Nvidia Or Palo Alto Networks: A Post-Nasdaq Sell-Off Stock Comparison

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia vs. Palo Alto Networks: Which Stock to Buy After the Nasdaq Sell-Off?

The recent Nasdaq sell-off has left many investors wondering where to put their money. Two tech giants, Nvidia (NVDA) and Palo Alto Networks (PANW), have emerged as potential candidates, but which one offers a better investment opportunity post-correction? This in-depth comparison examines both companies' performance, future prospects, and risk factors to help you make an informed decision.

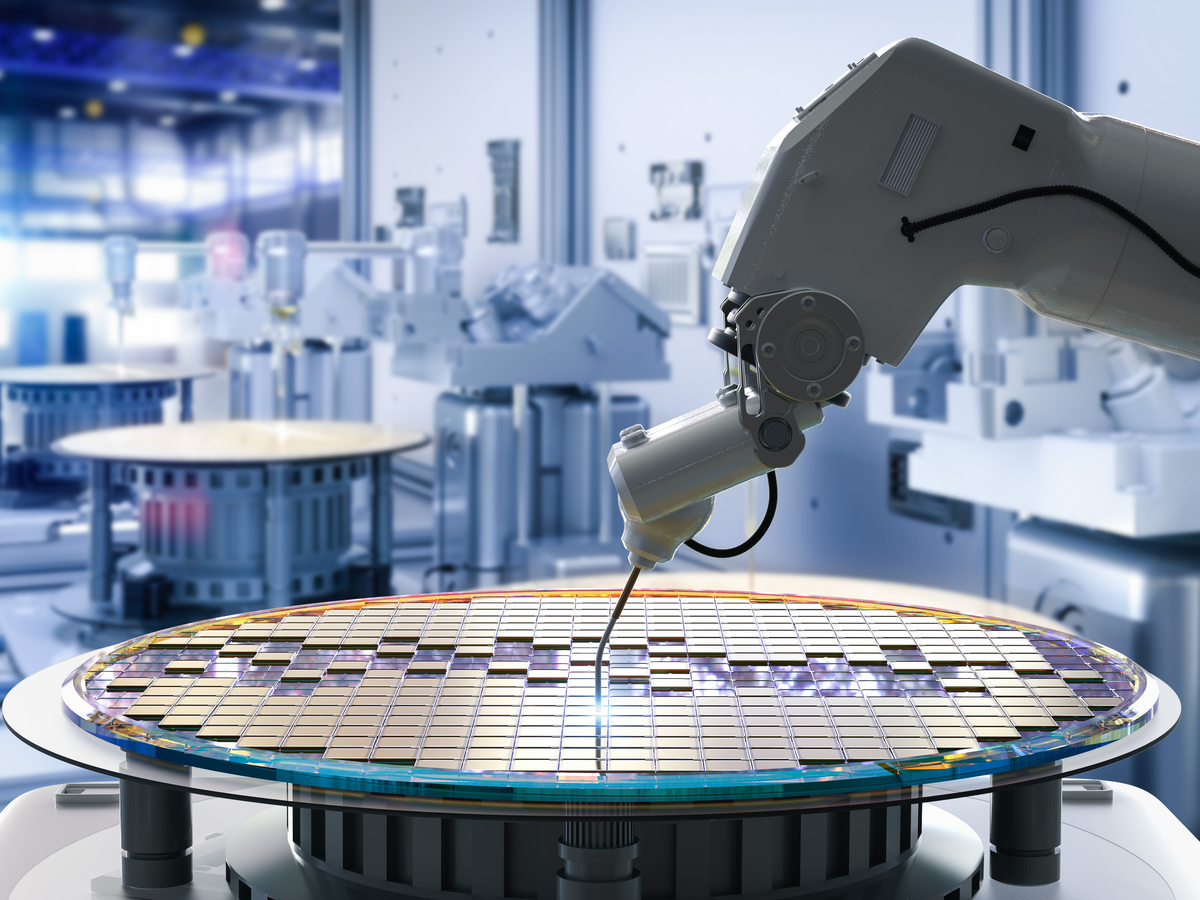

Nvidia (NVDA): The AI Powerhouse

Nvidia's recent surge is largely attributed to its dominant position in the artificial intelligence (AI) market. The company's high-performance GPUs are crucial for training and deploying large language models (LLMs), fueling the demand for its products across various sectors, including data centers, gaming, and autonomous vehicles.

