Nvidia Stock Downgrade: Wall Street's First Sell Rating And What It Means

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Stock Downgrade: Wall Street's First Sell Rating Sends Shockwaves

Nvidia, the tech giant that has fueled the AI boom, has received its first "sell" rating from Wall Street, sending shockwaves through the market and leaving investors questioning the future of the once-unstoppable stock. This unexpected downgrade from Rosenblatt Securities highlights growing concerns about the company's valuation and potential for future growth, prompting a closer look at the implications for investors.

The move marks a significant shift in sentiment surrounding Nvidia, a company that has consistently exceeded expectations in recent quarters, largely driven by the explosive demand for its high-performance GPUs used in artificial intelligence applications. The stock price, which has seen meteoric rises, is now facing its first major headwind.

Why the Downgrade? Rosenblatt's Concerns

Rosenblatt Securities analyst Hans Mosesmann cited concerns about Nvidia's current valuation as the primary reason for the sell rating. He argues that the stock price has already priced in much of the anticipated future growth, leaving little room for further substantial gains. This sentiment is echoed by some analysts who believe the current hype surrounding AI might be overblown, leading to a potential correction in the market.

Mosesmann's report also highlighted potential risks related to:

- Increased Competition: The booming AI sector is attracting significant investment, fostering a more competitive landscape. New players and established tech giants are entering the market, potentially eating into Nvidia's market share.

- Supply Chain Issues: While not explicitly stated as a primary concern, potential disruptions to Nvidia's complex supply chain remain a lingering risk, especially considering the global chip shortage that has impacted the tech industry in recent years.

- Valuation Concerns: The primary driver of the downgrade, as mentioned earlier, is the belief that Nvidia's current stock price is unsustainable given its current valuation relative to projected future earnings.

What This Means for Investors

This sell rating doesn't necessarily signal an immediate collapse of Nvidia's stock price. However, it represents a significant shift in analyst sentiment and could trigger a period of increased volatility. Investors should carefully consider the following:

- Diversification: Holding a diversified portfolio is crucial to mitigate risk. Over-reliance on a single stock, especially one as volatile as Nvidia, can lead to significant losses.

- Risk Tolerance: Investors with a lower risk tolerance might consider reducing their exposure to Nvidia, particularly in light of this first sell rating.

- Long-Term Perspective: Despite the downgrade, many analysts still see a long-term growth potential for Nvidia, particularly in the AI sector. However, investors need to have a long-term outlook and be prepared for short-term volatility.

The Future of Nvidia and AI

While this downgrade represents a setback, it doesn't necessarily diminish Nvidia's pivotal role in the AI revolution. The company continues to innovate and remains a key player in the development and deployment of AI technologies. However, the market's reaction to this sell rating underscores the importance of careful risk assessment and a balanced investment strategy. The future of Nvidia and the broader AI landscape remain intertwined, and investors must carefully weigh the potential risks and rewards. This unexpected sell rating serves as a timely reminder that even seemingly unstoppable growth stories can face significant headwinds. The coming weeks and months will be crucial in determining the market's ultimate response to this significant development.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Stock Downgrade: Wall Street's First Sell Rating And What It Means. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

