Navigating Stock Market Swings Amid Recession Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating Stock Market Swings Amid Recession Concerns

The global economy is facing headwinds, with recession fears looming large. This uncertainty is sending shockwaves through the stock market, leaving investors wondering how to navigate the turbulent waters ahead. Understanding the current climate and employing smart strategies are crucial for weathering this storm and potentially even capitalizing on opportunities.

Understanding the Current Market Landscape

Several factors are contributing to the current market volatility and recession concerns. High inflation, aggressive interest rate hikes by central banks, geopolitical instability (particularly the ongoing war in Ukraine), and supply chain disruptions are all playing significant roles. These factors create a complex and unpredictable environment, making accurate market predictions challenging. Experts are divided on the likelihood and severity of a recession, adding to the uncertainty.

Key Strategies for Navigating Market Volatility:

-

Diversify Your Portfolio: This is arguably the most important strategy. Don't put all your eggs in one basket. Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk. Consider including defensive stocks – companies whose products or services remain in demand even during economic downturns – such as consumer staples and utilities.

-

Rebalance Your Portfolio Regularly: Market fluctuations will inevitably shift the asset allocation of your portfolio. Regularly rebalancing – selling some assets that have performed well and buying those that have underperformed – helps maintain your desired risk level and capitalize on market opportunities.

-

Dollar-Cost Averaging (DCA): Instead of investing a lump sum, DCA involves investing a fixed amount at regular intervals (e.g., monthly). This strategy helps mitigate the risk of investing a large sum just before a market downturn.

-

Focus on Long-Term Goals: Short-term market swings are inevitable. Don't panic sell during market downturns if your investment timeline is long-term. Maintaining a long-term perspective can help you ride out the volatility and benefit from eventual market recovery.

-

Consider Defensive Investments: As mentioned earlier, defensive stocks, high-quality bonds, and even precious metals like gold can offer a degree of protection during economic uncertainty. These assets often hold their value or even appreciate during times of economic stress.

-

Stay Informed but Avoid Emotional Decisions: Keep abreast of economic news and market trends, but avoid making impulsive decisions based on short-term market fluctuations or sensational headlines. Sticking to your long-term investment plan is crucial.

-

Seek Professional Advice: If you're feeling overwhelmed or unsure about how to proceed, consider seeking advice from a qualified financial advisor. They can help you create a personalized investment strategy tailored to your risk tolerance and financial goals.

H2: Recession-Proofing Your Investments

While completely recession-proofing your portfolio is impossible, you can take steps to mitigate the impact of a potential downturn. This includes carefully assessing your risk tolerance, diversifying investments, and focusing on companies with strong fundamentals and a history of weathering economic storms.

H3: The Importance of Due Diligence

Before investing in any stock, conduct thorough research. Understand the company's financial health, competitive landscape, and growth potential. Don't rely solely on market hype or tips from others.

Conclusion:

Navigating the stock market during times of recessionary concerns requires a calm and strategic approach. By diversifying your portfolio, employing dollar-cost averaging, focusing on long-term goals, and seeking professional advice when needed, you can significantly improve your chances of weathering the storm and emerging stronger on the other side. Remember, informed decision-making and a well-defined investment plan are crucial for success in any market environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating Stock Market Swings Amid Recession Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jacqueline Jossa Addresses Dan Osbornes Departure End Of Their Eight Year Marriage

Mar 18, 2025

Jacqueline Jossa Addresses Dan Osbornes Departure End Of Their Eight Year Marriage

Mar 18, 2025 -

Rio Grande Do Sul Enfrenta Devastacao Apos Fortes Chuvas Mais De 75 Mortos E Crise De Agua E Energia

Mar 18, 2025

Rio Grande Do Sul Enfrenta Devastacao Apos Fortes Chuvas Mais De 75 Mortos E Crise De Agua E Energia