- Strengths: Unmatched market share in AI hardware, strong revenue growth, and a robust pipeline of innovative products. The continued expansion of AI applications globally promises long-term growth potential.

- Weaknesses: High valuation, dependence on a few key customers, and potential supply chain disruptions. Competition in the GPU market is intensifying, although Nvidia currently holds a commanding lead.

- Post-Sell-Off Outlook: While the stock has experienced a correction, analysts remain largely bullish on Nvidia's long-term prospects, driven by the continued growth of the AI sector. However, investors should be prepared for potential volatility.

Palo Alto Networks (PANW): Cybersecurity's Steady Hand

Palo Alto Networks provides cybersecurity solutions for businesses and governments worldwide. Its next-generation firewalls, cloud security services, and threat intelligence platforms are highly regarded in the industry, offering a strong defense against evolving cyber threats.

- Strengths: Strong and recurring revenue streams from subscription-based services, a diversified customer base, and a proven track record of innovation in the cybersecurity space. The increasing reliance on cloud technologies and the growing number of cyberattacks ensures consistent demand.

- Weaknesses: Intense competition in the cybersecurity market, potential vulnerability to economic downturns (as businesses may cut IT spending), and reliance on complex software solutions.

- Post-Sell-Off Outlook: Palo Alto Networks is often considered a more defensive investment compared to Nvidia. Its consistent performance and strong market position make it an attractive option for investors seeking stability amidst market uncertainty. However, growth might be less explosive than Nvidia's.

Head-to-Head Comparison: NVDA vs. PANW

| Feature | Nvidia (NVDA) | Palo Alto Networks (PANW) |

|---|---|---|

| Industry | Semiconductor, AI | Cybersecurity |

| Growth Potential | Extremely High | High |

| Risk | High Volatility, High Valuation | Moderate Volatility, Stable Revenue |

| Investment Style | Growth, Speculative | Growth, Defensive |

Which Stock Should You Choose?

The optimal choice depends on your individual risk tolerance and investment goals.

-

For aggressive investors seeking high growth potential: Nvidia (NVDA) might be the more suitable choice, despite its higher risk profile. The explosive growth in AI presents a significant opportunity, although it comes with increased volatility.

-

For investors prioritizing stability and consistent returns: Palo Alto Networks (PANW) offers a more conservative approach, with strong revenue streams and a less volatile stock price. This option is ideal for those looking for steady growth with reduced risk.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a financial advisor before making any investment decisions. The stock market is inherently risky, and past performance does not guarantee future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Or Palo Alto Networks: A Post-Nasdaq Sell-Off Stock Comparison. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Betting Preview Roberto Bautista Agut Vs Brandon Nakashima At Monte Carlo Masters 2025

Apr 08, 2025

Betting Preview Roberto Bautista Agut Vs Brandon Nakashima At Monte Carlo Masters 2025

Apr 08, 2025 -

Data Breach At Dbs And Bank Of China Ransomware Attack Exposes Customer Information

Apr 08, 2025

Data Breach At Dbs And Bank Of China Ransomware Attack Exposes Customer Information

Apr 08, 2025 -

Starship Super Heavy Booster 14 Everything We Know About Flight 9

Apr 08, 2025

Starship Super Heavy Booster 14 Everything We Know About Flight 9

Apr 08, 2025 -

Strictly Come Dancing Impact Gemma Atkinson Addresses Gorka Marquezs Absence

Apr 08, 2025

Strictly Come Dancing Impact Gemma Atkinson Addresses Gorka Marquezs Absence

Apr 08, 2025 -

2025 Monte Carlo Masters Roberto Bautista Agut Vs Brandon Nakashima Preview

Apr 08, 2025

2025 Monte Carlo Masters Roberto Bautista Agut Vs Brandon Nakashima Preview

Apr 08, 2025