New DBS CEO Aims High: 15-17% Return On Equity Target

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New DBS CEO Aims High: 15-17% Return on Equity Target

DBS Bank's newly appointed CEO, Piyush Gupta, has set an ambitious target of achieving a 15-17% return on equity (ROE) in the coming years. This bold move signals a renewed focus on profitability and growth for the Singaporean banking giant, marking a significant shift in strategic direction. The announcement sent ripples through the financial markets, prompting analysts to closely scrutinize DBS's plans for achieving this ambitious goal.

The previous ROE target, while respectable, fell short of Gupta's ambitious vision. This significant increase reflects a confident outlook for the bank, fueled by its strong financial position and strategic initiatives. Gupta's vision extends beyond mere financial targets; it encompasses a broader commitment to innovation, digital transformation, and sustainable growth.

<h3>Driving Forces Behind the Ambitious ROE Target</h3>

Several factors contribute to Gupta's confidence in achieving this high ROE target. These include:

-

Strong Regional Growth: DBS boasts a substantial presence across Asia, a region experiencing significant economic growth. This positions the bank to capitalize on expanding markets and increasing opportunities. The bank's strategic investments in key Asian economies are expected to yield substantial returns.

-

Digital Transformation Strategy: DBS has been a pioneer in digital banking, investing heavily in technology and innovation to enhance customer experience and streamline operations. This digital-first approach is expected to significantly boost efficiency and reduce costs, contributing to improved profitability. The bank's mobile app, for example, consistently ranks among the best in the industry.

-

Focus on Wealth Management: The burgeoning wealth management sector in Asia presents a significant opportunity for growth. DBS is strategically positioned to capture a larger share of this market, leveraging its strong brand reputation and extensive network. Expanding wealth management services is a key component of their strategic roadmap.

-

Sustainable and Responsible Banking: Increasingly, investors and customers prioritize sustainability. DBS's commitment to responsible banking practices not only aligns with global trends but also enhances its brand reputation and attracts environmentally conscious clients. This focus on ESG (Environmental, Social, and Governance) factors is seen as crucial for long-term success.

<h3>Challenges and Potential Roadblocks</h3>

While the target is ambitious, it's not without its challenges. Factors that could impact the achievement of the 15-17% ROE include:

-

Geopolitical Uncertainty: Global economic instability and geopolitical tensions pose risks to the banking sector. Successfully navigating these uncertainties will be crucial for DBS to stay on track.

-

Competition: The Asian banking landscape is fiercely competitive. Maintaining a competitive edge while delivering on the ambitious ROE target will require continuous innovation and strategic adjustments.

-

Regulatory Changes: Changes in regulatory frameworks could impact profitability and require DBS to adapt its operations accordingly.

<h3>Analyst Reactions and Market Outlook</h3>

Analysts have expressed a mixture of optimism and caution regarding DBS's ambitious target. While acknowledging the bank's strengths and strategic initiatives, some analysts remain concerned about the potential impact of external factors. The market reaction to the announcement has been generally positive, reflecting confidence in Gupta's leadership and DBS's long-term prospects. However, the coming years will be crucial in determining whether the bank can successfully navigate the challenges and achieve its ambitious ROE target. The success of this strategy will be closely monitored by investors and industry experts alike, setting a benchmark for other banks in the region.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New DBS CEO Aims High: 15-17% Return On Equity Target. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reims Vs Marseille Match Preview Predicted Lineups And Key Players

