Nasdaq Sell-Off: Is Palo Alto Networks Or Nvidia The Better Buy Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq Sell-Off: Palo Alto Networks vs. Nvidia – Which Tech Titan Reigns Supreme?

The recent Nasdaq sell-off has left investors scrambling, questioning the future of even the most robust tech giants. Two prominent players, Palo Alto Networks (PANW) and Nvidia (NVDA), find themselves in the crosshairs, prompting the crucial question: which is the better buy amidst this market downturn? Both companies represent significant players in the tech sector, but their approaches and vulnerabilities differ significantly. This analysis dives deep into both companies, weighing their strengths and weaknesses to help you make an informed investment decision.

Understanding the Market Downturn's Impact

The current Nasdaq slump is driven by a confluence of factors, including rising interest rates, persistent inflation, and concerns about future economic growth. This uncertainty creates a challenging environment for growth stocks, impacting both Palo Alto Networks and Nvidia, albeit in different ways. While both companies boast strong fundamentals, their differing business models mean they react differently to market volatility.

Palo Alto Networks (PANW): Cybersecurity's Steady Hand

Palo Alto Networks is a leader in the cybersecurity sector, offering a comprehensive suite of security solutions for businesses of all sizes. Its strong recurring revenue model, driven by subscriptions, provides a degree of stability that is particularly attractive during economic downturns. While the demand for cybersecurity services remains relatively consistent, PANW's valuation might be impacted by broader market sentiment.

- Strengths: Strong recurring revenue, market leadership in cybersecurity, robust product portfolio.

- Weaknesses: High valuation compared to historical metrics, potential for increased competition.

- Investment Outlook: A relatively safe bet in a volatile market, but potential for limited upside growth in the short-term.

