Nvidia Or Palo Alto Networks: A Value Stock Comparison Following The Nasdaq Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia vs. Palo Alto Networks: Unearthing Value After the Nasdaq Dip

The recent Nasdaq decline has left many investors wondering where to find value in the tech sector. Two prominent names, Nvidia (NVDA) and Palo Alto Networks (PANW), both experienced significant drops, presenting a potential opportunity for savvy investors. But which stock offers a better value proposition post-correction? This in-depth comparison examines both companies, analyzing their fundamentals, growth prospects, and risk factors to help you make an informed decision.

Understanding the Market Downturn's Impact:

The recent Nasdaq slump, driven by factors like rising interest rates and concerns about economic growth, significantly impacted growth stocks like Nvidia and Palo Alto Networks. While both companies are fundamentally strong, the market correction created a ripple effect, presenting a potential entry point for long-term investors. However, understanding the specific reasons behind each company's decline is crucial before making an investment.

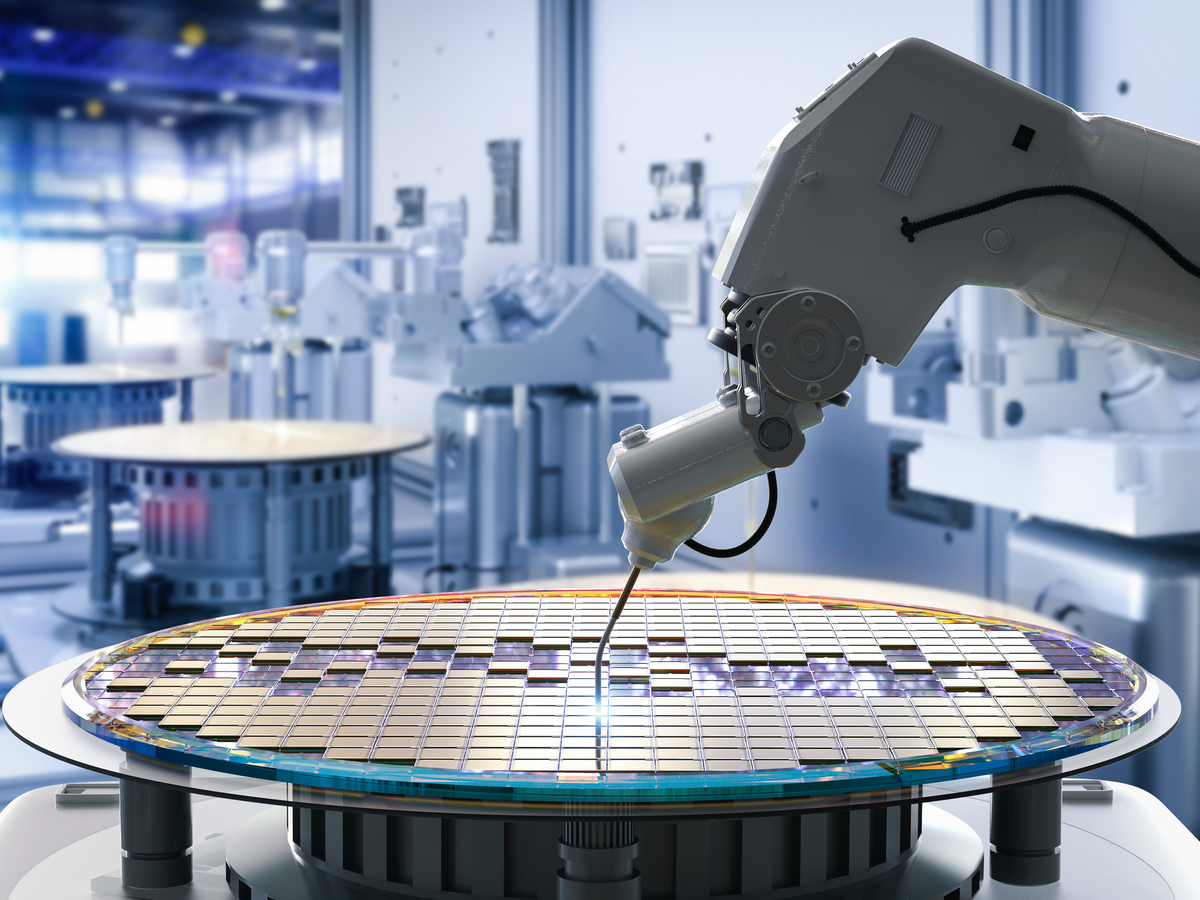

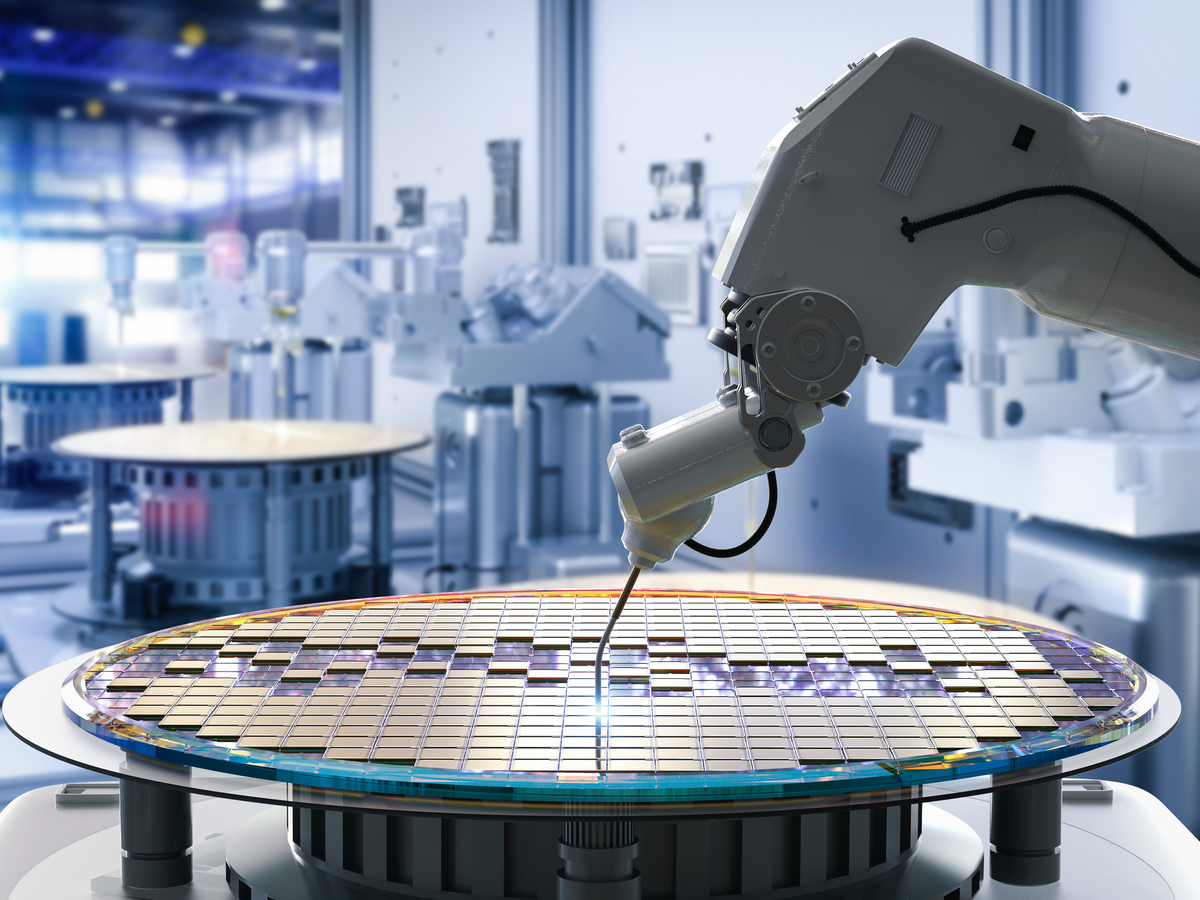

Nvidia (NVDA): The AI Powerhouse

Nvidia, a leading designer of graphics processing units (GPUs), has become synonymous with artificial intelligence (AI) due to its GPUs' crucial role in powering AI applications. This has fueled substantial growth in recent years. However, concerns about slowing demand for gaming GPUs and the cyclical nature of the semiconductor industry contributed to its recent price drop.

