NVDA Stock Evaluation: A Promising Investment Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NVDA Stock Evaluation: A Promising Investment Opportunity?

Nvidia (NVDA) has exploded onto the scene, transforming from a graphics card giant into a powerhouse driving the AI revolution. But is its meteoric rise sustainable, and is now the right time to invest? This in-depth evaluation explores the factors making NVDA a potentially lucrative investment, while also acknowledging the inherent risks.

The AI Gold Rush: Fueling NVDA's Growth

Nvidia's phenomenal success stems largely from its dominance in the Artificial Intelligence (AI) sector. Their high-performance GPUs (Graphics Processing Units) are crucial for training and running complex AI models, powering everything from generative AI applications like ChatGPT to advanced data centers. This isn't just hype; the demand for their hardware is skyrocketing, translating directly into record-breaking revenue and profits.

Key Factors Driving NVDA's Valuation:

- Dominant Market Share: NVDA holds a near-monopoly in the high-performance computing market crucial for AI development, giving them significant pricing power.

- Data Center Growth: The expansion of cloud computing and the increasing reliance on AI are fueling massive demand for NVDA's data center solutions.

- Software Ecosystem: Nvidia's software offerings, including CUDA and their various AI platforms, create a powerful ecosystem locking customers into their hardware.

- Automotive Advancements: The burgeoning autonomous vehicle market presents another significant growth opportunity for NVDA's technology.

H2: Potential Risks and Considerations:

While the prospects look bright, potential investors must acknowledge several key risks:

- Valuation Concerns: NVDA's stock price has experienced a dramatic surge, raising concerns about potential overvaluation. A market correction could significantly impact its price.

- Competition: While currently dominant, competitors like AMD and Intel are investing heavily in the AI space, potentially chipping away at NVDA's market share in the future.

- Geopolitical Factors: Global trade tensions and supply chain disruptions could impact NVDA's production and revenue.

- Economic Slowdown: A broader economic downturn could dampen demand for high-performance computing, negatively affecting NVDA's growth.

H3: Analyzing the Investment Opportunity:

So, is NVDA a promising investment opportunity? The answer, as with any investment, is nuanced. The company's current performance is undeniably impressive, driven by the explosive growth of AI. However, the high valuation and potential risks warrant careful consideration.

H3: Strategies for Investors:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

- Long-Term Perspective: NVDA's success hinges on the long-term growth of AI. A long-term investment approach might be more suitable than short-term trading.

- Fundamental Analysis: Thoroughly research NVDA's financials, including revenue, earnings, and debt levels, before making any investment decisions.

- Consult a Financial Advisor: Seek advice from a qualified financial advisor who can help you assess your risk tolerance and create a suitable investment strategy.

Conclusion:

NVDA's position at the forefront of the AI revolution makes it a compelling investment opportunity. However, the high valuation and inherent risks demand a thorough evaluation before committing capital. By carefully weighing the potential rewards against the risks, and employing a well-informed investment strategy, investors can make a decision aligned with their individual financial goals and risk tolerance. Remember to conduct your own due diligence and seek professional advice before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NVDA Stock Evaluation: A Promising Investment Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Connections Answers For Sunday May 11 Game 700

May 12, 2025

Nyt Connections Answers For Sunday May 11 Game 700

May 12, 2025 -

Expert Analysis Ai Semiconductor Stock Poised For Post May 28th Rally

May 12, 2025

Expert Analysis Ai Semiconductor Stock Poised For Post May 28th Rally

May 12, 2025 -

Check The Latest Lotto And Superenalotto Results For Today

May 12, 2025

Check The Latest Lotto And Superenalotto Results For Today

May 12, 2025 -

End Of An Era Virat Kohlis 14 Year Test Career Concludes At 269

May 12, 2025

End Of An Era Virat Kohlis 14 Year Test Career Concludes At 269

May 12, 2025 -

The Future Of Eu Cloud Decentralization And Data Security

May 12, 2025

The Future Of Eu Cloud Decentralization And Data Security

May 12, 2025

Latest Posts

-

Indian Cricket Legend Virat Kohli Announces Test Retirement

May 12, 2025

Indian Cricket Legend Virat Kohli Announces Test Retirement

May 12, 2025 -

Preventing The Next Crypto Crash How Ai Could Have Saved Investors From Mantras Om Failure

May 12, 2025

Preventing The Next Crypto Crash How Ai Could Have Saved Investors From Mantras Om Failure

