Nvidia Sell Rating Sparks Concerns: Is A Stock Price Drop Imminent?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Sell Rating Sparks Concerns: Is a Stock Price Drop Imminent?

Nvidia, the tech giant dominating the GPU market, has seen its stock price fluctuate wildly recently. A recent sell rating from a prominent investment firm has sent ripples through the market, leaving investors wondering: is a significant stock price drop imminent? Let's delve into the details and explore the potential implications.

The Catalyst: A Sell Rating and Analyst Concerns

The recent sell rating wasn't a lone wolf; several analysts have expressed concerns about Nvidia's future performance. These concerns stem from a variety of factors, including:

- Overvaluation Concerns: Some argue that Nvidia's stock price has become significantly overvalued, exceeding its intrinsic worth based on current financials and future projections. This overvaluation makes it a risky investment, prompting the sell recommendations.

- Competition Heating Up: The GPU market is far from a monopoly. AMD, Intel, and other players are increasingly challenging Nvidia's dominance, potentially eating into its market share and profitability. This intensified competition is a significant factor in the bearish outlook.

- Potential for Supply Chain Disruptions: Global supply chain issues continue to be a concern for many tech companies. Any unforeseen disruptions could impact Nvidia's production and sales, further impacting its stock price.

- Macroeconomic Headwinds: The broader economic climate, including potential recessions and inflation, also casts a shadow over the tech sector. Investor sentiment is often closely tied to these macroeconomic factors, impacting stock valuations across the board.

What Does This Mean for Investors?

The sell rating doesn't automatically translate to an immediate and drastic drop in Nvidia's stock price. However, it serves as a significant warning sign. Investors should carefully consider:

- Diversification: A well-diversified portfolio can help mitigate risk associated with any single stock, including Nvidia.

- Risk Tolerance: Only invest what you're comfortable potentially losing. High-growth stocks like Nvidia inherently carry higher risk.

- Long-Term vs. Short-Term Outlook: The long-term prospects for Nvidia remain strong, given its position in the growing AI and data center markets. However, short-term volatility is expected.

- Fundamental Analysis: Conduct thorough due diligence, including analyzing Nvidia's financial statements, competitive landscape, and future growth potential.

Beyond the Sell Rating: A Deeper Look at Nvidia's Future

While the sell rating is a significant event, it's crucial to look beyond the immediate concerns. Nvidia's involvement in crucial emerging technologies, such as AI and autonomous vehicles, positions it for considerable long-term growth. The company's robust research and development efforts continue to drive innovation. The key question is whether the current stock price accurately reflects this long-term potential, considering the near-term headwinds.

Conclusion: Cautious Optimism

The recent sell rating for Nvidia warrants caution, but it doesn't necessarily signal an impending collapse. Investors should approach the situation with a balanced perspective, considering both the short-term risks and the long-term growth potential. Thorough research and a well-defined investment strategy are essential for navigating this uncertainty. Staying informed about market trends and Nvidia's performance will be crucial for making informed decisions in the weeks and months ahead. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Sell Rating Sparks Concerns: Is A Stock Price Drop Imminent?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Breaking A12 Traffic Gridlock Emergency Incident Creates Huge Delays

May 12, 2025

Breaking A12 Traffic Gridlock Emergency Incident Creates Huge Delays

May 12, 2025 -

Historic Night For Padres 5 Home Runs 24 Hits Fuel 21 0 Victory Over Rockies

May 12, 2025

Historic Night For Padres 5 Home Runs 24 Hits Fuel 21 0 Victory Over Rockies

May 12, 2025 -

Unlocking Autonomous Driving And Superior Range The Significance Of Teslas Dojo And 4680 Battery Technology

May 12, 2025

Unlocking Autonomous Driving And Superior Range The Significance Of Teslas Dojo And 4680 Battery Technology

May 12, 2025 -

Clash Of The Titans Godzilla And Kongs Next Battle

May 12, 2025

Clash Of The Titans Godzilla And Kongs Next Battle

May 12, 2025 -

Road To Raleigh Capitals Coach Credits Bell Centres Hostile Environment For Playoff Success

May 12, 2025

Road To Raleigh Capitals Coach Credits Bell Centres Hostile Environment For Playoff Success

May 12, 2025

Latest Posts

-

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025 -

Catching A Glimpse Of Mays Full Flower Moon A Practical Guide

May 12, 2025

Catching A Glimpse Of Mays Full Flower Moon A Practical Guide

May 12, 2025 -

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025

Gary Sun On Coinbases Esports Strategy Building Trust And Expanding Cryptos Reach

May 12, 2025 -

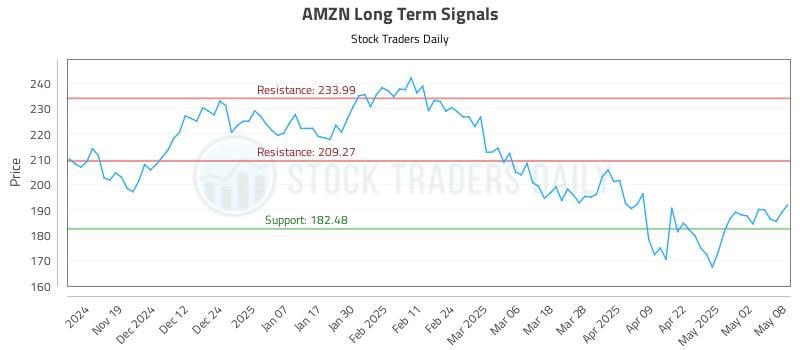

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025

Is Amzn A Buy In Depth Investment Report And Stock Forecast

May 12, 2025