Navigating The New Normal: Australia's Evolving Crypto Regulatory Framework And Its Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating the New Normal: Australia's Evolving Crypto Regulatory Framework and its Impact

Australia's crypto landscape is rapidly evolving, leaving businesses and investors grappling with a constantly shifting regulatory framework. The nation is striving to balance innovation with consumer protection, leading to a complex and often confusing regulatory environment. This article delves into the current state of Australian crypto regulation, its impact on the industry, and what the future might hold.

Australia's Crypto Regulatory Landscape: A Patchwork Approach

Currently, Australia doesn't have a single, comprehensive cryptocurrency law. Instead, a patchwork of existing legislation and regulatory pronouncements governs various aspects of the crypto space. Key players include:

-

The Australian Securities and Investments Commission (ASIC): ASIC primarily focuses on regulating the offering and trading of crypto assets that meet the definition of a financial product under the Corporations Act 2001. This includes initial coin offerings (ICOs) and crypto exchanges that facilitate trading. ASIC's role is crucial in preventing fraud and protecting investors.

-

The Australian Prudential Regulation Authority (APRA): APRA's involvement centers on regulating crypto activities of authorized deposit-taking institutions (ADIs) and other financial institutions. This oversight ensures financial stability within the broader financial system.

-

The Australian Taxation Office (ATO): The ATO treats cryptocurrency as property for tax purposes. This means that capital gains tax applies to profits made from cryptocurrency transactions. Understanding these complex tax implications is critical for individuals and businesses involved in crypto trading.

-

AUSTRAC (Australian Transaction Reports and Analysis Centre): AUSTRAC is responsible for combating money laundering and terrorism financing. This involves regulating crypto exchanges and other businesses dealing with crypto assets to ensure compliance with anti-money laundering and counter-terrorism financing (AML/CTF) laws.

The Impact on Businesses and Investors

This multifaceted approach presents both opportunities and challenges. For businesses:

- Increased Compliance Costs: Navigating the various regulatory bodies and their requirements necessitates significant investment in compliance programs and legal expertise.

- Innovation Challenges: The lack of clear, consistent rules can hinder innovation and make it difficult for Australian crypto businesses to scale and compete globally.

- Investor Protection: The increased regulatory scrutiny aims to protect investors from fraudulent schemes and scams, fostering a more trustworthy environment.

For investors:

- Risk Mitigation: Clearer regulations can help investors understand the risks associated with crypto investments and make informed decisions.

- Market Stability: A well-defined regulatory framework can contribute to a more stable and predictable cryptocurrency market in Australia.

- Access to Legitimate Services: Regulations help weed out illegitimate players, leaving investors with access to reliable and secure platforms.

Looking Ahead: The Future of Crypto Regulation in Australia

The Australian government is actively considering further regulatory reforms. The focus is likely to be on:

- Licensing and Registration: Introducing a licensing framework for crypto exchanges and other service providers.

- Consumer Protection: Strengthening consumer protection measures to safeguard investors from scams and market manipulation.

- International Collaboration: Aligning Australian crypto regulations with international standards to promote global consistency.

The development of a more comprehensive regulatory framework will be crucial for Australia to remain competitive in the global crypto market while ensuring investor protection and financial stability. The journey towards a clear and consistent regulatory landscape is ongoing, and staying informed about developments is vital for both businesses and investors operating within this dynamic sector. Continuous monitoring of ASIC, APRA, ATO, and AUSTRAC announcements is crucial for navigating this evolving terrain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating The New Normal: Australia's Evolving Crypto Regulatory Framework And Its Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Swansea City At Leeds Championship Clash Form Guide And Head To Head Analysis

