MSTR Stock Price Prediction: Can MicroStrategy Outpace Bitcoin's Growth In 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MSTR Stock Price Prediction: Can MicroStrategy Outpace Bitcoin's Growth in 2025?

MicroStrategy (MSTR), the business intelligence firm that's become synonymous with Bitcoin's institutional adoption, has captivated investors with its aggressive Bitcoin strategy. But the question on everyone's mind is: can MSTR's stock price outpace Bitcoin's growth by 2025? The answer is complex, intertwined with several market factors and future predictions.

While no one possesses a crystal ball, analyzing current trends and market forecasts can help us paint a more informed picture. This article delves into the factors that will influence MSTR's stock price, comparing its potential trajectory to that of Bitcoin.

Bitcoin's Influence: The Elephant in the Room

MicroStrategy's stock price is undeniably intertwined with Bitcoin's performance. The company holds a significant amount of Bitcoin, making its valuation directly susceptible to the cryptocurrency's price fluctuations. A bullish Bitcoin market is likely to propel MSTR's stock price higher, and vice-versa. Therefore, predicting MSTR's future requires understanding Bitcoin's potential price movements in 2025.

Several analysts predict a continued rise in Bitcoin's price, driven by factors such as increasing institutional adoption, growing global demand, and potential regulatory clarity. However, inherent volatility remains a significant risk. Unforeseen events, regulatory changes, or market corrections could negatively impact both Bitcoin and MSTR's stock price.

Beyond Bitcoin: MicroStrategy's Business Fundamentals

While Bitcoin is the dominant factor, overlooking MicroStrategy's core business would be a mistake. The company provides business intelligence and analytics software, a market with consistent, albeit perhaps slower, growth potential. The success of its software offerings will contribute independently to its stock price. Investors should analyze:

- Software Revenue Growth: Consistent year-over-year growth in software revenue signals a healthy and sustainable business model, mitigating reliance solely on Bitcoin's price.

- Profitability and Margins: Improving profitability demonstrates efficient operations and financial stability, bolstering investor confidence irrespective of Bitcoin's performance.

- Innovation and Product Development: Continuous innovation and development of new software solutions are crucial for long-term competitiveness and market share growth.

MSTR Stock Price Prediction: A Cautious Outlook

Predicting a precise stock price is speculative. However, considering Bitcoin's potential and MicroStrategy's business fundamentals, we can offer a cautious outlook.

-

Bullish Scenario: A significant rise in Bitcoin's price, combined with strong performance in MicroStrategy's software business, could lead to substantial gains in MSTR's stock price by 2025. This scenario hinges on continued institutional adoption of Bitcoin and successful execution of MicroStrategy's business strategy.

-

Bearish Scenario: A downturn in the Bitcoin market, coupled with underperformance in the software sector, could significantly impact MSTR's stock price. This scenario underscores the inherent risks associated with investing in a company heavily reliant on a volatile asset.

Conclusion: A High-Risk, High-Reward Investment

Investing in MSTR is undoubtedly a high-risk, high-reward proposition. While the potential for significant returns exists, the volatility tied to Bitcoin's price presents substantial challenges. Investors must carefully weigh the risks and potential rewards, conducting thorough due diligence before making any investment decisions. Diversification within a broader portfolio is also crucial to manage risk. The future of MSTR's stock price remains closely tied to the performance of Bitcoin, but its underlying business operations will play a vital role in determining its long-term success. Keep a close eye on both Bitcoin's price movements and MicroStrategy's financial performance for a clearer understanding of the company's trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MSTR Stock Price Prediction: Can MicroStrategy Outpace Bitcoin's Growth In 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Djokovic Devoile La Presence De Federer Aux Cotes De Nadal Dimanche

