NFTs And Securities: SEC Commissioner Peirce Clarifies Position On Creator-Based NFT Models

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NFTs and Securities: SEC Commissioner Peirce Clarifies Position on Creator-Based NFT Models

The intersection of non-fungible tokens (NFTs) and securities law remains a murky area, causing uncertainty for creators and investors alike. However, SEC Commissioner Hester Peirce, known for her crypto-friendly stance, recently offered crucial clarification regarding creator-based NFT models, providing much-needed insight into this evolving landscape. Her comments shed light on the potential distinction between NFTs sold as investments and those offered as purely creative works.

Peirce's Emphasis on the "Howey Test"

Commissioner Peirce's statements centered on the application of the Howey Test, the cornerstone of US securities law. This test determines whether an offering constitutes an investment contract, and thus, a security. The Howey Test has four prongs:

- Investment of money: Did investors contribute funds?

- In a common enterprise: Is there a shared venture between investors and promoters?

- With a reasonable expectation of profits: Do investors anticipate profits derived primarily from the efforts of others?

- Derived from the efforts of others: Is the success of the investment reliant on the efforts of the promoter or a third party?

Peirce suggests that NFTs sold directly by creators, without promises of future returns or reliance on a centralized entity for their value, are less likely to meet the criteria of the Howey Test. This implies they may not be classified as securities.

Distinguishing between Investment and Artistic Merit

The key distinction, according to Peirce, lies in the marketing and the nature of the offering. NFTs marketed solely on their artistic merit, with the creator retaining full control and offering no promises of future financial gains, fall outside the purview of securities regulation. This approach focuses on the intent behind the NFT offering – is it primarily an artistic endeavor or an investment scheme?

Creator-Based NFT Models: A Safer Bet?

This clarification offers a lifeline for creators looking to leverage NFTs to fund their work without navigating the complex regulatory maze of securities law. Models where creators directly sell their digital artwork, with clear disclaimers about the lack of investment potential, appear to be better positioned to avoid securities classification.

Challenges and Uncertainties Remain

Despite this clarification, uncertainties remain. The line between a legitimate artistic endeavor and a thinly veiled investment scheme can be blurry. The SEC's interpretation of the Howey Test can be subjective, and future case law will likely further shape the legal landscape. Factors like:

- The use of marketing materials: Promising future returns or highlighting potential appreciation in value can trigger securities implications.

- The level of creator involvement: NFTs sold through a centralized platform with promises of secondary market gains may still be considered securities.

- The structure of the offering: Complex offerings with tiered rewards or profit-sharing arrangements are more likely to be classified as securities.

will influence how the SEC views specific NFT offerings.

Conclusion: Navigating the Regulatory Landscape

Commissioner Peirce's statements offer a welcome degree of clarity for creators and entrepreneurs in the NFT space. While uncertainty still exists, focusing on the artistic merit of the NFT, avoiding promises of future returns, and maintaining full creative control significantly reduces the likelihood of regulatory scrutiny. As the NFT market matures, continued dialogue and further regulatory guidance will be critical to fostering innovation while upholding investor protection. Consult with legal counsel for personalized advice on navigating the complexities of NFT regulations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NFTs And Securities: SEC Commissioner Peirce Clarifies Position On Creator-Based NFT Models. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Elon Musk Driverless Tesla Robotaxis In Austin Next Month Million Nationwide By 2026

May 23, 2025

Elon Musk Driverless Tesla Robotaxis In Austin Next Month Million Nationwide By 2026

