Navigating The New Landscape: Australia's Evolving Crypto Regulatory Framework

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating the New Landscape: Australia's Evolving Crypto Regulatory Framework

Australia's crypto landscape is rapidly evolving, leaving businesses and investors grappling with a constantly shifting regulatory framework. The lack of a cohesive, comprehensive national approach has led to uncertainty, but recent developments signal a move towards clearer guidelines. This article unpacks the current state of Australian crypto regulation, highlighting key challenges and emerging opportunities.

The Current Regulatory Patchwork:

Currently, Australia lacks a single, dedicated crypto law. Instead, regulation is fragmented across several agencies and legislation, creating complexities for businesses operating within the crypto space. Key players include the Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulation Authority (APRA), and AUSTRAC (the Australian Transaction Reports and Analysis Centre). This decentralized approach means different aspects of crypto are overseen by different bodies, leading to potential inconsistencies and overlaps.

-

ASIC's Focus: Primarily concerned with the financial products side, ASIC regulates cryptocurrencies that are considered financial products under existing laws. This includes crypto exchanges offering services to retail investors, who are increasingly turning to digital assets as alternative investments. They're scrutinizing compliance with anti-money laundering and counter-terrorism financing (AML/CTF) regulations, focusing on ensuring responsible conduct of business within the crypto sector.

-

AUSTRAC's Role: AUSTRAC's remit centers on AML/CTF compliance. Digital currency exchanges and other relevant businesses must register with AUSTRAC and comply with stringent reporting requirements. Non-compliance can lead to significant penalties, emphasizing the importance of robust AML/CTF programs for crypto businesses operating in Australia.

-

APRA's Involvement: APRA's role is less direct, primarily focusing on the systemic risk that cryptocurrencies could pose to the broader financial system. They are observing the sector closely, ready to intervene if necessary to protect financial stability.

Emerging Trends and Future Directions:

The government is actively working towards a more unified approach to crypto regulation. Recent announcements hint at potential legislative changes that could reshape the industry. Key areas of focus include:

-

Licensing and Registration: Expect stricter licensing requirements for crypto exchanges and related businesses, bringing them under a more centralized regulatory umbrella. This move aims to enhance consumer protection and improve market integrity.

-

Stablecoins: The regulation of stablecoins, cryptocurrencies pegged to fiat currencies, is a critical area of focus. The government is likely to introduce specific rules to manage the risks associated with these assets.

-

DeFi (Decentralized Finance): The rapid growth of DeFi presents unique regulatory challenges. The decentralized nature of DeFi platforms makes traditional regulatory approaches difficult to implement, and innovative solutions are needed to address this.

-

NFTs (Non-Fungible Tokens): While still relatively nascent, the regulatory treatment of NFTs is also an area of growing interest. The government will need to consider how best to classify and regulate NFTs, depending on their use case.

Opportunities and Challenges:

A clearer regulatory framework could unlock significant opportunities for the Australian crypto industry. Greater regulatory certainty would attract more investment, foster innovation, and enhance the overall legitimacy of the sector. However, overregulation could stifle innovation and competitiveness. Finding the right balance between promoting innovation and protecting consumers is crucial for Australia's success in the global crypto market.

Conclusion:

Australia's evolving crypto regulatory landscape presents both challenges and opportunities. While the current fragmented approach creates uncertainty, the government's active engagement suggests a move towards a more cohesive and comprehensive regulatory framework in the near future. Businesses operating in the crypto space must stay informed about these developments and adapt their strategies accordingly to ensure compliance and capitalize on the emerging opportunities. The coming years will be pivotal in shaping Australia's position as a player in the global cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating The New Landscape: Australia's Evolving Crypto Regulatory Framework. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dwd Unwetterwarnung Bayern Bis Zu 20 Cm Schnee Und Starkregen Erwartet