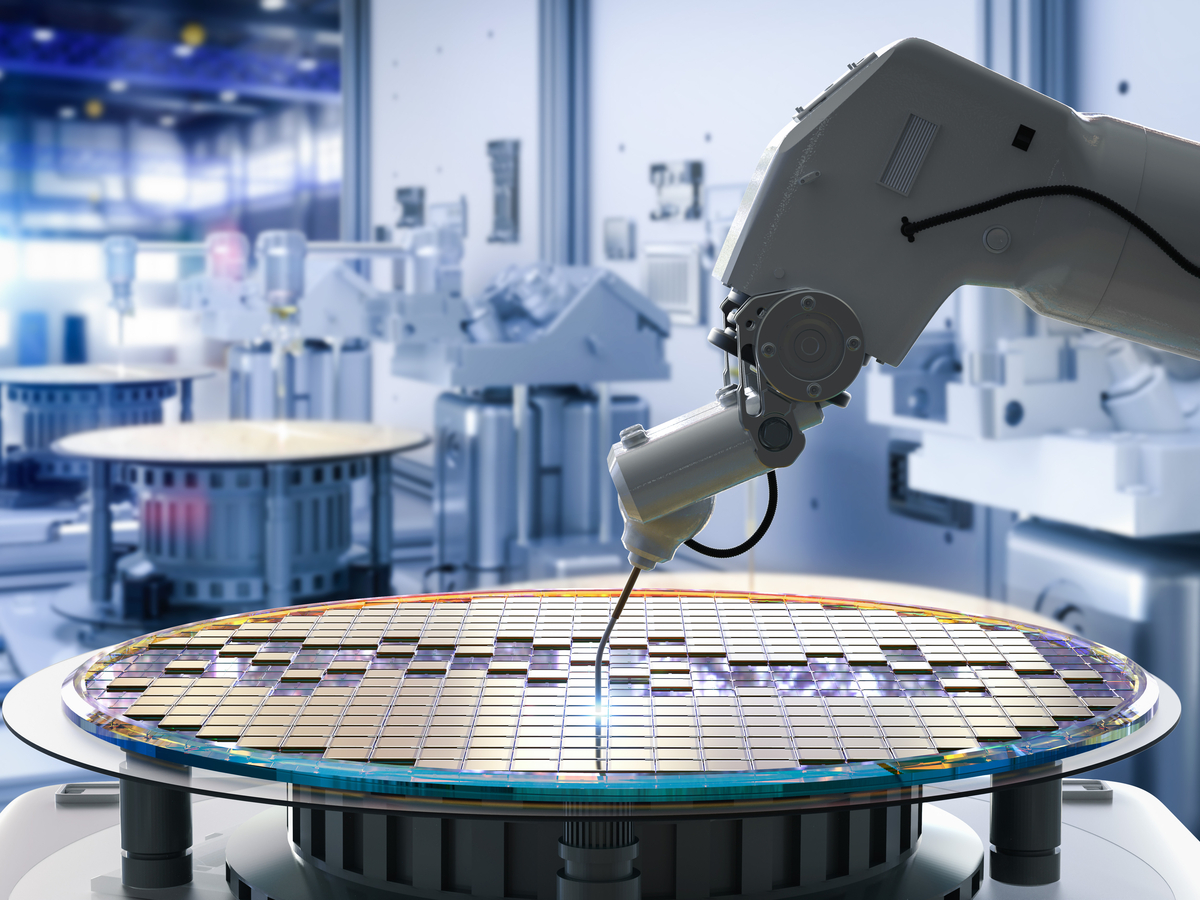

Nvidia (NVDA): Riding the AI Wave

Nvidia, a dominant force in the graphics processing unit (GPU) market, is experiencing explosive growth fueled by the burgeoning artificial intelligence (AI) revolution. Its GPUs are crucial for powering AI applications, from machine learning to data centers. This positions NVDA as a key beneficiary of long-term AI adoption, but also makes it vulnerable to shifts in AI investment.

- Strengths: Dominant market share in GPUs, crucial role in the AI boom, high growth potential.

- Weaknesses: High valuation reflecting significant growth expectations, susceptibility to shifts in AI investment trends.

- Investment Outlook: High-risk, high-reward. Significant growth potential, but potential for significant correction if AI hype fades.

Head-to-Head Comparison: PANW vs. NVDA

| Feature | Palo Alto Networks (PANW) | Nvidia (NVDA) |

|---|---|---|

| Sector | Cybersecurity | Semiconductors/AI |

| Growth Rate | Moderate | High |

| Risk Profile | Lower | Higher |

| Valuation | Relatively High | Very High |

| Recurring Revenue | High | Lower |

Conclusion: Navigating the Investment Landscape

The choice between Palo Alto Networks and Nvidia ultimately depends on your risk tolerance and investment horizon. PANW offers a more conservative investment with a relatively stable revenue stream, suitable for investors seeking lower risk. NVDA presents a higher-risk, higher-reward opportunity for investors willing to bet on the continued growth of the AI sector. Both companies are industry leaders, but their contrasting profiles reflect the complexities of navigating the current market climate. Thorough due diligence and consideration of your personal investment strategy are crucial before committing to either stock. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq Sell-Off: Is Palo Alto Networks Or Nvidia The Better Buy Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

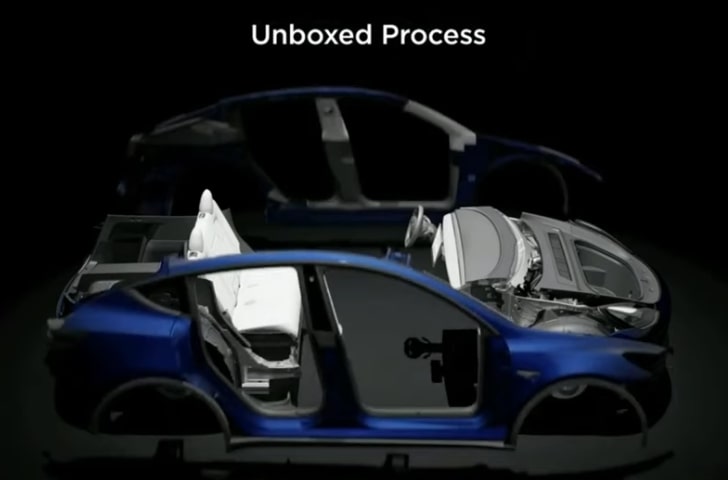

How Teslas Cybercab Production Parallels Space X Starships Reusable Design

Apr 07, 2025

How Teslas Cybercab Production Parallels Space X Starships Reusable Design

Apr 07, 2025 -

Smaller Cheaper Smarter Amazon Echo Show Challenges Googles Smart Display Dominance

Apr 07, 2025

Smaller Cheaper Smarter Amazon Echo Show Challenges Googles Smart Display Dominance

Apr 07, 2025 -

Jonathan Wilson On Real Madrid Facing A New Era In The Champions League

Apr 07, 2025

Jonathan Wilson On Real Madrid Facing A New Era In The Champions League

Apr 07, 2025 -

What Time Is The Japanese Grand Prix 2025 On In Australia

Apr 07, 2025

What Time Is The Japanese Grand Prix 2025 On In Australia

Apr 07, 2025 -

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025