Nvidia Sell Rating: Is The Stock Overvalued After Its Recent Surge?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Sell Rating: Is the Stock Overvalued After Its Recent Surge?

Nvidia's stock price has skyrocketed recently, fueled by the explosive growth of the AI sector and the company's dominant position in the GPU market. But this meteoric rise has prompted some analysts to issue a sell rating, raising concerns about potential overvaluation. Is the party over for Nvidia investors, or is this just a temporary dip before further growth? Let's delve into the details.

Nvidia's Reign in the AI Revolution:

Nvidia's success is intrinsically linked to the burgeoning artificial intelligence industry. Their high-performance GPUs are crucial for training and running complex AI models, making them a key player in everything from generative AI to autonomous vehicles. This demand has driven exceptional revenue growth, exceeding even the most optimistic projections. The company's recent financial reports showcased record-breaking figures, further solidifying its position as a market leader. Keywords like Nvidia GPU, AI chip, and artificial intelligence hardware are consistently associated with the company's success.

The Sell Rating: A Warning Sign or Market Correction?

Despite the impressive performance, several investment firms have issued sell ratings for Nvidia stock. Their concerns primarily center on the stock's valuation. After such a dramatic price increase, some analysts believe the stock is significantly overvalued, potentially leaving little room for further growth and increasing the risk of a substantial correction. They point to the potential for increased competition and the possibility of a slowdown in the AI market as contributing factors to their bearish outlook. Understanding the Nvidia stock price and its trajectory is crucial for investors navigating this uncertain landscape.

Factors Contributing to the Debate:

- Valuation Concerns: The primary driver behind the sell ratings is the perceived overvaluation of Nvidia stock compared to its historical performance and future projections. While the company's growth is undeniable, the question remains whether the current price accurately reflects its long-term potential.

- Competition: While Nvidia currently dominates the market, competition is intensifying. Companies like AMD and Intel are investing heavily in developing their own AI-focused GPUs, which could potentially erode Nvidia's market share in the future. The Nvidia vs AMD rivalry is a key aspect of the ongoing market analysis.

- Market Saturation: The rapid growth of the AI market raises concerns about potential saturation in the near future. While demand remains high, the possibility of a slowdown could significantly impact Nvidia's revenue and, subsequently, its stock price.

- Economic Uncertainty: The broader economic climate also plays a role. Concerns about inflation, interest rate hikes, and a potential recession could dampen investor enthusiasm and lead to a sell-off in high-growth tech stocks like Nvidia.

What's Next for Nvidia Investors?

The sell rating on Nvidia stock doesn't necessarily signal an impending crash. It's crucial to remember that analysts' opinions differ, and the market is inherently unpredictable. Investors should conduct thorough due diligence, considering both the bullish and bearish arguments before making any investment decisions. Factors to consider include:

- Long-Term Growth Potential: Despite the current concerns, Nvidia's position in the AI revolution suggests significant long-term growth potential.

- Diversification: Diversifying your portfolio can help mitigate the risk associated with investing in a single, high-growth stock.

- Risk Tolerance: Understand your personal risk tolerance before investing in volatile stocks like Nvidia.

In conclusion, the sell rating on Nvidia stock highlights the inherent risks associated with investing in high-growth technology companies. While the company's future looks bright, the recent surge in its stock price has prompted valid concerns about overvaluation. Investors need to carefully weigh the potential rewards against the significant risks before making any investment decisions. Continuously monitoring Nvidia stock news and market trends is essential for informed investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Sell Rating: Is The Stock Overvalued After Its Recent Surge?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Ufc 315 Preliminary Fights Muhammad Vs Della Maddalena And More

May 12, 2025

Analysis Ufc 315 Preliminary Fights Muhammad Vs Della Maddalena And More

May 12, 2025 -

Israels Gaza Annexation Plans An Immediate Threat To Palestinian Rights

May 12, 2025

Israels Gaza Annexation Plans An Immediate Threat To Palestinian Rights

May 12, 2025 -

Will Nvidia Stock Double In 5 Years A Realistic Assessment

May 12, 2025

Will Nvidia Stock Double In 5 Years A Realistic Assessment

May 12, 2025 -

Hackers Exploit Employee Monitoring Software For Large Scale Ransomware Campaign

May 12, 2025

Hackers Exploit Employee Monitoring Software For Large Scale Ransomware Campaign

May 12, 2025 -

Mexico Cattle Ban Us Concerns Over Flesh Eating Maggot Infestation

May 12, 2025

Mexico Cattle Ban Us Concerns Over Flesh Eating Maggot Infestation

May 12, 2025

Latest Posts

-

Amazon Unveils Compact Affordable Echo Show To Rival Googles Smart Displays

May 12, 2025

Amazon Unveils Compact Affordable Echo Show To Rival Googles Smart Displays

May 12, 2025 -

Mantras Om Implosion How Ai Could Predict And Prevent Future Cryptocurrency Market Crashes

