Nvidia Stock Downgrade: Wall Street's First Sell Rating And What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Stock Downgrade: Wall Street's First Sell Rating Sends Shockwaves Through the Market

Nvidia, the tech giant that has powered the AI boom, has received its first sell rating from a major Wall Street firm, sending shockwaves through the investment community and leaving many investors wondering what this means for their portfolios. The unexpected downgrade highlights growing concerns about the sustainability of Nvidia's meteoric rise and raises questions about the future of the AI chip market.

This unprecedented move by Rosenblatt Securities, a respected research firm, marks a significant shift in sentiment towards a company that has been a darling of investors for months. The downgrade, coupled with a lowered price target, signals a potential turning point for Nvidia's stock performance, prompting investors to re-evaluate their positions.

What Sparked the Downgrade?

Rosenblatt's decision to issue a sell rating isn't arbitrary. Their analysts cite several key factors contributing to their bearish outlook:

-

Valuation Concerns: Nvidia's stock price has soared to astronomical heights, fueled by the intense demand for its high-performance GPUs crucial for AI development. Analysts argue that the current valuation is unsustainable, exceeding even the most optimistic projections for future growth. This overvaluation is a primary driver behind the sell recommendation.

-

Competition Heating Up: While Nvidia currently dominates the market, the AI chip landscape is rapidly evolving. Competitors like AMD and Intel are aggressively investing in their own AI solutions, posing a growing threat to Nvidia's market share. This increased competition could significantly impact Nvidia's future revenue growth.

-

Supply Chain Risks: The global semiconductor industry remains susceptible to disruptions in the supply chain. Any unexpected setbacks, such as geopolitical instability or manufacturing challenges, could impact Nvidia's ability to meet the burgeoning demand for its products, negatively affecting its financial performance.

-

Potential for a Market Correction: The broader tech sector is not immune to market corrections. The current economic climate, with rising interest rates and inflation concerns, poses a risk to the overall market, and Nvidia's stock could be particularly vulnerable given its recent rapid appreciation.

What Does This Mean for Investors?

The Rosenblatt downgrade serves as a stark reminder that even the most successful companies can experience setbacks. For investors, this presents a critical juncture:

-

Re-evaluate Your Holdings: Existing Nvidia investors should carefully review their investment strategy and risk tolerance in light of this news. Consider diversifying your portfolio to mitigate potential losses.

-

Consider the Long-Term Perspective: While the sell rating is a significant event, it's crucial to consider Nvidia's long-term prospects in the rapidly expanding AI market. The company's technological leadership and market dominance shouldn't be completely disregarded.

-

Stay Informed: Keep abreast of further analyst commentary and news related to Nvidia and the broader AI sector. Informed decision-making is paramount in navigating market volatility.

The Bottom Line:

The Nvidia stock downgrade is a major development with potentially significant implications for investors. While the company retains substantial strengths, the concerns raised by Rosenblatt and the inherent risks in the tech market warrant careful consideration. This situation underscores the importance of diligent research, diversification, and a well-defined investment strategy. The future trajectory of Nvidia's stock price remains uncertain, emphasizing the need for a cautious and informed approach.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Stock Downgrade: Wall Street's First Sell Rating And What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

American Idol Season Season Number Top 5 Contestants Announced

May 12, 2025

American Idol Season Season Number Top 5 Contestants Announced

May 12, 2025 -

This Undervalued Stock Is Crushing The Market Heres Why

May 12, 2025

This Undervalued Stock Is Crushing The Market Heres Why

May 12, 2025 -

Nyt Connections Sunday May 11 Game 700 Complete Answers

May 12, 2025

Nyt Connections Sunday May 11 Game 700 Complete Answers

May 12, 2025 -

The Future Of Design Figma Ceos Ai Focused Roadmap

May 12, 2025

The Future Of Design Figma Ceos Ai Focused Roadmap

May 12, 2025 -

Backlash 2025 Analyzing The Potential Impact Of New Wwe Superstars

May 12, 2025

Backlash 2025 Analyzing The Potential Impact Of New Wwe Superstars

May 12, 2025

Latest Posts

-

Fantastic Four Reboot Weapons Innovation And Teen Drama Series Recent News Roundup

May 12, 2025

Fantastic Four Reboot Weapons Innovation And Teen Drama Series Recent News Roundup

May 12, 2025 -

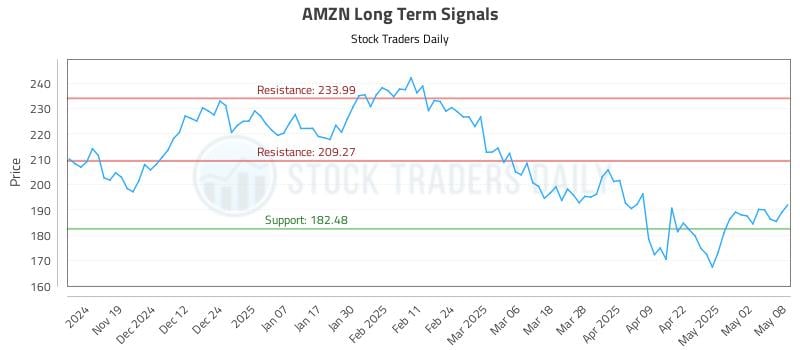

Amzn Investment Report Analyzing Amazons Future Growth Potential

May 12, 2025

Amzn Investment Report Analyzing Amazons Future Growth Potential

May 12, 2025 -

Pascal Siakams Future Uncertain Amidst Pacers Cavs Playoff Thriller And Nba Trade Rumors

May 12, 2025

Pascal Siakams Future Uncertain Amidst Pacers Cavs Playoff Thriller And Nba Trade Rumors

May 12, 2025 -

Despite Recent Drop Is Tesla Stock Still A Buy

May 12, 2025

Despite Recent Drop Is Tesla Stock Still A Buy

May 12, 2025 -

Sinner Vs De Jong Key Talking Points And Prediction For Atp Rome Day 6

May 12, 2025

Sinner Vs De Jong Key Talking Points And Prediction For Atp Rome Day 6

May 12, 2025