Netflix Stock Dips: Impact Of New Tariffs Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Netflix Stock Dips: Impact of New Tariffs Analyzed

Netflix investors saw a dip in the streaming giant's stock price following the announcement of new tariffs impacting international operations. The implications are complex, extending beyond simple cost increases and impacting everything from subscriber acquisition to content creation strategies. This article delves into the specifics of the situation, analyzing the potential long-term effects on Netflix's global dominance.

The Tariff Trigger:

Recent tariff increases, primarily impacting data transfer and international bandwidth usage, have directly hit Netflix's bottom line. These tariffs, imposed by [Insert Country/Region and Specify Tariff Type if possible, e.g., the European Union's new digital services tax], significantly increase the cost of delivering content to international subscribers. This is a considerable blow to a company that prides itself on its global reach and vast library of international programming.

Immediate Impact on Netflix Stock:

The stock market reacted swiftly to the news, with Netflix shares experiencing a noticeable decline. Analysts attribute this drop to concerns about reduced profitability and potential impacts on future growth. The increased costs directly eat into profit margins, forcing Netflix to either absorb the expense or pass it on to consumers through price hikes. Both options present significant challenges.

Long-Term Implications:

The impact of these new tariffs extends far beyond short-term stock fluctuations. Here are some key long-term considerations:

-

Price Increases and Subscriber Churn: Passing on the increased costs to subscribers through price hikes risks driving away price-sensitive consumers, leading to subscriber churn. This is particularly concerning in regions with lower average incomes where Netflix faces stiff competition from cheaper, locally produced content.

-

Content Acquisition and Production: Higher operational costs may force Netflix to reassess its content budget. This could mean less investment in original programming, potentially impacting the platform's appeal and competitive edge. The shift could favor cheaper, locally-sourced content over large-scale, internationally produced shows.

-

Geographic Expansion Strategies: Future expansion into new international markets might be hindered by the increased costs associated with these tariffs. Netflix might prioritize regions with more favorable regulatory environments and lower operational costs.

-

Innovation and Technological Adaptation: The pressure to remain profitable in this new environment might incentivize Netflix to invest more heavily in technological solutions to optimize content delivery and reduce bandwidth costs. This could involve advancements in compression technology or strategic partnerships with local internet providers.

Analyst Perspectives:

Financial analysts offer mixed opinions on the long-term outlook. While some express concern about the sustained impact of these tariffs on Netflix's profitability and growth, others point to Netflix's strong brand recognition and extensive content library as buffers against significant negative effects. The coming quarters will be crucial in determining the true extent of these tariffs' impact.

Conclusion:

The recent dip in Netflix stock highlights the complexities of operating a global streaming service in a world of ever-changing regulatory landscapes. The impact of new tariffs will undoubtedly shape Netflix's strategies for the foreseeable future. The company's ability to navigate these challenges effectively will be a key factor in determining its continued success and market dominance. Only time will tell if Netflix can effectively adapt and mitigate these newly imposed costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Netflix Stock Dips: Impact Of New Tariffs Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Llama 4 Metas Latest Ai Advance Anticipation Builds For Future Models

Apr 07, 2025

Llama 4 Metas Latest Ai Advance Anticipation Builds For Future Models

Apr 07, 2025 -

Ge Force Rtx 5060 Ti And Rtx 5060 Pcs Oems Launch Pre Built Gaming Systems Starting At 1149

Apr 07, 2025

Ge Force Rtx 5060 Ti And Rtx 5060 Pcs Oems Launch Pre Built Gaming Systems Starting At 1149

Apr 07, 2025 -

Dan Biggars Retirement A Look Back At The Welsh Fly Halfs Legacy

Apr 07, 2025

Dan Biggars Retirement A Look Back At The Welsh Fly Halfs Legacy

Apr 07, 2025 -

Guardians Overwhelmed Angels Offensive Powerhouse Shines

Apr 07, 2025

Guardians Overwhelmed Angels Offensive Powerhouse Shines

Apr 07, 2025 -

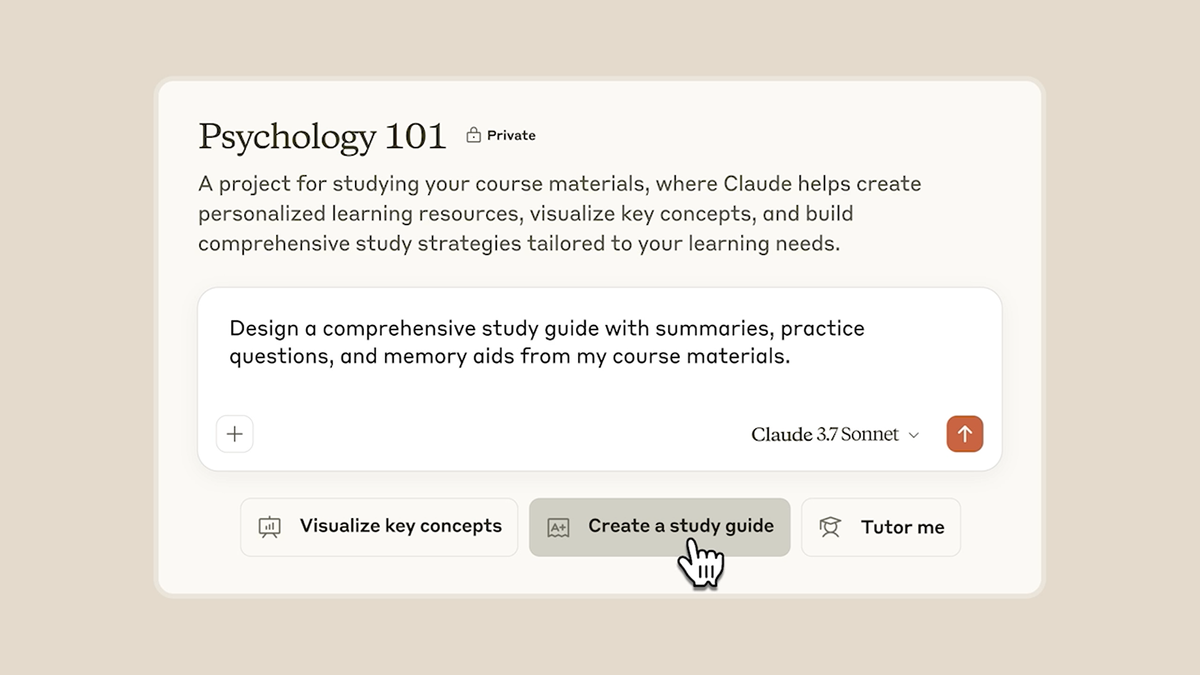

From Freshman To Graduate Claudes College Study Plan

Apr 07, 2025

From Freshman To Graduate Claudes College Study Plan

Apr 07, 2025