May 12, 2025

Mantras Om Implosion How Ai Could Predict And Prevent Future Cryptocurrency Market Crashes

May 12, 2025 -

Nyt Strands Answers And Hints Sunday May 11 Game 434

May 12, 2025

Nyt Strands Answers And Hints Sunday May 11 Game 434

May 12, 2025 -

Unexpected Surge These 3 Solana Memecoins Show Signs Of Life

May 12, 2025

Unexpected Surge These 3 Solana Memecoins Show Signs Of Life

May 12, 2025 -

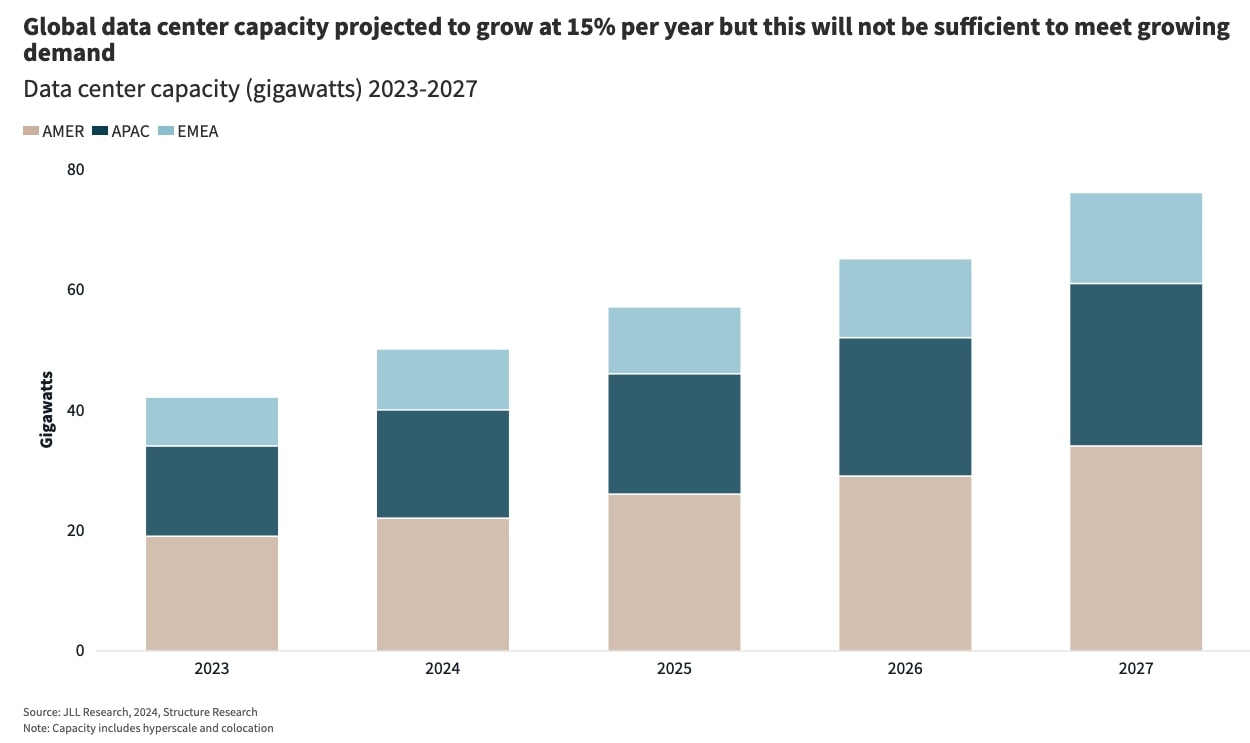

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025

The Future Of Global Ai Data Centers Trends And Challenges

May 12, 2025