May 26, 2025

Djokovic Devoile La Presence De Federer Aux Cotes De Nadal Dimanche

May 26, 2025 -

Major Health Update On Libertines Member Following Recent Toe Surgery

May 26, 2025

Major Health Update On Libertines Member Following Recent Toe Surgery

May 26, 2025 -

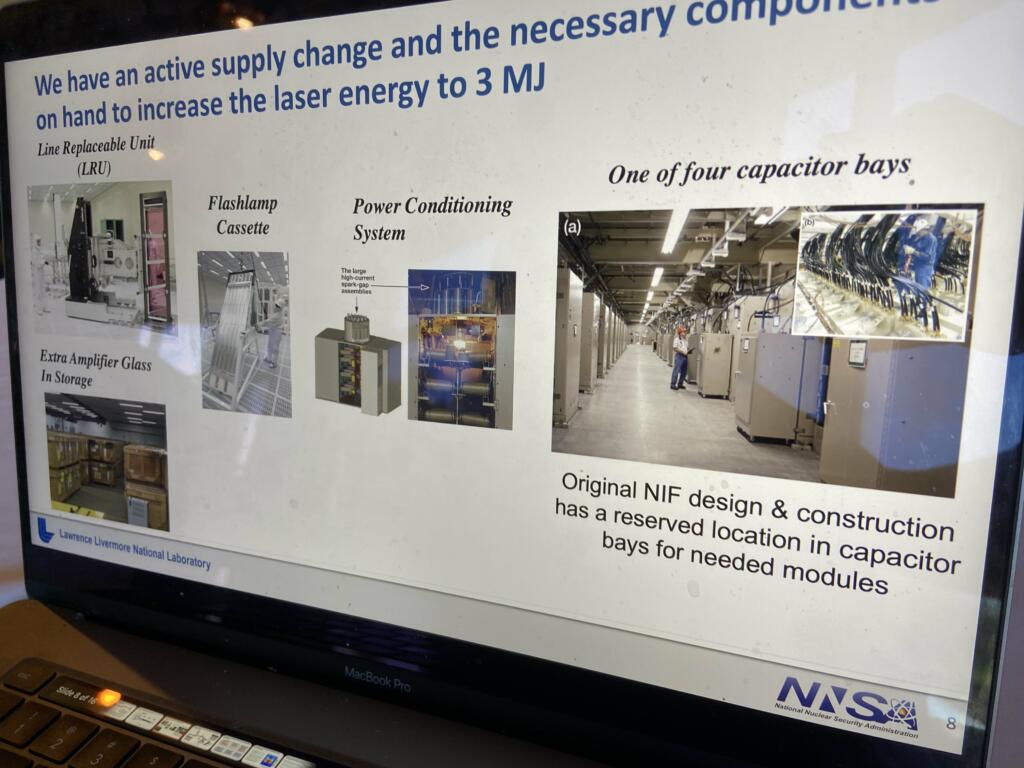

The Future Of Energy Analyzing The Potential Of Laser Fusion For Commercial Use

May 26, 2025

The Future Of Energy Analyzing The Potential Of Laser Fusion For Commercial Use

May 26, 2025 -

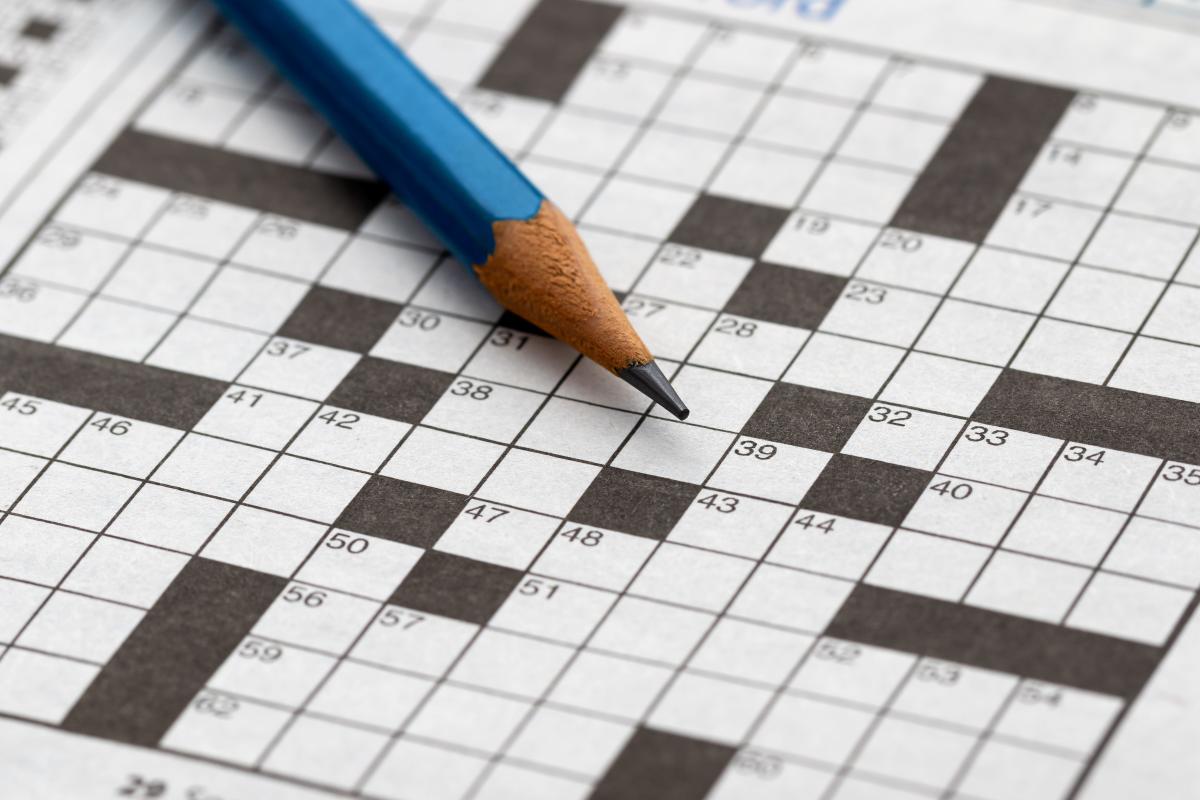

Complete Guide Puzzle Solutions For Sunday May 25 2025

May 26, 2025

Complete Guide Puzzle Solutions For Sunday May 25 2025

May 26, 2025 -

From Health Scare To Healthier Lifestyle Pete Dohertys Weight Loss

May 26, 2025

From Health Scare To Healthier Lifestyle Pete Dohertys Weight Loss

May 26, 2025