Nasdaq Sell-Off: Is Palo Alto Networks Or Nvidia The Better Value?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq Sell-Off: Is Palo Alto Networks or Nvidia the Better Value?

The recent Nasdaq sell-off has left investors scrambling to identify undervalued tech giants. Two prominent players, Palo Alto Networks (PANW) and Nvidia (NVDA), both experienced significant drops, prompting the crucial question: which offers the better value proposition for long-term investors? Both companies are industry leaders, but their distinct business models and market positions present different risk and reward profiles.

This analysis dives deep into the current market conditions, examining the financials and future prospects of Palo Alto Networks and Nvidia to help you make an informed investment decision.

Understanding the Market Downturn:

The current tech sector downturn is largely attributed to rising interest rates, inflation concerns, and a potential recession. This environment disproportionately impacts growth stocks like PANW and NVDA, leading to increased volatility. However, this volatility also presents opportunities for discerning investors to acquire shares at potentially discounted prices.

Palo Alto Networks (PANW): Cybersecurity Strength in a Volatile Market

Palo Alto Networks is a leading cybersecurity company, providing a comprehensive suite of network security solutions. Its strong position in the enterprise security market makes it a relatively defensive play during economic uncertainty. Businesses, regardless of economic climate, require robust cybersecurity protection.

- Strengths: Strong brand recognition, recurring revenue streams through subscription models, and consistent growth in cloud security offerings.

- Weaknesses: High valuation compared to some competitors, potential vulnerability to shifts in enterprise spending.

- Investment Thesis: PANW offers a relatively stable investment during uncertain economic times due to its essential services. However, the premium valuation needs careful consideration.

