MSTR Stock Vs. Bitcoin: A 2025 Performance Comparison And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MSTR Stock vs. Bitcoin: A 2025 Performance Comparison and Analysis

MicroStrategy (MSTR) has made headlines for its significant Bitcoin holdings, leading many investors to question: is investing in MSTR stock a better bet than directly holding Bitcoin (BTC) in 2025 and beyond? This in-depth analysis compares the potential performance of MSTR stock and Bitcoin, considering various factors influencing their future trajectory.

The MSTR Stock Story: More Than Just Bitcoin

MicroStrategy, a business intelligence company, isn't solely defined by its Bitcoin holdings. While its BTC investments heavily influence its stock price, the company's core business performance also plays a crucial role. Understanding this dual nature is key to accurately predicting MSTR's future.

Factors Influencing MSTR Stock Performance in 2025:

- Bitcoin's Price: This is the elephant in the room. MSTR's stock price is highly correlated with Bitcoin's price. A bullish Bitcoin market significantly boosts MSTR's valuation, while a bearish market negatively impacts it. Predicting Bitcoin's price in 2025 remains challenging, with various analysts offering widely differing forecasts.

- MicroStrategy's Core Business: The company's success in its analytics and software sector is crucial. Strong revenue growth and profitability independent of Bitcoin would bolster investor confidence and positively impact MSTR's stock price.

- Regulatory Landscape: The evolving regulatory environment surrounding Bitcoin and cryptocurrencies globally significantly impacts both Bitcoin's price and investor sentiment towards MSTR. Increased regulatory clarity (or lack thereof) could drastically alter the market.

- Market Sentiment: Overall investor sentiment towards technology stocks and the broader economy will play a role. A positive economic outlook generally benefits technology companies, including MSTR.

Bitcoin's Potential in 2025:

Bitcoin's future is inherently uncertain, dependent on several factors including:

- Adoption Rate: Wider institutional and individual adoption could drive significant price appreciation. However, slow adoption could limit its growth.

- Technological Advancements: Upgrades to the Bitcoin network, such as the Lightning Network, could enhance scalability and transaction speed, potentially increasing its appeal.

- Macroeconomic Factors: Global economic conditions, inflation rates, and the performance of traditional financial markets influence Bitcoin's price. A flight to safety during economic uncertainty could drive demand for Bitcoin.

- Competition: The emergence of competing cryptocurrencies could challenge Bitcoin's dominance.

MSTR Stock vs. Bitcoin: A Direct Comparison (Hypothetical Scenarios)

Let's explore two hypothetical scenarios for 2025:

Scenario 1: Bullish Bitcoin Market

- Bitcoin: If Bitcoin's price rises significantly, MSTR stock would likely outperform its core business performance, potentially yielding substantial returns for investors.

- MSTR Stock: The gains would be amplified by the appreciation of Bitcoin holdings, but investors need to consider the risk of a sharp correction.

Scenario 2: Bearish Bitcoin Market

- Bitcoin: A significant drop in Bitcoin's price would negatively impact MSTR's stock price, potentially outweighing any positive performance from its core business.

- MSTR Stock: Investors would face potential losses, depending on the extent of the Bitcoin price decline and the performance of MicroStrategy's core business.

Conclusion: A Risky Proposition, Yet Potentially Rewarding

Investing in MSTR stock exposes investors to both the risks and potential rewards of Bitcoin's price volatility, alongside the performance of MicroStrategy's core business. While a bullish Bitcoin market could significantly benefit MSTR shareholders, a bearish market could lead to considerable losses. Directly holding Bitcoin carries its own set of risks, but potentially offers higher upside with a higher risk tolerance. Ultimately, the optimal choice depends on individual risk tolerance and investment goals. Thorough research and diversification remain crucial for any investment strategy. This analysis does not constitute financial advice; consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MSTR Stock Vs. Bitcoin: A 2025 Performance Comparison And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baby Number Two On The Way For Victor Radley And Taylah Cratchley

May 24, 2025

Baby Number Two On The Way For Victor Radley And Taylah Cratchley

May 24, 2025 -

Walyalups Ta Btouch Team Consistent Lineup For Year Season

May 24, 2025

Walyalups Ta Btouch Team Consistent Lineup For Year Season

May 24, 2025 -

Oklahoma Citys Gilgeous Alexander Claims Nbas Most Valuable Player

May 24, 2025

Oklahoma Citys Gilgeous Alexander Claims Nbas Most Valuable Player

May 24, 2025 -

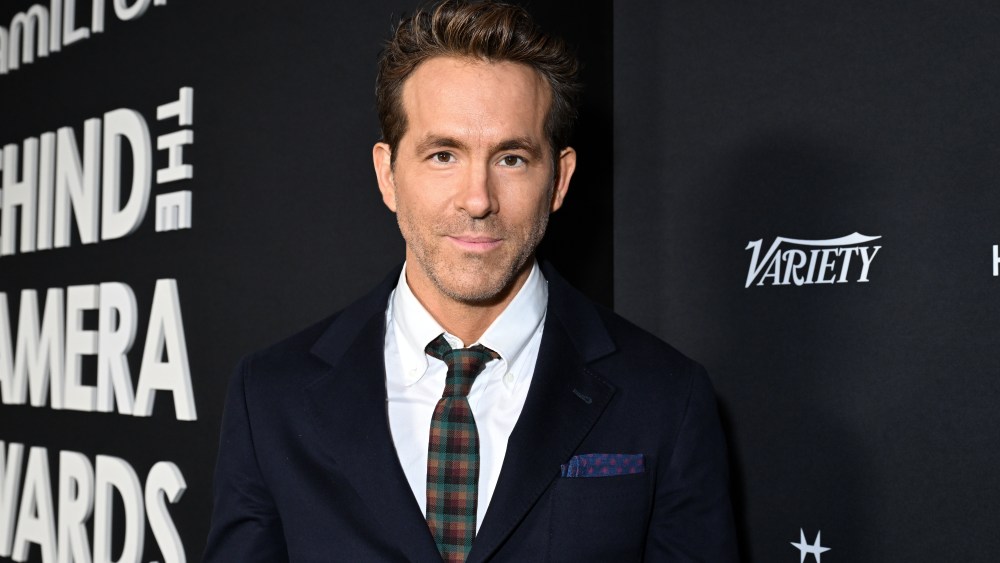

Reynolds Reveals Rejected R Rated Star Wars Pitch Bad Fit For Him

May 24, 2025

Reynolds Reveals Rejected R Rated Star Wars Pitch Bad Fit For Him

May 24, 2025 -

Avery Shenfeld Cibc On The Bank Of Canadas Proactive Inflation Management In Canada

May 24, 2025

Avery Shenfeld Cibc On The Bank Of Canadas Proactive Inflation Management In Canada

May 24, 2025