Multi-Firm Executive Admits To $7 Million Misappropriation Of Funds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Multi-Firm Executive Admits to $7 Million Misappropriation of Funds: A Shocking Case of Corporate Fraud

A high-level executive has confessed to embezzling a staggering $7 million from multiple companies, sending shockwaves through the business world and raising serious questions about corporate oversight. The confession, made during a plea hearing, details a years-long scheme involving fraudulent invoices, shell companies, and sophisticated accounting manipulations. This case highlights the vulnerability of even large corporations to sophisticated internal fraud and underscores the critical need for robust financial controls.

The accused, identified as 48-year-old Robert Miller, formerly held senior financial positions at three separate firms: Apex Technologies, Global Dynamics, and Stellar Industries. Miller's plea agreement reveals a meticulously planned operation spanning from 2018 to 2023. He utilized his extensive knowledge of accounting procedures to create and submit fraudulent invoices to these companies, diverting funds into secretly controlled accounts.

How the Scheme Worked:

Miller's sophisticated scheme involved several key components:

- Creation of Shell Companies: He established several shell companies, ostensibly providing legitimate services to the three firms. However, these companies were entirely fictitious, serving only as conduits for the misappropriated funds.

- Inflated Invoices: Miller inflated invoices for goods and services, ensuring a consistent flow of excess payments into his controlled accounts. The scale of the inflation was subtle enough to avoid immediate detection by standard auditing procedures.

- Complex Accounting Maneuvers: His deep understanding of accounting software and procedures allowed him to mask the fraudulent transactions within the larger financial records of the affected companies. This obfuscation proved crucial in delaying the discovery of his criminal activity.

Impact on the Businesses and Employees:

The $7 million loss has dealt a significant blow to all three companies. Apex Technologies has reported temporary layoffs, while Global Dynamics has announced a restructuring plan. Stellar Industries, the smallest of the three firms, faces an uncertain future. The impact extends beyond the financial losses, damaging the reputation of all three organizations and potentially impacting employee morale and investor confidence.

Legal Ramifications and Corporate Accountability:

Miller faces a maximum sentence of 20 years in prison and significant financial penalties. The ongoing investigation will likely focus on determining the extent of complicity from other individuals within the three firms. The case raises concerns about the effectiveness of existing corporate governance structures and emphasizes the need for improved internal controls, stronger auditing practices, and increased vigilance against potential fraud.

Lessons Learned and Future Implications:

This case serves as a stark reminder of the importance of:

- Robust Internal Controls: Companies must invest in robust internal control systems, including regular audits, segregation of duties, and strong oversight of financial transactions.

- Employee Background Checks: Thorough background checks and ongoing monitoring of employees in sensitive financial positions are crucial to mitigate the risk of fraud.

- Whistleblower Protection: Strong whistleblower protection programs encourage employees to report suspected misconduct without fear of retaliation.

The outcome of this case will undoubtedly have significant implications for corporate governance practices across various industries. It underscores the critical need for proactive measures to prevent and detect financial fraud, protecting both businesses and their employees from devastating consequences. The ongoing investigation promises further revelations that could reshape corporate accountability and security measures in the coming years.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Multi-Firm Executive Admits To $7 Million Misappropriation Of Funds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Southern France Devastated Watch The Impact Of Fatal Storms And Flooding

May 22, 2025

Southern France Devastated Watch The Impact Of Fatal Storms And Flooding

May 22, 2025 -

Analysis Delhi Capitals Failure To Sign Csks Dewald Brevis

May 22, 2025

Analysis Delhi Capitals Failure To Sign Csks Dewald Brevis

May 22, 2025 -

Hands On With Huaweis Innovative Foldable Laptop A Technological Leap

May 22, 2025

Hands On With Huaweis Innovative Foldable Laptop A Technological Leap

May 22, 2025 -

Could Dalton Knecht Trade Bring 16 1 Ppg Pacer To Lakers

May 22, 2025

Could Dalton Knecht Trade Bring 16 1 Ppg Pacer To Lakers

May 22, 2025 -

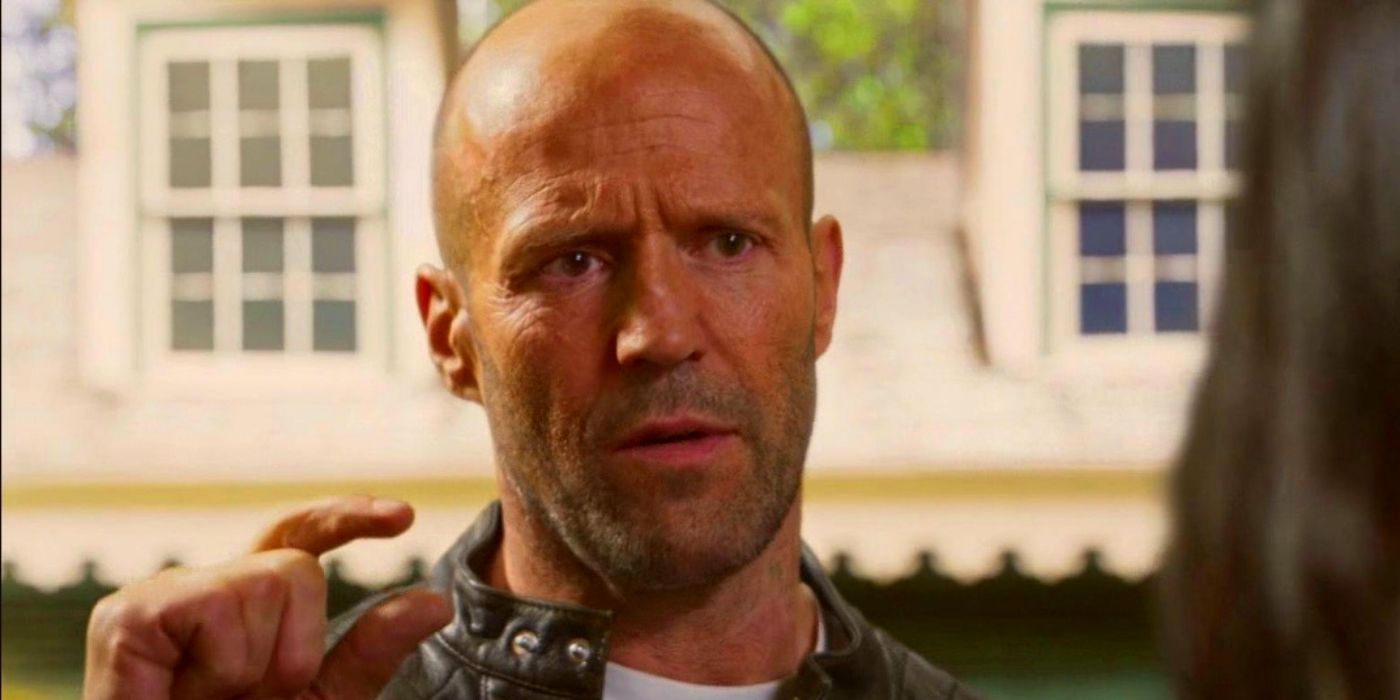

Streaming Hit Jason Stathams 14 Rotten Tomatoes Action Movie With Megan Fox

May 22, 2025

Streaming Hit Jason Stathams 14 Rotten Tomatoes Action Movie With Megan Fox

May 22, 2025