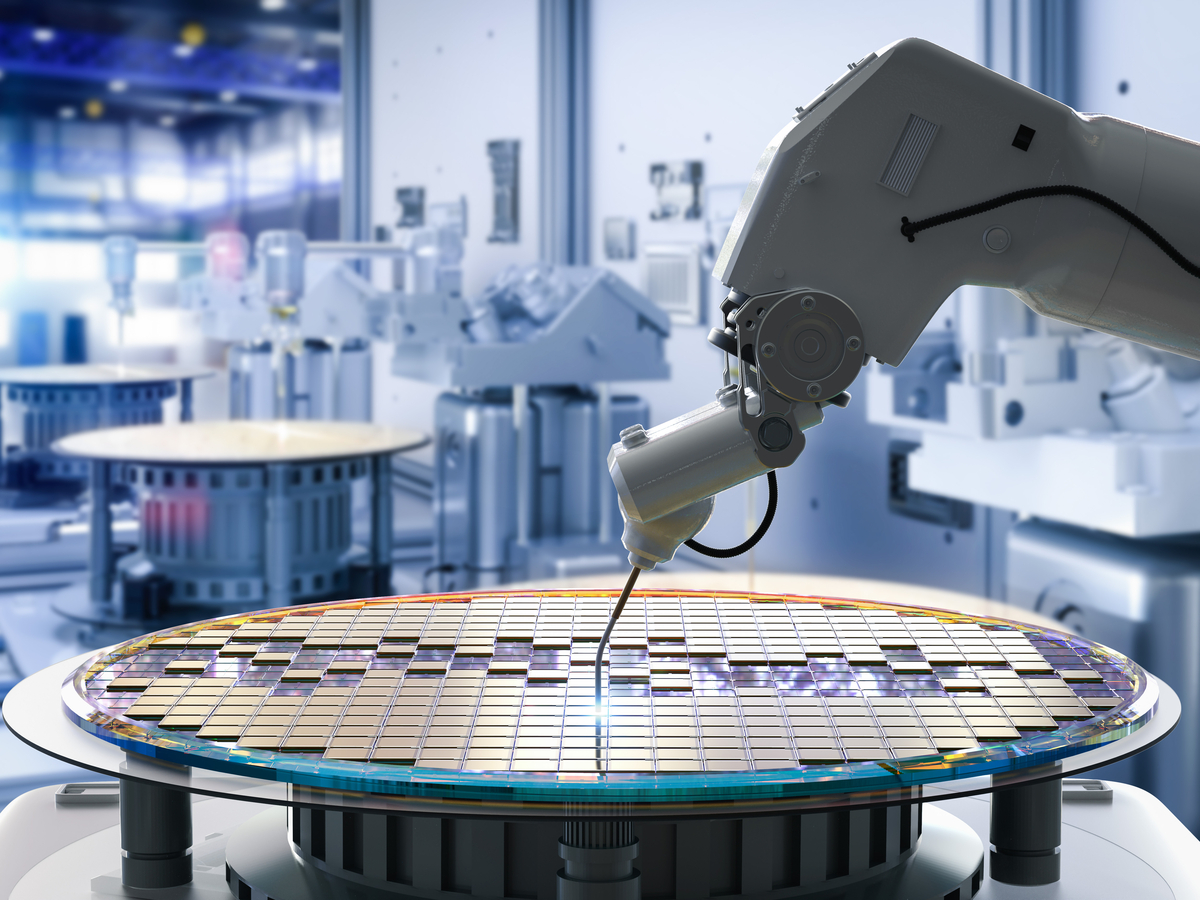

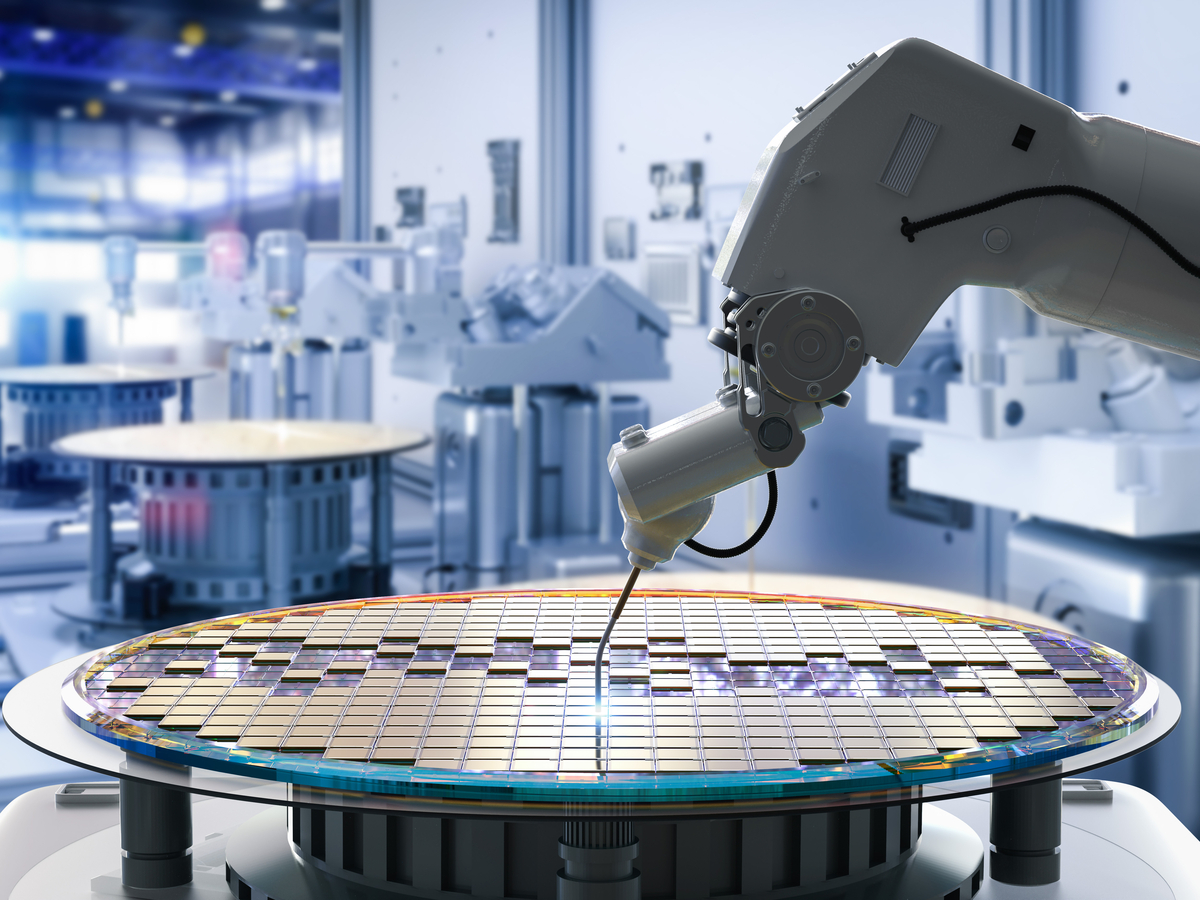

Nvidia (NVDA): Riding the AI Wave, But Facing Headwinds

Nvidia is a dominant force in the graphics processing unit (GPU) market, increasingly crucial for artificial intelligence (AI) development and high-performance computing (HPC). While its involvement in AI positions it for massive future growth, the current market conditions present some short-term challenges.

- Strengths: Dominant market share in GPUs for AI and gaming, strong potential for growth in the expanding AI market, and diversification into other areas like automotive.

- Weaknesses: High dependence on the semiconductor industry, susceptibility to supply chain disruptions, and recent revenue slowdown due to weaker demand in certain segments.

- Investment Thesis: NVDA presents higher growth potential in the long term, driven by the AI boom. However, the increased risk associated with its high-growth profile and dependence on cyclical industries needs careful assessment.

Palo Alto Networks vs. Nvidia: A Comparative Analysis

| Feature | Palo Alto Networks (PANW) | Nvidia (NVDA) |

|---|---|---|

| Sector | Cybersecurity | Semiconductors/AI |

| Growth Potential | Moderate, consistent | High, but volatile |

| Risk | Lower | Higher |

| Valuation | Premium | Premium |

| Current Market Sentiment | Relatively stable | More volatile |

The Verdict: Which Stock to Choose?

The "better" value depends entirely on your risk tolerance and investment horizon.

-