May 12, 2025 -

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025 -

Simu Lius Engagement To Allison Hsu Details Revealed

May 12, 2025

Simu Lius Engagement To Allison Hsu Details Revealed

May 12, 2025 -

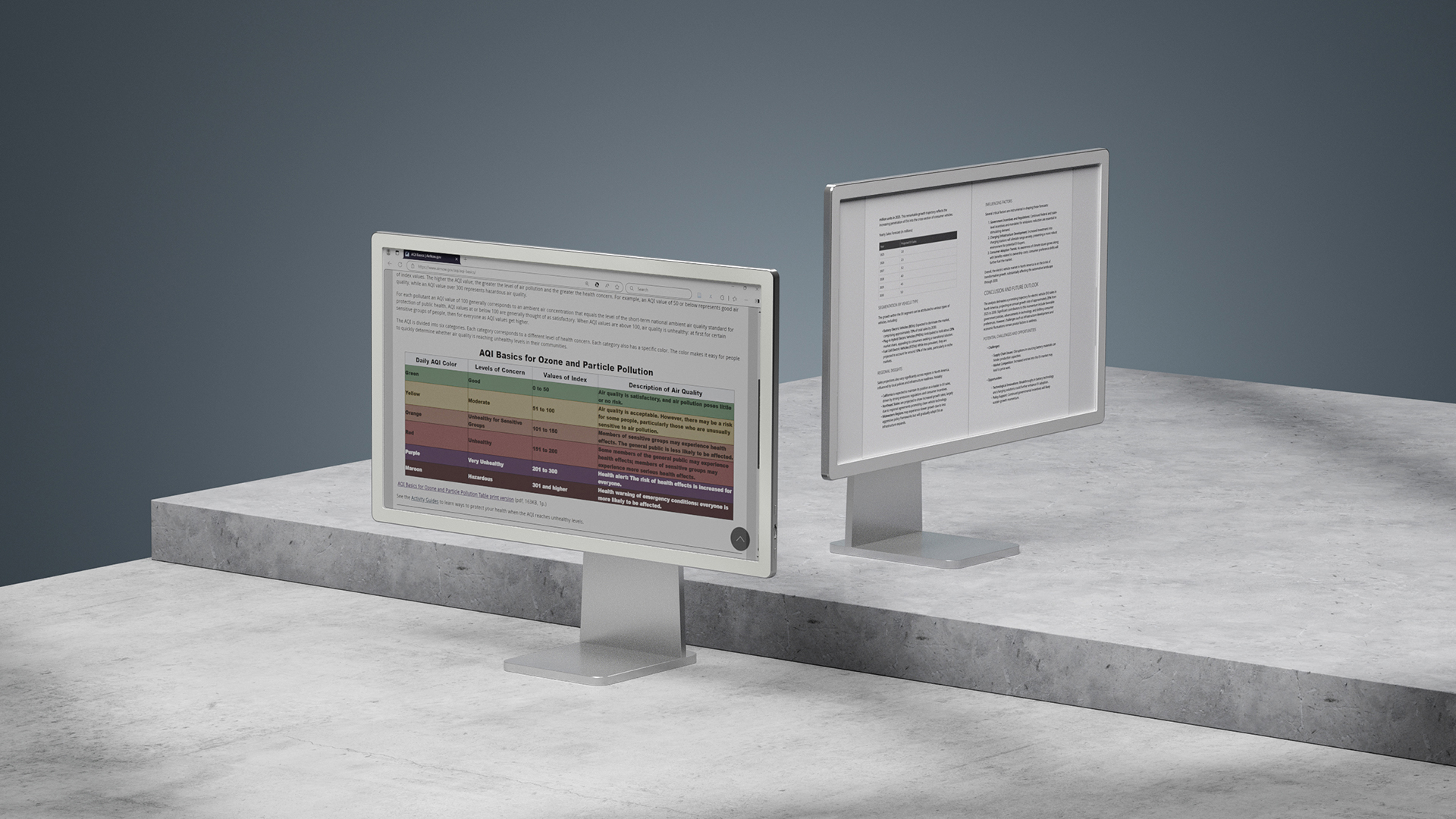

High Resolution E Ink The Cost And Benefits Of A 25 Inch Color Screen

May 12, 2025

High Resolution E Ink The Cost And Benefits Of A 25 Inch Color Screen

May 12, 2025