Mar 30, 2025

Reims Vs Marseille Match Preview Predicted Lineups And Key Players

Mar 30, 2025 -

Prithviraj Sukumaran Mammoottys Unbreakable Bond With Mohanlal

Mar 30, 2025

Prithviraj Sukumaran Mammoottys Unbreakable Bond With Mohanlal

Mar 30, 2025 -

Is Crocodile Dundees Popularity Still Strong After Almost 40 Years

Mar 30, 2025

Is Crocodile Dundees Popularity Still Strong After Almost 40 Years

Mar 30, 2025 -

Critical Analysis The Shortcomings Of Mob Land Starring Tom Hardy

Mar 30, 2025

Critical Analysis The Shortcomings Of Mob Land Starring Tom Hardy

Mar 30, 2025 -

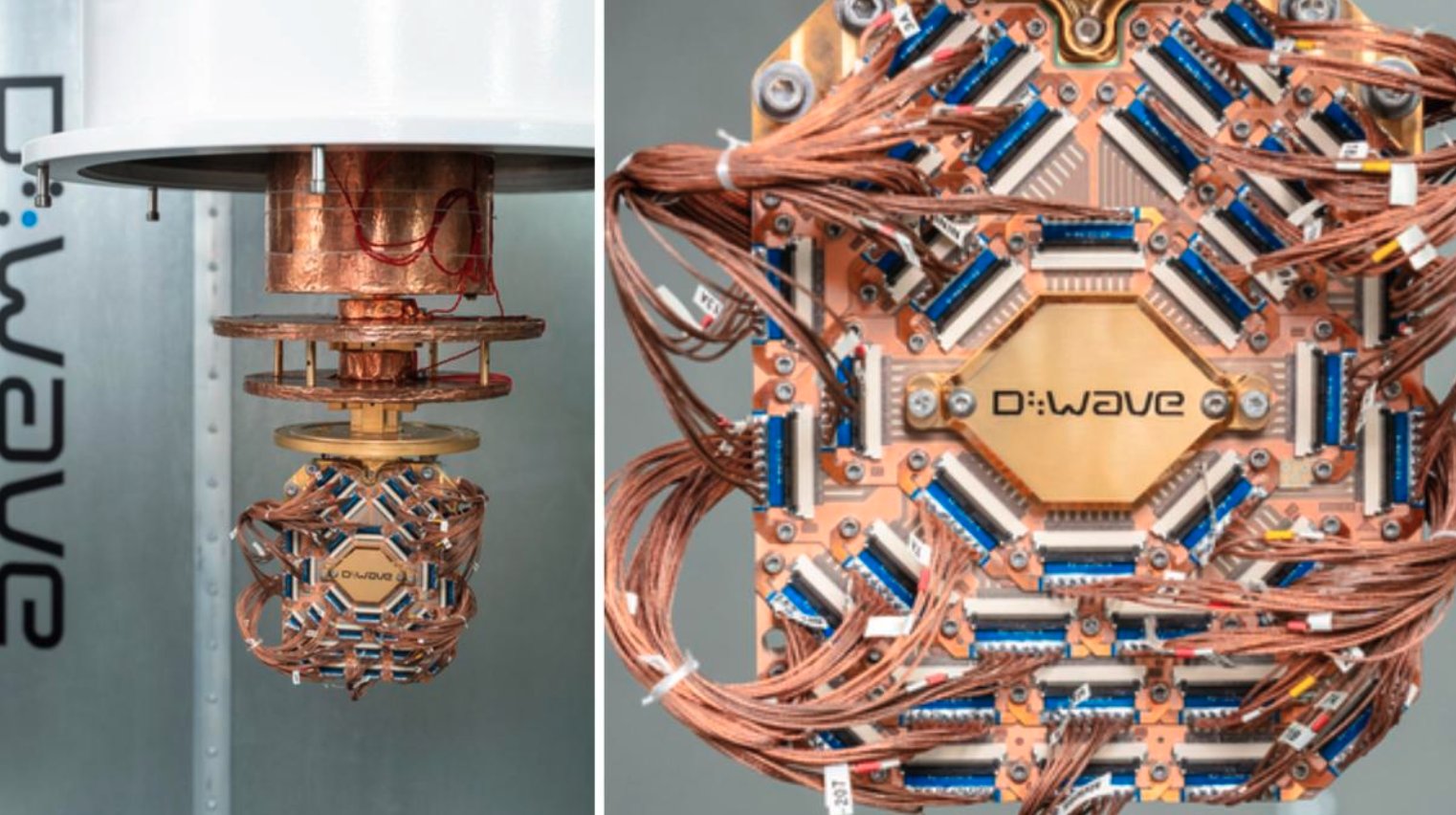

Superior Materials Simulation D Waves Quantum Annealer Demonstrates Computational Advantage

Mar 30, 2025

Superior Materials Simulation D Waves Quantum Annealer Demonstrates Computational Advantage

Mar 30, 2025