Key Strengths of Nvidia:

- Dominant market share in AI: Nvidia enjoys a near-monopoly in the high-performance computing market vital for AI development.

- Strong growth potential in data centers: The increasing demand for AI and data center infrastructure provides a long runway for growth.

- Diversified product portfolio: Beyond gaming and data centers, Nvidia is expanding into automotive and other emerging technologies.

Key Risks of Nvidia:

- Cyclicality of the semiconductor industry: Nvidia's performance is sensitive to economic fluctuations and the cyclical nature of the semiconductor market.

- Competition: While dominant, Nvidia faces increasing competition from AMD and other players in the GPU market.

- Overvaluation concerns: Even with the recent price drop, some analysts still consider Nvidia to be overvalued.

Palo Alto Networks (PANW): Cybersecurity Leader

Palo Alto Networks is a cybersecurity giant, offering a comprehensive suite of security products and services. While the company has demonstrated consistent growth, it too experienced a pullback during the recent market downturn, potentially creating a buying opportunity for long-term investors.

Key Strengths of Palo Alto Networks:

- Strong recurring revenue model: A significant portion of Palo Alto's revenue is recurring, providing revenue predictability and stability.

- Market leadership in cybersecurity: The company holds a leading position in the rapidly expanding cybersecurity market.

- Strategic acquisitions: Palo Alto has successfully integrated acquisitions to broaden its product offerings and strengthen its market position.

Key Risks of Palo Alto Networks:

- High competition in the cybersecurity market: The cybersecurity landscape is highly competitive, with established players and emerging startups vying for market share.

- Dependence on enterprise spending: Palo Alto's revenue is tied to enterprise spending, making it susceptible to economic slowdowns.

- Integration challenges from acquisitions: Successful integration of acquired companies is crucial for maintaining growth momentum.

Nvidia vs. Palo Alto Networks: A Value Comparison

Both Nvidia and Palo Alto Networks offer compelling long-term growth potential, but their risk profiles differ significantly. Nvidia's growth is heavily reliant on the AI boom and the semiconductor market cycle, making it a higher-risk, higher-reward investment. Palo Alto Networks, with its recurring revenue model and established market position in the essential cybersecurity sector, offers a more stable, albeit potentially slower-growth, investment.

The Verdict:

The "better" value stock depends on your risk tolerance and investment horizon. For investors with a higher risk tolerance seeking potentially explosive growth, Nvidia might be a compelling choice. For investors prioritizing stability and steady growth in a less volatile sector, Palo Alto Networks could be a more suitable option. Thorough due diligence, considering your personal investment strategy, and consulting a financial advisor before making any investment decisions are crucial steps. The recent market correction has undeniably presented opportunities, but careful consideration is essential for navigating this dynamic investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Or Palo Alto Networks: A Value Stock Comparison Following The Nasdaq Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

At Least 13 Dead After Nightclub Roof Collapse In Popular Dominican Republic Spot

Apr 08, 2025

At Least 13 Dead After Nightclub Roof Collapse In Popular Dominican Republic Spot

Apr 08, 2025 -

Global Trade War Australia Faces Significant Growth Risks Says Chalmers

Apr 08, 2025

Global Trade War Australia Faces Significant Growth Risks Says Chalmers

Apr 08, 2025 -

Tragedy Strikes River Valley Road Shophouse Fire Leaves Child Dead 20 Injured In Singapore

Apr 08, 2025

Tragedy Strikes River Valley Road Shophouse Fire Leaves Child Dead 20 Injured In Singapore

Apr 08, 2025 -

United Health Group Nyse Unh Fundamentals Supporting Impressive Stock Growth

Apr 08, 2025

United Health Group Nyse Unh Fundamentals Supporting Impressive Stock Growth

Apr 08, 2025 -

What Bida Said About Starlinks Future In Country Region

Apr 08, 2025

What Bida Said About Starlinks Future In Country Region

Apr 08, 2025