New Russian Law: Crypto Disputes Require Prior Tax Reporting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Russian Law: Crypto Disputes Require Prior Tax Reporting – Implications for Investors

Russia's tightening grip on cryptocurrency continues with a new law demanding taxpayers report all crypto transactions before engaging in any legal disputes. This significant development impacts both individual investors and businesses operating within the burgeoning Russian crypto market, adding another layer of complexity to an already intricate regulatory landscape. The implications are far-reaching and necessitate a thorough understanding of the new requirements.

What the New Law Entails

The recently enacted legislation mandates that any individual or entity initiating legal action concerning cryptocurrency transactions – be it a contract dispute, fraud claim, or any other legal challenge – must first demonstrate full compliance with Russian tax laws regarding those specific transactions. This means providing irrefutable proof of declared income and paid taxes related to the crypto assets involved in the dispute. Failure to do so could result in the court dismissing the case outright.

This effectively creates a significant hurdle for resolving crypto-related legal issues. It's no longer enough to simply possess evidence supporting your claim; you must also prove your tax compliance, potentially delaying or even derailing the legal process.

Who is Affected?

This law has wide-ranging implications, impacting a broad spectrum of individuals and entities:

- Individual Cryptocurrency Investors: Anyone trading, holding, or using cryptocurrencies for investment purposes must ensure meticulous record-keeping and tax compliance to protect themselves in case of future disputes.

- Cryptocurrency Businesses: Companies involved in crypto exchange, mining, or related services face increased scrutiny and must implement robust systems for tracking and reporting transactions to comply with the new stipulations.

- Legal Professionals: Lawyers specializing in crypto-related matters will need to adapt their strategies and incorporate tax compliance verification into their due diligence processes.

The Significance of Tax Reporting Compliance

The underlying rationale behind this legislation is clear: the Russian government aims to increase transparency and crack down on tax evasion within the cryptocurrency sector. This is part of a larger global trend where governments are grappling with the regulatory challenges posed by decentralized digital assets.

By linking legal recourse to tax compliance, Russia is sending a strong message to crypto users. This creates a powerful incentive for proper tax reporting, strengthening the government's ability to monitor and regulate the crypto market effectively.

Navigating the New Landscape

The implementation of this new law presents challenges for navigating the legal complexities surrounding cryptocurrency in Russia. Individuals and businesses must:

- Maintain meticulous records: Keep detailed logs of all crypto transactions, including dates, amounts, and counterparties.

- Seek professional advice: Consult with tax and legal professionals specializing in cryptocurrency to ensure compliance.

- Stay updated on regulatory changes: The crypto regulatory landscape is constantly evolving, so staying informed is crucial.

Conclusion:

This new Russian law significantly alters the landscape for cryptocurrency disputes, placing a strong emphasis on tax reporting compliance. The implications are profound, requiring individuals and businesses operating within the Russian crypto market to prioritize meticulous record-keeping and seek expert guidance to avoid potential legal pitfalls. The move reflects a broader global trend of governments seeking greater control over the cryptocurrency sector. Failure to comply could have severe consequences, highlighting the importance of proactive tax planning and legal counsel in this evolving area.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Russian Law: Crypto Disputes Require Prior Tax Reporting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Messi Comparisons For Inters Martinez Says The Striker Himself

May 01, 2025

No Messi Comparisons For Inters Martinez Says The Striker Himself

May 01, 2025 -

Arsenal Women Vs Aston Villa Poor Performance Hands Chelsea Wsl Title

May 01, 2025

Arsenal Women Vs Aston Villa Poor Performance Hands Chelsea Wsl Title

May 01, 2025 -

Ge 2025 Gigene Wongs Racial Slur Against Fellow Sdp Candidate Sparks Outrage

May 01, 2025

Ge 2025 Gigene Wongs Racial Slur Against Fellow Sdp Candidate Sparks Outrage

May 01, 2025 -

Acesso A Casas De Praia E Campo Alternativas A Compra Direta Do Imovel

May 01, 2025

Acesso A Casas De Praia E Campo Alternativas A Compra Direta Do Imovel

May 01, 2025 -

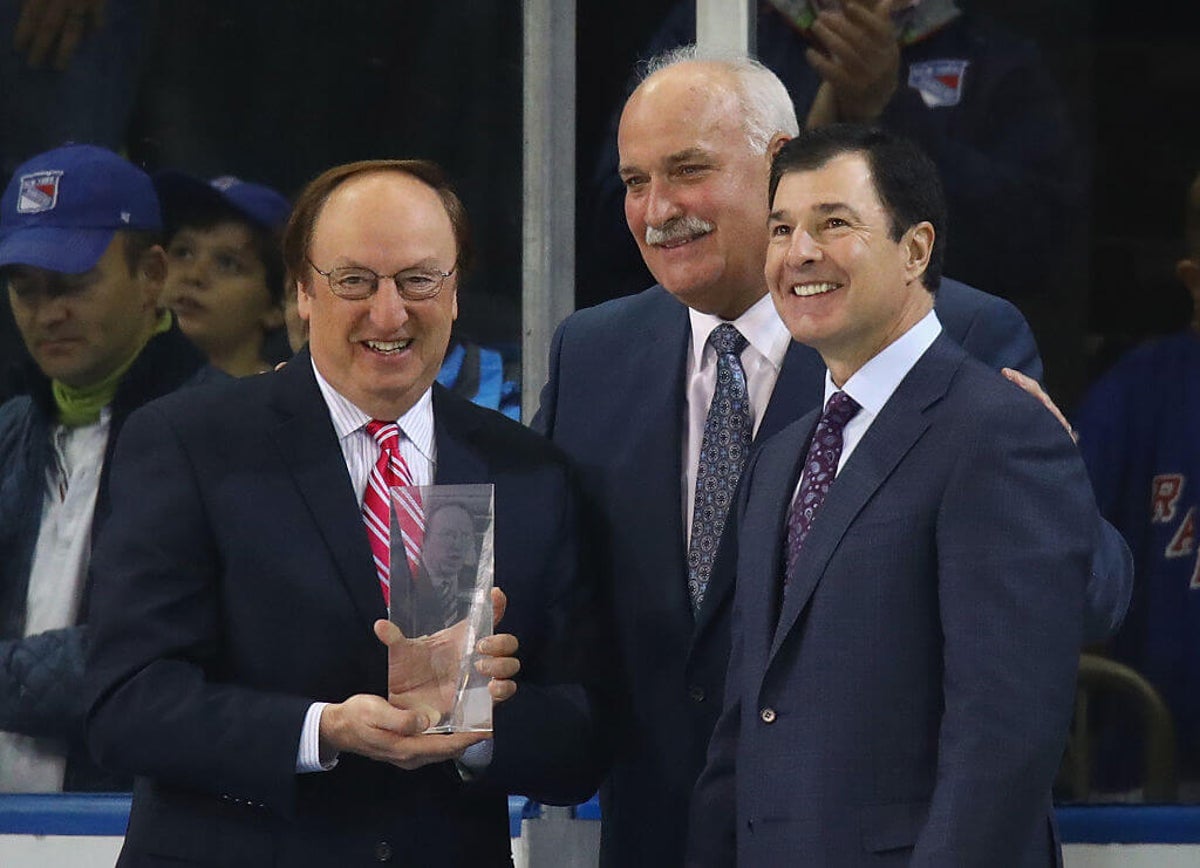

Joe Michelettis Retirement A Look Back At The Legendary Rangers Analysts Career

May 01, 2025

Joe Michelettis Retirement A Look Back At The Legendary Rangers Analysts Career

May 01, 2025