Mar 18, 2025 -

Bri Pembagian Dividen 2024 Diproyeksikan 85 Dari Laba Data Lengkap 2020 2023

Mar 18, 2025

Bri Pembagian Dividen 2024 Diproyeksikan 85 Dari Laba Data Lengkap 2020 2023

Mar 18, 2025 -

Designer Shopping Bags Woolworths Latest Move To Elevate The Grocery Experience

Mar 18, 2025

Designer Shopping Bags Woolworths Latest Move To Elevate The Grocery Experience

Mar 18, 2025 -

Denver Nuggets Face Fiery Golden State Warriors Test

Mar 18, 2025

Denver Nuggets Face Fiery Golden State Warriors Test

Mar 18, 2025

Latest Posts

-

Watch Dc Vs Kkr Live Cricket Score Commentary And Scorecard

Apr 30, 2025

Watch Dc Vs Kkr Live Cricket Score Commentary And Scorecard

Apr 30, 2025 -

Grab A Bargain Qantas International Airfares Start At 499

Apr 30, 2025

Grab A Bargain Qantas International Airfares Start At 499

Apr 30, 2025 -

Chinas 737 Max Ban Boeings Response And Flight Resumption

Apr 30, 2025

Chinas 737 Max Ban Boeings Response And Flight Resumption

Apr 30, 2025 -

The Rock And Oleksandr Usyk 40 Million Project Marks A Dramatic Transformation

Apr 30, 2025

The Rock And Oleksandr Usyk 40 Million Project Marks A Dramatic Transformation

Apr 30, 2025 -

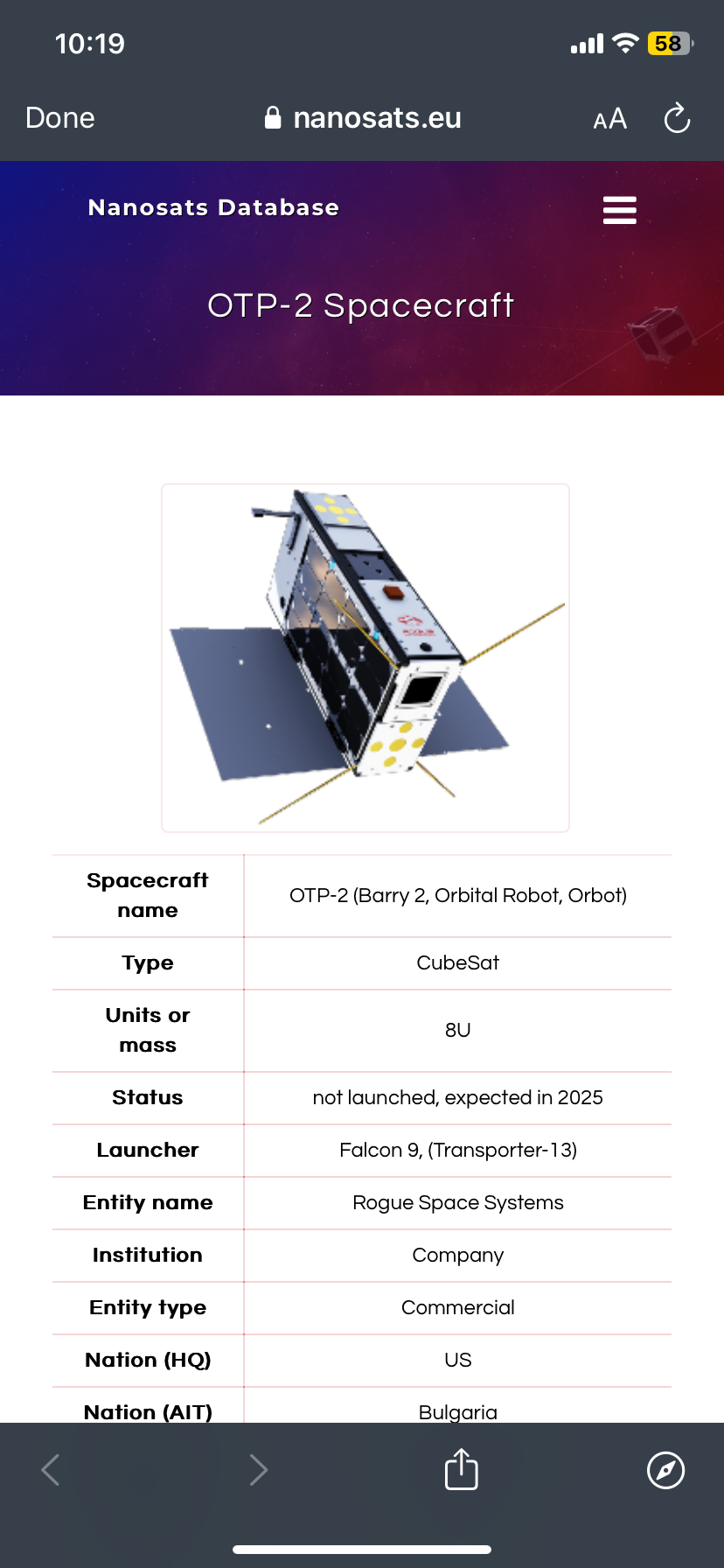

Next Big Future Com Details On Two Novel Otp 2 Propulsion Experiments

Apr 30, 2025

Next Big Future Com Details On Two Novel Otp 2 Propulsion Experiments

Apr 30, 2025