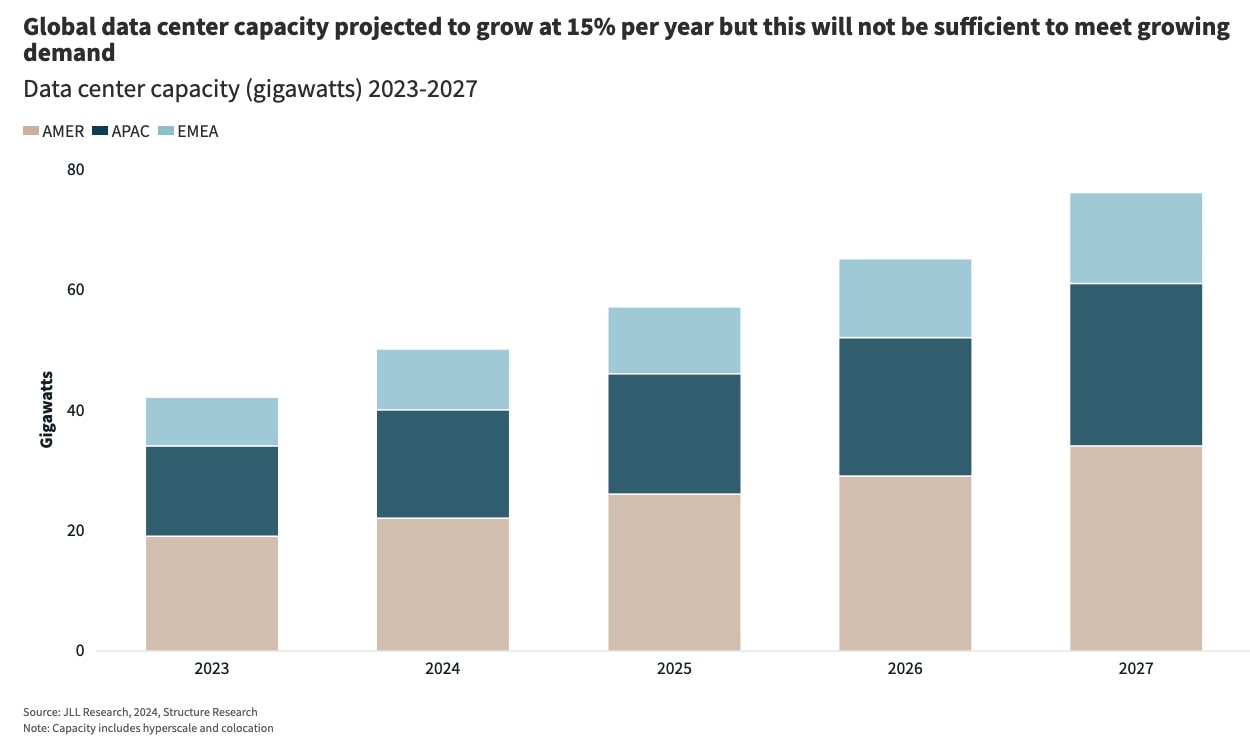

Amazon And Microsoft Adjust Strategies But Global Ai Data Center Expansion Remains Strong

May 12, 2025

Amazon And Microsoft Adjust Strategies But Global Ai Data Center Expansion Remains Strong

May 12, 2025 -

The Kanye West Story John Legend On Grief Loss And A Troubled Artists Journey

May 12, 2025

The Kanye West Story John Legend On Grief Loss And A Troubled Artists Journey

May 12, 2025 -

Vfl Round Recap Geelongs Loss To Giants At Gmhba Stadium

May 12, 2025

Vfl Round Recap Geelongs Loss To Giants At Gmhba Stadium

May 12, 2025 -

May 2025 Flower Micromoon Date Time And Viewing Guide

May 12, 2025

May 2025 Flower Micromoon Date Time And Viewing Guide

May 12, 2025 -

Victoria Clave Atletico De Madrid Se Clasifica Para La Champions League

May 12, 2025

Victoria Clave Atletico De Madrid Se Clasifica Para La Champions League

May 12, 2025

Latest Posts

-

Taylan May Injury Closer To Nrl Return Than Ever Before

May 12, 2025

Taylan May Injury Closer To Nrl Return Than Ever Before

May 12, 2025 -

Show Some Respect Beckhams Response To Minnesota Uniteds Social Media Goading

May 12, 2025

Show Some Respect Beckhams Response To Minnesota Uniteds Social Media Goading

May 12, 2025 -

Fan Fury Netflix Defends Season 3 Renewal Of Critically Panned Drama Series

May 12, 2025

Fan Fury Netflix Defends Season 3 Renewal Of Critically Panned Drama Series

May 12, 2025 -

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025

Figmas Ceo Unveils Innovative Ai Approach For Design

May 12, 2025 -

Gmas Breakfast In Bed Surprise For A Beloved Mom And Teacher

May 12, 2025

Gmas Breakfast In Bed Surprise For A Beloved Mom And Teacher

May 12, 2025