NVDA Stock: Strong Position, But What's Next?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NVDA Stock: Strong Position, but What's Next for Nvidia?

Nvidia (NVDA) has experienced a meteoric rise, captivating investors and solidifying its position as a tech titan. The company's dominance in the GPU market, fueled by the AI boom, has led to unprecedented growth. But with the stock price reaching stratospheric levels, the crucial question on every investor's mind is: what's next for NVDA? This article delves into Nvidia's current strengths, potential challenges, and future outlook, offering insights for both seasoned investors and newcomers considering adding NVDA to their portfolios.

Nvidia's Current Strengths: A Colossus in the Making

Nvidia's success isn't accidental. Several key factors contribute to its robust market position:

-

Dominance in AI Hardware: The surge in artificial intelligence has catapulted NVDA to the forefront. Its high-performance GPUs are essential for training and deploying AI models, making the company a critical player in this rapidly expanding sector. This demand translates directly into soaring revenue and profit margins.

-

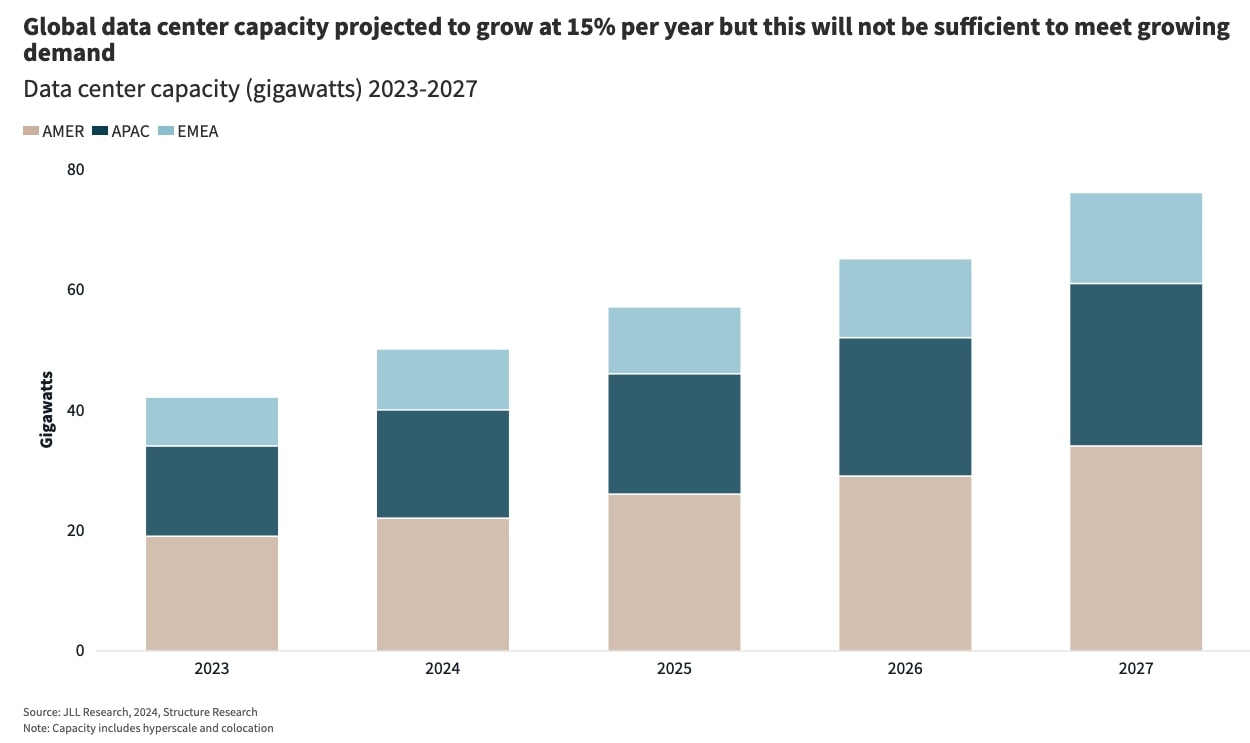

Data Center Growth: Beyond AI, Nvidia's data center business is booming. The increasing need for high-performance computing across various industries, from cloud computing to high-frequency trading, fuels this segment's impressive growth trajectory.