Mar 30, 2025

Dwd Unwetterwarnung Bayern Bis Zu 20 Cm Schnee Und Starkregen Erwartet

Mar 30, 2025 -

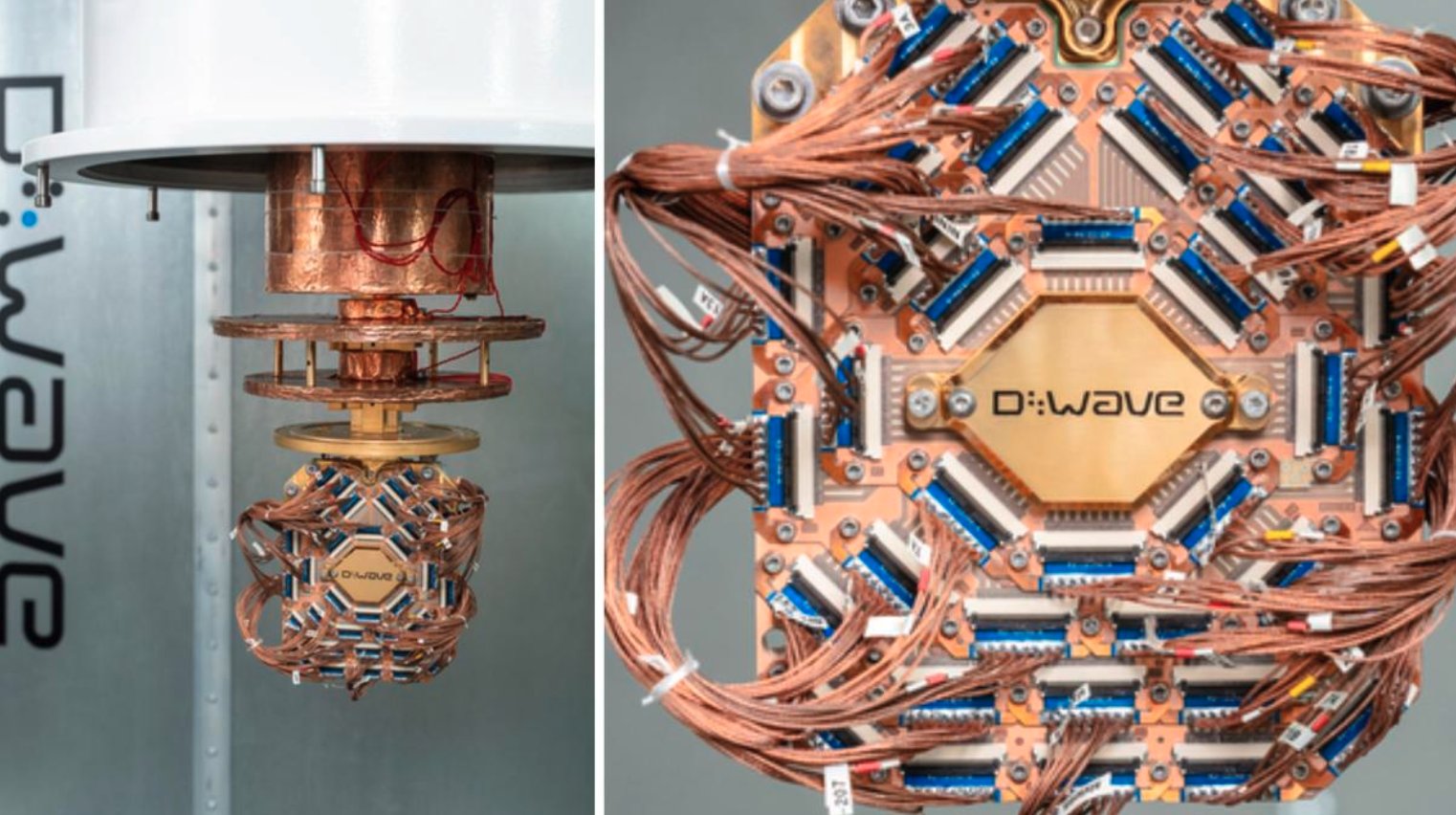

D Wave Quantum Annealing A New Standard For Materials Simulation Speed And Efficiency

Mar 30, 2025

D Wave Quantum Annealing A New Standard For Materials Simulation Speed And Efficiency

Mar 30, 2025 -

Hamas Internal Divisions Hamper Us Mediated Ceasefire Efforts

Mar 30, 2025

Hamas Internal Divisions Hamper Us Mediated Ceasefire Efforts

Mar 30, 2025 -

Cricket Match Dubai And The 1993 Mumbai Blasts New Details Emerge

Mar 30, 2025

Cricket Match Dubai And The 1993 Mumbai Blasts New Details Emerge

Mar 30, 2025 -

Ufc On Espn 64 Torres And Dober Poised For Explosive Fight Of The Night Contender

Mar 30, 2025

Ufc On Espn 64 Torres And Dober Poised For Explosive Fight Of The Night Contender

Mar 30, 2025