Mar 30, 2025

Swansea City At Leeds Championship Clash Form Guide And Head To Head Analysis

Mar 30, 2025 -

Your Favorite Businesses The New Weapon In Phishing Attacks

Mar 30, 2025

Your Favorite Businesses The New Weapon In Phishing Attacks

Mar 30, 2025 -

March 30 Nyt Strands Answers Game 392 Find The Solution Here

Mar 30, 2025

March 30 Nyt Strands Answers Game 392 Find The Solution Here

Mar 30, 2025 -

Ipl 2025 Gujarat Titans Gt Vs Mumbai Indians Mi Live Score And Updates

Mar 30, 2025

Ipl 2025 Gujarat Titans Gt Vs Mumbai Indians Mi Live Score And Updates

Mar 30, 2025 -

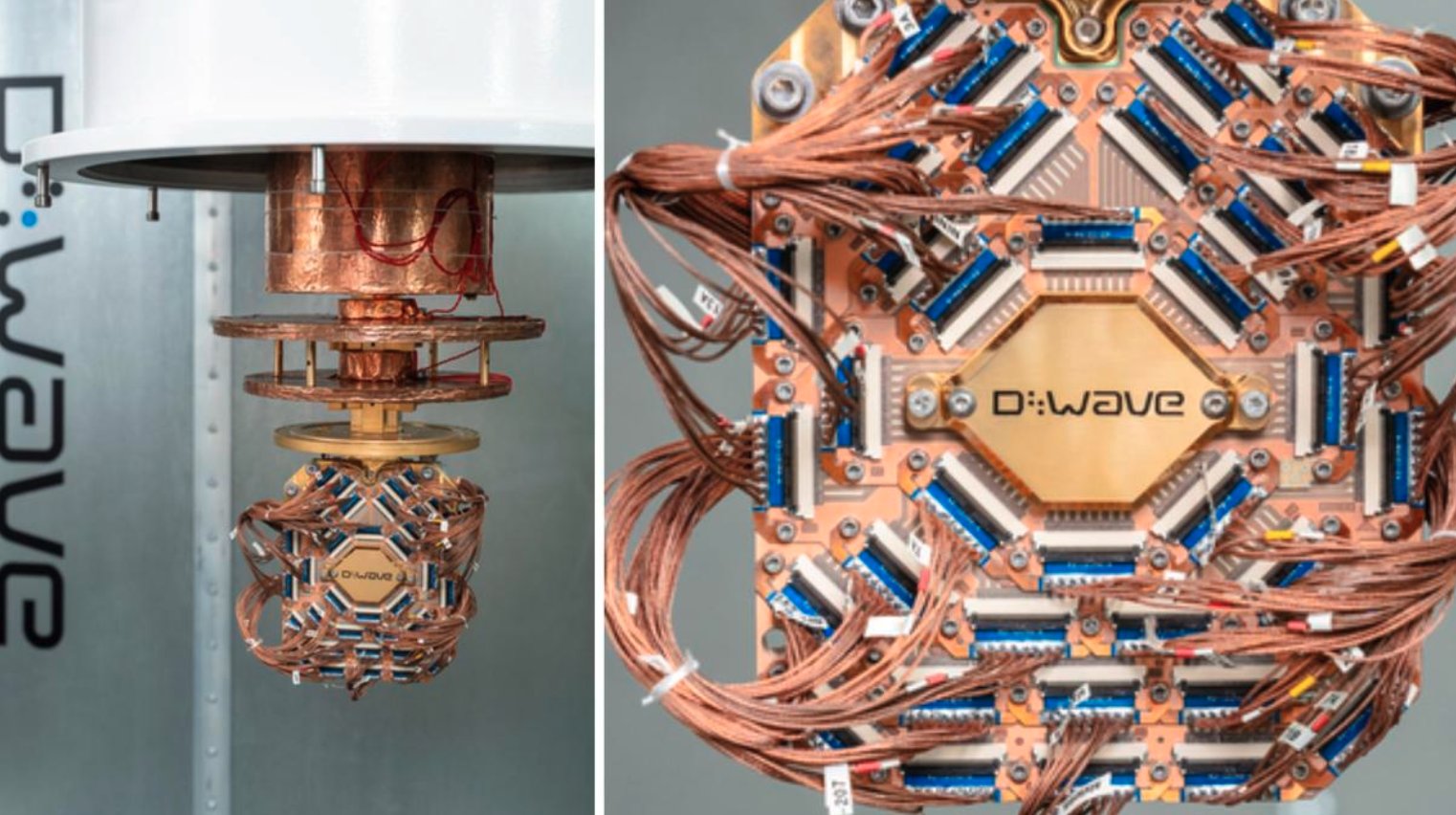

Materials Science Breakthrough D Waves Quantum Annealing Achieves Superior Simulation Results

Mar 30, 2025

Materials Science Breakthrough D Waves Quantum Annealing Achieves Superior Simulation Results

Mar 30, 2025