For risk-averse investors with a shorter time horizon: Palo Alto Networks (PANW) provides a more stable, albeit slower-growth, investment. Its defensive position in the cybersecurity market offers a degree of protection during economic downturns.

-

For risk-tolerant investors with a longer time horizon: Nvidia (NVDA) offers significantly higher growth potential, driven by the rapidly expanding AI market. However, this potential comes with greater volatility and risk.

Ultimately, thorough due diligence, considering your personal financial goals, and consulting with a financial advisor are crucial before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice. Remember to diversify your portfolio and never invest more than you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq Sell-Off: Is Palo Alto Networks Or Nvidia The Better Value?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

China Stock Market Plunges Major Indices Down Over 7

Apr 07, 2025

China Stock Market Plunges Major Indices Down Over 7

Apr 07, 2025 -

Gold Price Plunge Will The Rally Return Experts Weigh In

Apr 07, 2025

Gold Price Plunge Will The Rally Return Experts Weigh In

Apr 07, 2025 -

Nagpurs Shri Poddareshwar Ram Temple A Sea Of Devotees For Ram Navami

Apr 07, 2025

Nagpurs Shri Poddareshwar Ram Temple A Sea Of Devotees For Ram Navami

Apr 07, 2025 -

Receba Dividendos Empresas Que Pagam Nesta Semana E Como Investir

Apr 07, 2025

Receba Dividendos Empresas Que Pagam Nesta Semana E Como Investir

Apr 07, 2025 -

25 000 Tesla By 2025 Factory Changes Fuel Price Drop Predictions

Apr 07, 2025

25 000 Tesla By 2025 Factory Changes Fuel Price Drop Predictions

Apr 07, 2025