No Deep Rate Cuts Expected: Bullock's Assessment Post-Trump Political Upheaval

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Deep Rate Cuts Expected: Bullock's Assessment Post-Trump Political Upheaval

The aftermath of the Trump administration has left the US economic landscape in a state of flux, sparking considerable speculation about potential Federal Reserve actions. However, prominent economist Dr. Anya Bullock recently downplayed expectations of drastic interest rate cuts, offering a nuanced perspective on the current economic climate and its implications for monetary policy. Her assessment, delivered during a highly anticipated press conference yesterday, provides crucial insight into the future direction of interest rates and their potential impact on investors and consumers alike.

Bullock's Cautious Optimism Amidst Uncertainty

Dr. Bullock, renowned for her accurate economic forecasting, highlighted several factors contributing to her relatively conservative outlook on interest rate reductions. While acknowledging the lingering uncertainties stemming from the recent political upheaval, she emphasized the resilience of the US economy. Her analysis points to a surprisingly robust job market and continued, albeit slower, growth in key sectors.

"While the political transition has undoubtedly created volatility," Dr. Bullock stated, "the fundamental strength of the US economy shouldn't be underestimated. We are not facing a crisis that demands immediate, drastic intervention."

Key Factors Influencing Bullock's Prediction:

- Strong Labor Market: The consistently low unemployment rate indicates a healthy economy capable of withstanding short-term shocks.

- Steady, albeit Slower, Growth: While growth may have slowed compared to previous years, it remains positive, suggesting a stable, if not booming, economy.

- Inflation Remains Manageable: Current inflation figures remain within the Federal Reserve's target range, reducing the urgency for aggressive rate cuts to combat rising prices.

- Global Economic Factors: Bullock also acknowledged the impact of global economic uncertainties, but stressed that the US economy possesses sufficient resilience to navigate these challenges without requiring deep rate cuts.

What Does This Mean for Investors and Consumers?

Dr. Bullock's assessment suggests a period of relative stability, at least in the short term. Investors should expect a more measured approach from the Federal Reserve, minimizing the risk of sudden market fluctuations associated with aggressive rate cuts. For consumers, this translates to a relatively predictable economic environment, although sustained low interest rates may not materialize as quickly as some had hoped.

The Long-Term Outlook Remains Uncertain

While Dr. Bullock's analysis offers a degree of reassurance, she cautioned against complacency. The long-term economic consequences of the recent political transition remain unclear, and unforeseen events could still significantly impact the economy and the Federal Reserve's policy decisions. Continued monitoring of key economic indicators and close observation of global economic trends are crucial in navigating this period of uncertainty.

Conclusion: A Measured Approach to Monetary Policy

Dr. Bullock's prediction of no deep rate cuts offers a much-needed dose of realism in the face of ongoing political and economic uncertainty. Her analysis, grounded in a careful assessment of current economic data, suggests a more measured and cautious approach to monetary policy. While the future remains uncertain, her insights provide a valuable framework for investors, consumers, and policymakers alike as they navigate the complexities of the post-Trump economic landscape. The coming months will undoubtedly be crucial in determining the long-term trajectory of the US economy and the Federal Reserve’s response.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Deep Rate Cuts Expected: Bullock's Assessment Post-Trump Political Upheaval. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

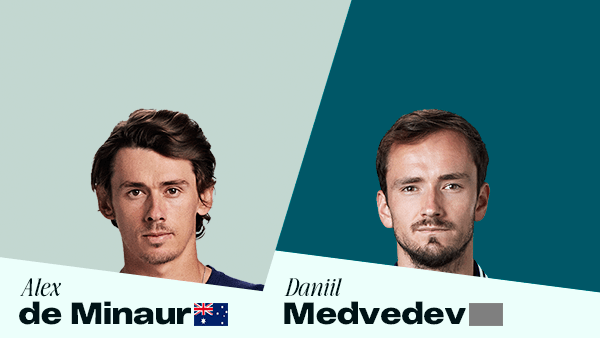

Medvedev Vs De Minaur Monte Carlo Masters Preview And Live Streaming Guide

Apr 11, 2025

Medvedev Vs De Minaur Monte Carlo Masters Preview And Live Streaming Guide

Apr 11, 2025 -

Australian Duo Shine Popyrin And De Minaurs Successful Monte Carlo Masters Debut

Apr 11, 2025

Australian Duo Shine Popyrin And De Minaurs Successful Monte Carlo Masters Debut

Apr 11, 2025 -

Live Stream Masters Golf 2025 Second Round Free Watch Rose Scheffler De Chambeau Play

Apr 11, 2025

Live Stream Masters Golf 2025 Second Round Free Watch Rose Scheffler De Chambeau Play

Apr 11, 2025 -

Smolensk I Pilka Nozna Policja Ostrzega Przed Utrudnieniami W Warszawie

Apr 11, 2025

Smolensk I Pilka Nozna Policja Ostrzega Przed Utrudnieniami W Warszawie

Apr 11, 2025 -

Max Homas Outburst Golf Star Strikes Caddie Then Screams

Apr 11, 2025

Max Homas Outburst Golf Star Strikes Caddie Then Screams

Apr 11, 2025