liquid than trading large quantities of Bitcoin.

Conclusion:

In a hypothetical February 2025 scenario with moderate Bitcoin growth, MSTR stock could outperform Bitcoin purely based on its diversified business model. However, MSTR’s success remains intrinsically linked to Bitcoin’s price trajectory. The regulatory landscape, MSTR's business performance, and broader market sentiment all play significant roles. Investors need to carefully weigh these factors before making investment decisions, considering both the potential rewards and the substantial risks involved. A thorough due diligence process, considering diverse market forecasts and risk assessments, is crucial before investing in either MSTR stock or Bitcoin directly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MSTR Stock: Outperforming Bitcoin? A February 2025 Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Dire Warning Attenboroughs Powerful New Documentary On The Oceans Future

May 16, 2025

A Dire Warning Attenboroughs Powerful New Documentary On The Oceans Future

May 16, 2025 -

Securing The Future Teslas Approach To Battery Supply

May 16, 2025

Securing The Future Teslas Approach To Battery Supply

May 16, 2025 -

Alibabas Q Quarter Number Earnings 5 Stock Drop Follows Profit Shortfall

May 16, 2025

Alibabas Q Quarter Number Earnings 5 Stock Drop Follows Profit Shortfall

May 16, 2025 -

Gold Coast Bakerys Legal Troubles Court Reveals Operational Issues

May 16, 2025

Gold Coast Bakerys Legal Troubles Court Reveals Operational Issues

May 16, 2025 -

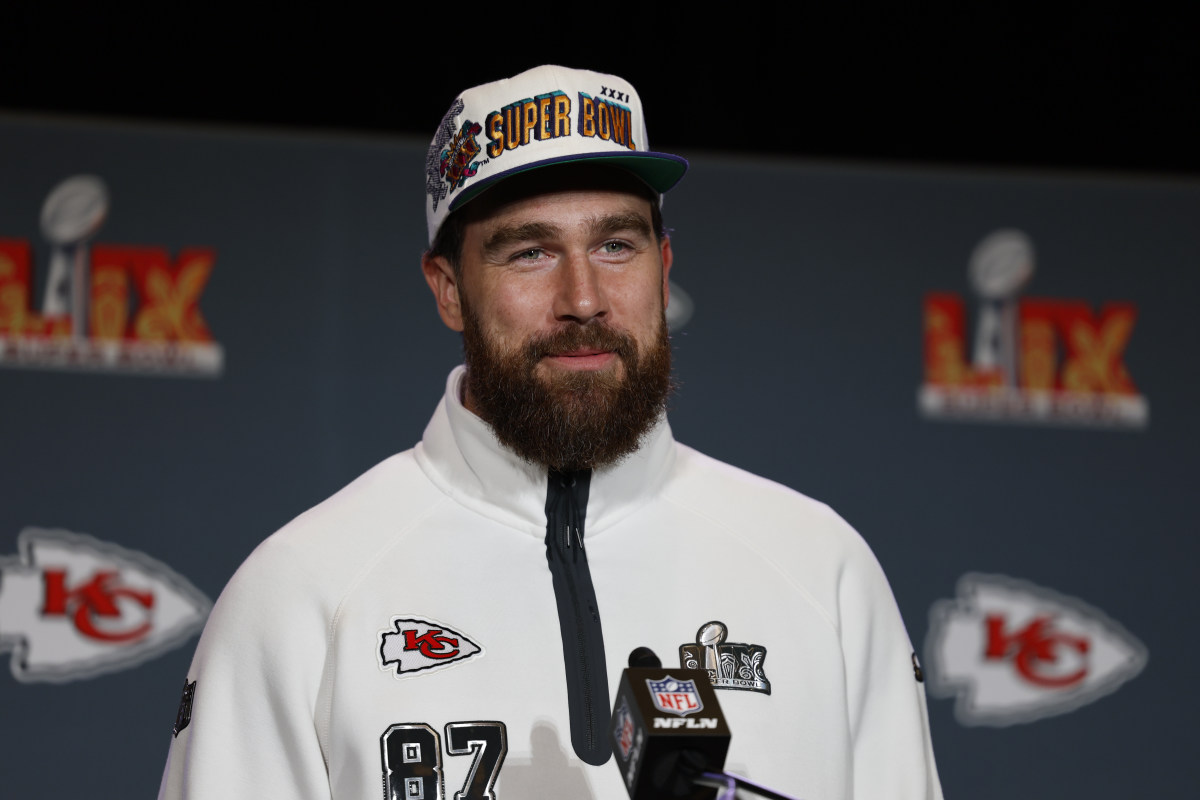

Exclusive Travis Kelce Supports Erin Andrews Bold Career Decision

May 16, 2025

Exclusive Travis Kelce Supports Erin Andrews Bold Career Decision

May 16, 2025