-

Automotive Innovation: Nvidia's foray into the automotive sector, particularly with its DRIVE platform for autonomous vehicles, represents a significant long-term growth opportunity. As self-driving technology matures, this segment is poised for explosive expansion.

-

Strong Brand Recognition and Market Leadership: Nvidia enjoys unparalleled brand recognition and market leadership in the GPU space. This established position creates a strong moat against competitors, safeguarding its market share.

Challenges on the Horizon: Navigating the Future

Despite its impressive achievements, NVDA faces potential headwinds:

-

Competition: While currently dominant, Nvidia isn't immune to competition. AMD and Intel are actively investing in GPU technology, aiming to chip away at Nvidia's market share. The intensity of this competition could impact future growth.

-

Overvaluation Concerns: The significant price appreciation of NVDA stock has led some analysts to express concerns about potential overvaluation. While future growth is expected, the current valuation leaves little room for error.

-

Economic Slowdown: A potential global economic slowdown could negatively impact demand for high-end computing, affecting Nvidia's sales and profitability. This macroeconomic factor presents a significant risk.

-

Supply Chain Disruptions: Continued supply chain disruptions could hinder Nvidia's ability to meet the growing demand for its products, impacting revenue and potentially investor sentiment.

What's Next for NVDA Stock? A Look Ahead

Predicting the future of any stock is inherently challenging, but several factors suggest a continued, albeit potentially less dramatic, growth trajectory for NVDA:

-

Continued AI Adoption: The long-term growth of AI is undeniable. As AI permeates various sectors, the demand for Nvidia's GPUs will likely remain strong.

-

Innovation and Diversification: Nvidia's commitment to innovation and diversification across different sectors mitigates risk and ensures continued growth avenues.

-

Strategic Partnerships: Strategic partnerships and collaborations will further strengthen Nvidia's position in the market and open up new opportunities.

Conclusion: A High-Growth Stock with Inherent Risks

NVDA stock represents a compelling investment opportunity for those with a high-risk tolerance. While the company's current position is undeniably strong, investors should carefully consider the potential challenges before making any investment decisions. Thorough due diligence and a long-term perspective are crucial for navigating the complexities of this high-growth, high-risk investment. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NVDA Stock: Strong Position, But What's Next?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025 -

Alan Shearer Predicts Liverpools Gakpo Signing Spotted Together

May 12, 2025

Alan Shearer Predicts Liverpools Gakpo Signing Spotted Together

May 12, 2025 -

Setor Publico Em Greve Empresas Contabilizam Prejuizos Multimilionarios

May 12, 2025

Setor Publico Em Greve Empresas Contabilizam Prejuizos Multimilionarios

May 12, 2025 -

Thunder Vs Nuggets Game 4 An Unattractive Win A Crucial Victory

May 12, 2025

Thunder Vs Nuggets Game 4 An Unattractive Win A Crucial Victory

May 12, 2025 -

Virgin Media O2 And Daisy Merge Creating A 3 Billion Telecoms Giant

May 12, 2025

Virgin Media O2 And Daisy Merge Creating A 3 Billion Telecoms Giant

May 12, 2025

Latest Posts

-

The Kohli Era Ends Impact Of Virat Kohlis Test Retirement On Indian Cricket

May 13, 2025

The Kohli Era Ends Impact Of Virat Kohlis Test Retirement On Indian Cricket

May 13, 2025 -

Smarter Phishing Safer You Combating Ai Driven Email Scams

May 13, 2025

Smarter Phishing Safer You Combating Ai Driven Email Scams

May 13, 2025 -

Betting Odds And Preview Osaka Vs Stearns Italian Open 2025 Round 4

May 13, 2025

Betting Odds And Preview Osaka Vs Stearns Italian Open 2025 Round 4

May 13, 2025 -

Brisbane Mp Sacked Labor Party Faces Internal Crisis

May 13, 2025

Brisbane Mp Sacked Labor Party Faces Internal Crisis

May 13, 2025 -

Bainbridge Educator Honored Good Morning Americas Breakfast In Bed Spotlight

May 13, 2025

Bainbridge Educator Honored Good Morning Americas Breakfast In Bed Spotlight

May 13, 2025