Near-Record Low: American Confidence In The Economy Crumbles

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Near-Record Low: American Confidence in the Economy Crumbles

American confidence in the economy has plummeted to near-record lows, fueling concerns about potential recession and impacting consumer spending. The latest Consumer Confidence Index (CCI), released this week, paints a grim picture, revealing widespread anxieties about inflation, job security, and the overall economic outlook. This significant drop signals a potential shift in consumer behavior and could have major implications for the nation's economic trajectory.

A Nation's Worry: Key Findings of the CCI

The CCI, a widely followed economic indicator, measures consumers' assessment of current economic conditions and their expectations for the future. This month's reading shows a dramatic decline, reaching its lowest point since [Insert Month and Year of previous low, cite source]. Several key factors contributed to this sharp fall:

-

Inflationary Pressures: Persistently high inflation continues to erode purchasing power, leaving many Americans feeling financially strained. The rising cost of everyday necessities, from groceries to gasoline, is a major source of concern. This is particularly impacting lower-income households, who are disproportionately affected by price increases.

-

Job Market Uncertainty: While the unemployment rate remains relatively low, concerns about potential layoffs and economic slowdown are contributing to anxiety. News of major companies announcing hiring freezes or layoffs adds to this sense of instability, further depressing consumer confidence.

-

Geopolitical Instability: The ongoing war in Ukraine and its global impact on energy prices and supply chains continue to weigh heavily on the minds of consumers. This adds another layer of uncertainty to an already challenging economic landscape.

-

Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, are also impacting consumer sentiment. Higher interest rates increase borrowing costs, making it more expensive for consumers to finance purchases, such as homes and cars.

The Impact on Consumer Spending: A Looming Recession?

The decline in consumer confidence is likely to translate into a slowdown in consumer spending, a key driver of economic growth. When consumers are pessimistic about the future, they tend to reduce their spending, which can trigger a downward economic spiral. This decreased spending could further exacerbate economic challenges and potentially push the economy into a recession.

Economists are closely monitoring the situation, with some predicting a potential recession in the coming months. The current economic climate is characterized by a complex interplay of factors, making accurate predictions challenging.

What Lies Ahead: Potential Government Interventions and Consumer Strategies

The government may need to implement further measures to address the economic challenges and boost consumer confidence. This could include targeted fiscal policies aimed at alleviating the burden of inflation on vulnerable populations, or further regulatory adjustments to manage economic volatility.

For consumers, it's crucial to adopt prudent financial strategies:

-

Budgeting and Saving: Creating and sticking to a realistic budget is paramount. Saving for emergencies and building a financial safety net can provide a buffer during uncertain times.

-

Debt Management: Managing existing debt and avoiding new debt is crucial to maintain financial stability.

-

Diversification: Diversifying investments can help to mitigate risk and protect against potential economic downturns.

The current economic climate necessitates careful monitoring and strategic adjustments. The near-record low in consumer confidence serves as a stark warning, highlighting the urgent need for effective policies and responsible financial management to navigate these challenging times. The coming months will be crucial in determining the trajectory of the American economy and the well-being of its citizens.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Near-Record Low: American Confidence In The Economy Crumbles. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wh 1000 Xm 6 Review Do Sonys Flagship Headphones Beat Bose

