MSTR Stock Vs. Bitcoin: Which Investment Will Reign Supreme In 2025?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MSTR Stock vs. Bitcoin: Which Investment Will Reign Supreme in 2025?

The cryptocurrency market's volatility and MicroStrategy's (MSTR) significant Bitcoin holdings have created a fascinating investment dilemma: MSTR stock or Bitcoin itself? Predicting the future is impossible, but by analyzing current trends and potential scenarios, we can explore which investment might offer greater returns by 2025.

The MicroStrategy Gamble: Riding the Bitcoin Wave

MicroStrategy, a business analytics company, made a bold move by accumulating a substantial Bitcoin reserve, becoming one of the largest corporate holders of the cryptocurrency. This strategy, spearheaded by CEO Michael Saylor, hinges on the belief that Bitcoin's value will continue to appreciate significantly. Investing in MSTR stock means indirectly betting on Bitcoin's success, coupled with the performance of MicroStrategy's core business.

MSTR Stock Advantages:

- Diversification (indirect): While primarily a Bitcoin bet, MSTR offers a degree of diversification compared to holding Bitcoin directly. The company's operational performance, however small a factor it may be, influences the stock price.

- Liquidity: MSTR stock is traded on major exchanges, offering greater liquidity than Bitcoin in some markets. This means it's generally easier and faster to buy or sell.

- Regulation: Investing in MSTR stock falls under traditional securities regulations, offering a more familiar and regulated investment framework.

MSTR Stock Disadvantages:

- Bitcoin Dependence: The stock's price is heavily correlated with Bitcoin's performance. A Bitcoin downturn would severely impact MSTR's value.

- Company Performance: The success of MicroStrategy's core business also impacts the stock price, adding another layer of risk beyond Bitcoin's volatility.

- Limited Upside (potentially): While MSTR's Bitcoin holdings could bring significant gains, the stock price might not mirror Bitcoin's growth one-to-one.

Bitcoin: The Decentralized Digital Gold

Bitcoin, the original cryptocurrency, has gained significant traction as a store of value and a hedge against inflation. Its decentralized nature and limited supply are key factors driving its potential for long-term growth.

Bitcoin Advantages:

- Potential for High Returns: Bitcoin's history demonstrates significant price appreciation, suggesting considerable potential for future growth.

- Decentralization: Bitcoin operates independently of governments and central banks, making it less susceptible to certain economic and political risks.

- Direct Ownership: Investing in Bitcoin gives you direct ownership of the asset, eliminating the intermediary of a company like MicroStrategy.

Bitcoin Disadvantages:

- Volatility: Bitcoin's price is notoriously volatile, experiencing significant swings in short periods. This makes it a high-risk investment.

- Security Risks: Protecting your Bitcoin holdings requires robust security measures to mitigate the risks of theft or hacking.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, creating uncertainty for investors.

The 2025 Prediction: A Difficult Call

Predicting which investment will perform better by 2025 is speculative. Both MSTR stock and Bitcoin carry significant risks and rewards. Bitcoin's price trajectory will largely determine MSTR's success, making a direct Bitcoin investment potentially more lucrative if your risk tolerance is high. However, MSTR provides a less volatile, albeit potentially less rewarding, indirect route to Bitcoin exposure.

Conclusion: Assess Your Risk Tolerance

Ultimately, the choice between MSTR stock and Bitcoin depends on your individual risk tolerance and investment goals. Those comfortable with high volatility and potentially significant rewards might favor Bitcoin. Those seeking a slightly less volatile, albeit potentially less rewarding, approach might prefer MSTR stock. Thorough research and consulting with a financial advisor are crucial before making any investment decisions. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MSTR Stock Vs. Bitcoin: Which Investment Will Reign Supreme In 2025?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Major Ice Cream Recall Over 16 000 Gallons Affected

May 17, 2025

Major Ice Cream Recall Over 16 000 Gallons Affected

May 17, 2025 -

Political Fallout Examining Trumps Potential Role In Taylor Swifts Public Image Shift

May 17, 2025

Political Fallout Examining Trumps Potential Role In Taylor Swifts Public Image Shift

May 17, 2025 -

Prince William Opens Up About The Unbearable Grief Of Losing His Mother

May 17, 2025

Prince William Opens Up About The Unbearable Grief Of Losing His Mother

May 17, 2025 -

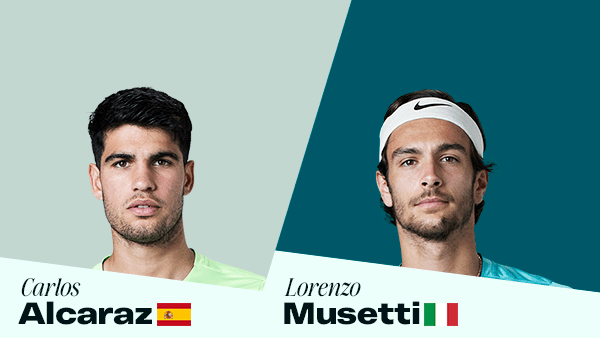

Where To Watch Carlos Alcaraz Vs Lorenzo Musetti Rome Semifinal

May 17, 2025

Where To Watch Carlos Alcaraz Vs Lorenzo Musetti Rome Semifinal

May 17, 2025 -

Close Call At The Pga Championship Max Homas Near Hole In One On Par 4

May 17, 2025

Close Call At The Pga Championship Max Homas Near Hole In One On Par 4

May 17, 2025