May 23, 2025 -

106 K Bitcoin Institutional Investment Fuels Record Breaking Rally

May 23, 2025

106 K Bitcoin Institutional Investment Fuels Record Breaking Rally

May 23, 2025 -

Android Autos Latest Update 5 Useful Free Improvements

May 23, 2025

Android Autos Latest Update 5 Useful Free Improvements

May 23, 2025 -

Memorial Day Weekend Forecast Prepare For Possible Soggy Weather

May 23, 2025

Memorial Day Weekend Forecast Prepare For Possible Soggy Weather

May 23, 2025 -

Dells Ceo Ai Our New Tools For A More Efficient Species

May 23, 2025

Dells Ceo Ai Our New Tools For A More Efficient Species

May 23, 2025

Latest Posts

-

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

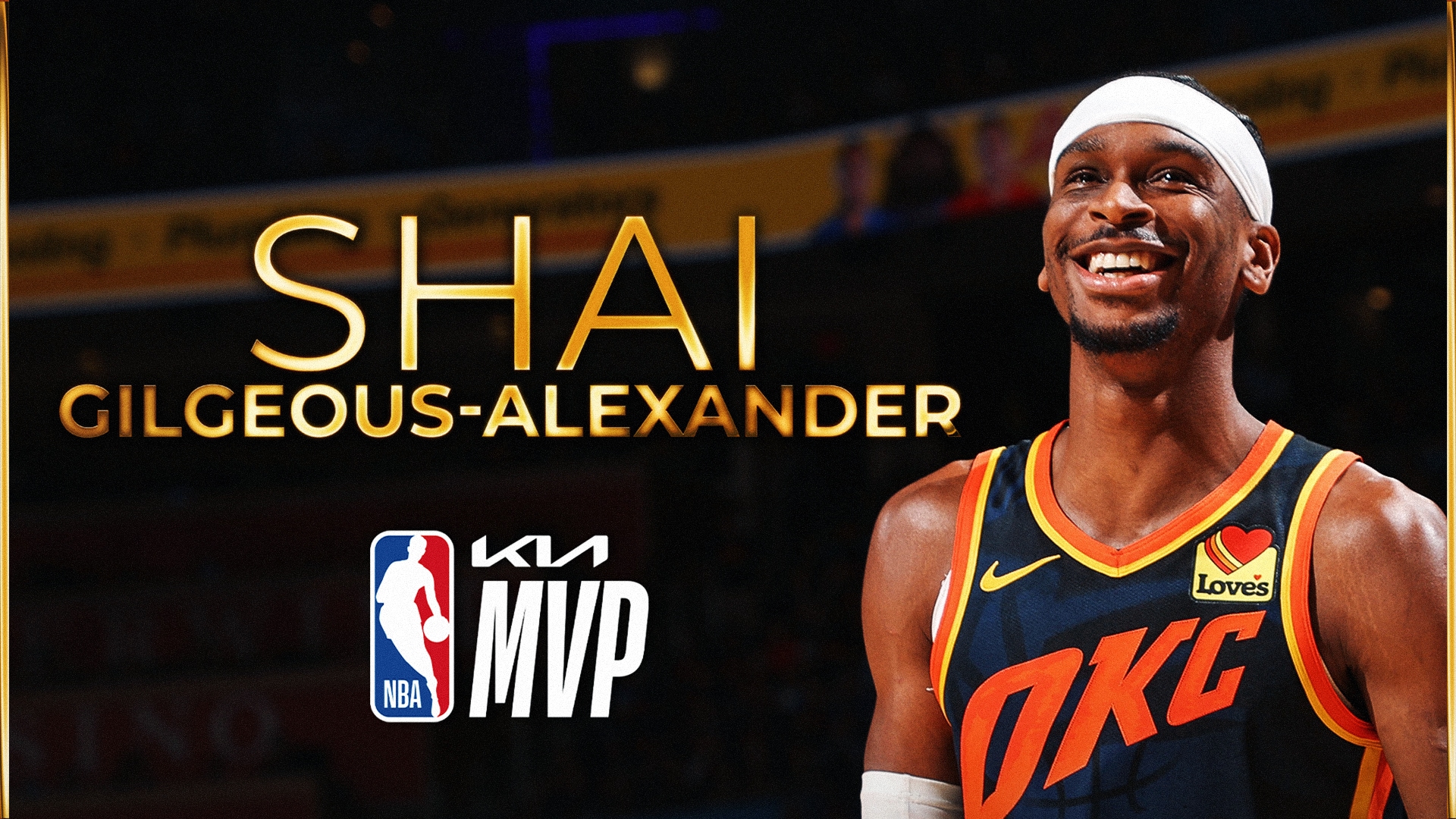

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025 -

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025