May 17, 2025

Wh 1000 Xm 6 Review Do Sonys Flagship Headphones Beat Bose

May 17, 2025 -

Bitcoins Future Experts Debate The Significance Of The Current Price Correction

May 17, 2025

Bitcoins Future Experts Debate The Significance Of The Current Price Correction

May 17, 2025 -

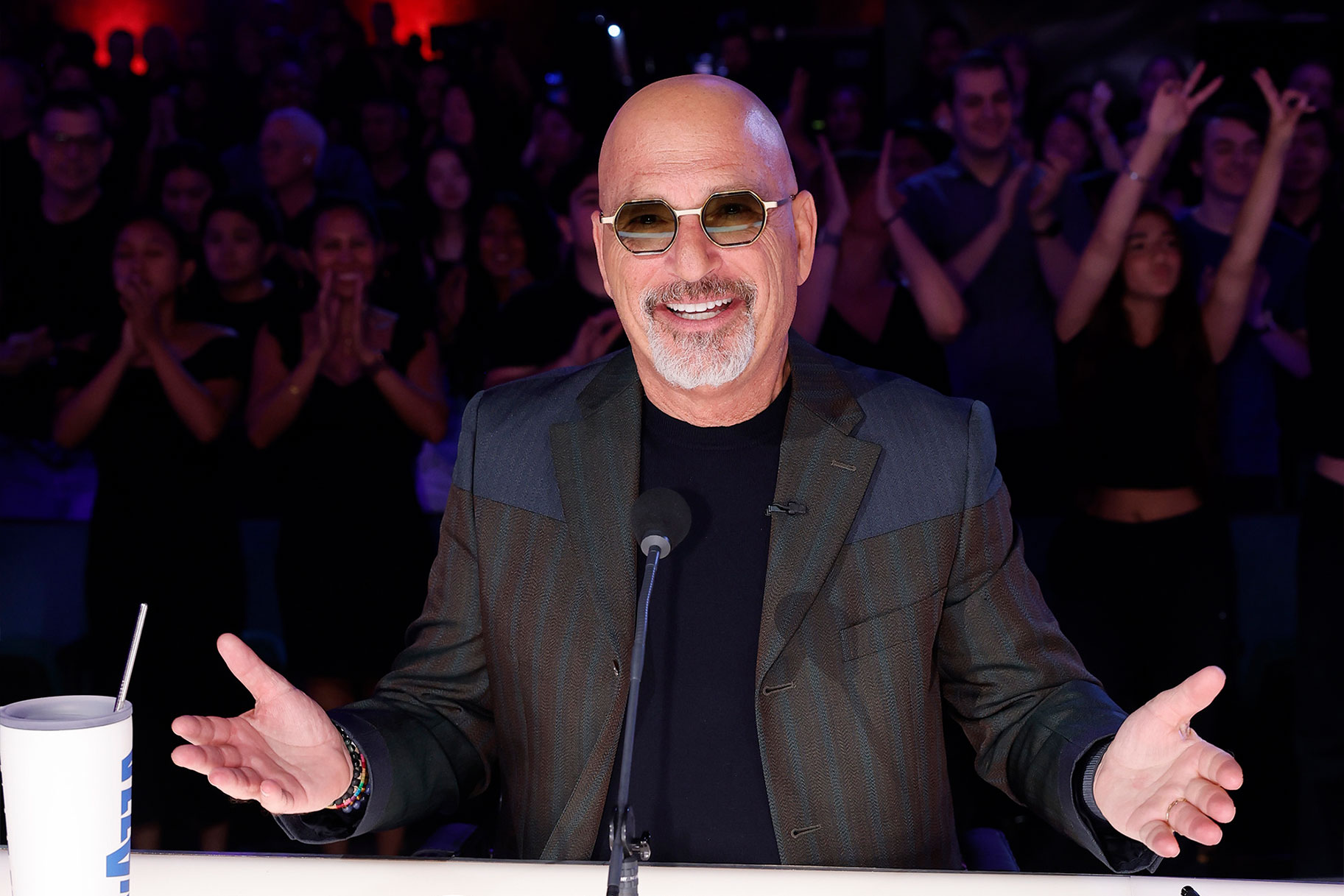

Howie Mandels Granddaughters Got Talent Performance Goes Viral Video

May 17, 2025

Howie Mandels Granddaughters Got Talent Performance Goes Viral Video

May 17, 2025 -

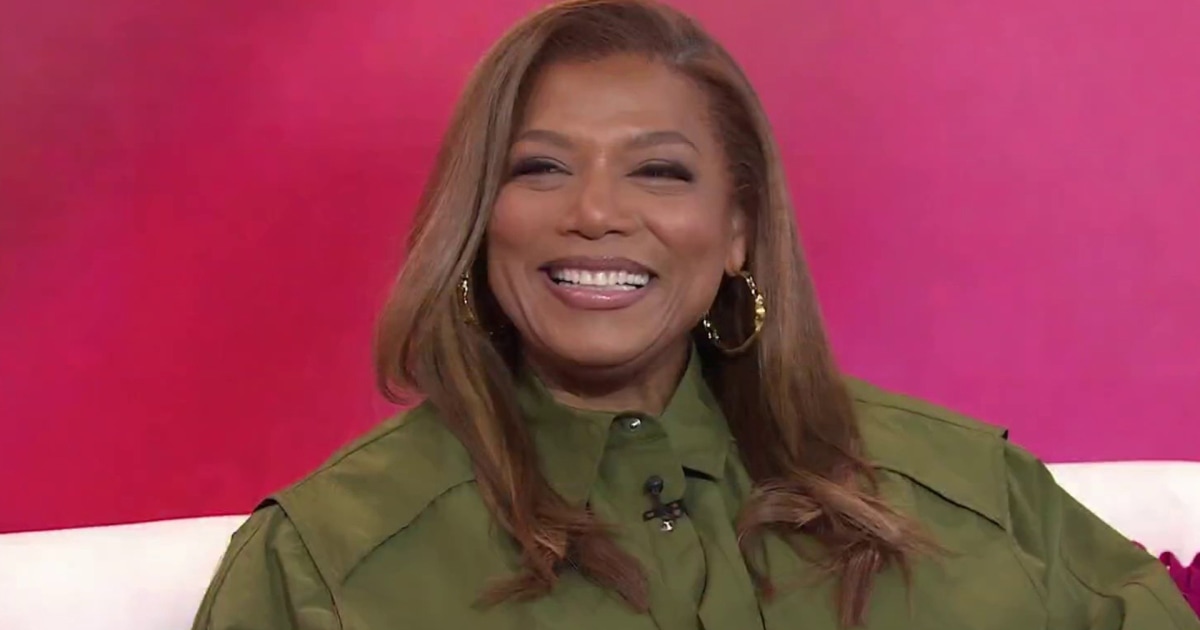

Queen Latifahs Biopic And The Journey Of A Legendary Icon

May 17, 2025

Queen Latifahs Biopic And The Journey Of A Legendary Icon

May 17, 2025 -

Warren Buffetts Investment Philosophy And The Volatility Of The Crypto Market

May 17, 2025

Warren Buffetts Investment Philosophy And The Volatility Of The Crypto Market

May 17, 2025