NASDAQ:NVDA - Will Nvidia Hit $150 Before The End Of The Year?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NASDAQ:NVDA – Will Nvidia Hit $150 Before the End of the Year?

Nvidia (NVDA), the undisputed king of the GPU market, has seen its stock price soar in 2023, fueled by the explosive growth of artificial intelligence (AI). The question on many investors' minds is: can NVDA reach $150 before the year's end? This ambitious target hinges on several key factors, and the answer isn't a simple yes or no.

Nvidia's Meteoric Rise: A Look at the Fundamentals

Nvidia's success is intrinsically linked to the AI boom. Its high-performance GPUs are crucial for training and running large language models (LLMs) and other AI applications. This demand has driven unprecedented revenue growth and propelled NVDA's stock price to record highs. Recent quarterly earnings reports have consistently exceeded expectations, further solidifying investor confidence.

However, the path to $150 isn't without its potential obstacles. Let's examine some key factors influencing NVDA's price trajectory:

Factors Supporting a $150 Price Target:

- Sustained AI Growth: The continued expansion of the AI market remains the primary driver. As more businesses and researchers adopt AI technologies, the demand for Nvidia's GPUs will likely remain strong, supporting further price increases.

- Strong Earnings Reports: Continued outperformance in earnings reports will bolster investor sentiment and fuel further upward momentum. Analysts' predictions will be crucial in gauging market expectations.

- Limited Competition: While competition exists, Nvidia currently holds a significant market share in the high-performance computing space, giving them a strong competitive advantage.

- Positive Analyst Sentiment: Many analysts maintain bullish outlooks on NVDA, predicting further growth and price appreciation. This positive sentiment influences investor decisions.

Challenges and Potential Headwinds:

- Overvaluation Concerns: Some analysts express concerns about NVDA's current valuation, arguing that the stock price may be ahead of its fundamentals. A market correction could impact the price.

- Geopolitical Risks: Global economic uncertainty and geopolitical instability could negatively impact investor confidence and lead to market volatility.

- Supply Chain Issues: Although less significant than in previous years, potential supply chain disruptions could impact production and revenue.

- Competition Intensification: While currently dominant, increased competition from companies investing heavily in AI chip development could erode Nvidia's market share over the long term.

The Verdict: A Realistic Assessment

Reaching $150 by the end of the year is a significant challenge, but not impossible. The continued growth of the AI market is overwhelmingly in Nvidia's favor. However, the potential for overvaluation and external factors like geopolitical risks must be considered.

Investing in NVDA requires careful consideration of both the potential rewards and inherent risks. It's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions. While the outlook remains positive, predicting the precise price trajectory of any stock, especially one as volatile as NVDA, is inherently speculative.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NASDAQ:NVDA - Will Nvidia Hit $150 Before The End Of The Year?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

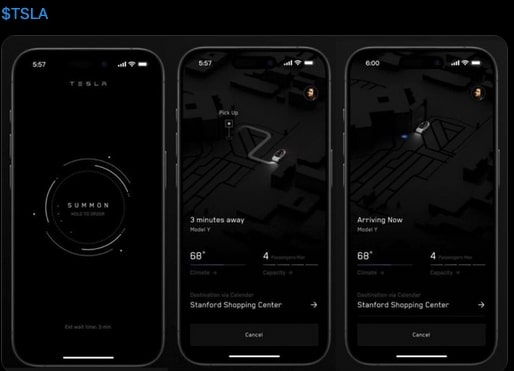

Tesla Stock Plunges Understanding Todays Sharp Decline

May 13, 2025

Tesla Stock Plunges Understanding Todays Sharp Decline

May 13, 2025 -

Us China Trade War 90 Day Reprieve Negotiated

May 13, 2025

Us China Trade War 90 Day Reprieve Negotiated

May 13, 2025 -

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025 -

Nvidia Stock Predicting A 150 Price Point Before 2024

May 13, 2025

Nvidia Stock Predicting A 150 Price Point Before 2024

May 13, 2025 -

Beckham Urges Minnesota United For Respect

May 13, 2025

Beckham Urges Minnesota United For Respect

May 13, 2025

Latest Posts

-

Teslas Austin Expansion June Launch Of Supervised And Unsupervised Ridesharing Anticipated

May 13, 2025

Teslas Austin Expansion June Launch Of Supervised And Unsupervised Ridesharing Anticipated

May 13, 2025 -

F 18 Fighter Jet Casualties Examining Us Navy Losses In Yemen Conflict

May 13, 2025

F 18 Fighter Jet Casualties Examining Us Navy Losses In Yemen Conflict

May 13, 2025 -

The Coinbase Riot Partnership Building Trust And Growing Crypto Adoption In Esports

May 13, 2025

The Coinbase Riot Partnership Building Trust And Growing Crypto Adoption In Esports

May 13, 2025 -

St Kilda Concert Violence Womans Intoxication Leads To Brawl At Tina Arena Performance

May 13, 2025

St Kilda Concert Violence Womans Intoxication Leads To Brawl At Tina Arena Performance

May 13, 2025 -

Meet The Top Performing Stock Consistently Beating Market Averages

May 13, 2025

Meet The Top Performing Stock Consistently Beating Market Averages

May 13, 2025