Nvidia Stock Forecast: Will More Sell Ratings Follow The Recent Downgrade?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Stock Forecast: Will More Sell Ratings Follow the Recent Downgrade?

Nvidia's stock (NVDA) has experienced a rollercoaster ride in recent months, fueled by the explosive growth of AI and the subsequent surge in demand for its high-performance GPUs. However, the recent downgrade from a major investment firm has sent ripples through the market, leaving investors questioning the future trajectory of NVDA. Will this downgrade be an isolated incident, or will more sell ratings follow, potentially triggering a significant correction?

The recent downgrade, issued by [Insert Investment Firm Name and Date Here], cited concerns about [Insert Specific Reasons for Downgrade, e.g., valuation, competition, slowing growth in specific sectors]. This decision immediately impacted NVDA's stock price, causing a [Percentage] drop. This volatility has left many investors scrambling to understand the implications and predict the next move.

What Fueled the Initial Surge?

Nvidia's dominance in the AI chip market is undeniable. The rapid advancements in generative AI, fueled by massive computing power, have created an insatiable demand for Nvidia's GPUs. Data centers worldwide are investing heavily in upgrading their infrastructure, driving significant revenue growth for the company. This surge in demand propelled NVDA to become a market darling, with its stock price reaching record highs.

The Downgrade: A Sign of Things to Come?

While the recent downgrade presents a bearish outlook, it's crucial to analyze the reasoning behind it. Was the downgrade based on fundamental weaknesses within Nvidia's business model, or is it a more short-term perspective reacting to market sentiment and potential cyclical factors?

Several factors are at play:

- Valuation Concerns: Some analysts argue that NVDA's stock price has become significantly overvalued, reflecting the immense hype surrounding AI rather than a sustainable, long-term growth trajectory.

- Increased Competition: While Nvidia currently holds a dominant market share, competitors are aggressively investing in developing their own AI chips, potentially eroding Nvidia's market dominance in the future.

- Economic Uncertainty: The global economic climate plays a significant role. A potential recession could impact capital expenditures by data centers, reducing demand for Nvidia's high-priced GPUs.

- Supply Chain Issues: The global chip shortage is easing, but potential supply chain disruptions could still impact Nvidia's production and delivery capabilities.

What to Expect Next?

Predicting the future of any stock is inherently challenging, and NVDA is no exception. However, several scenarios are possible:

- Further Downgrades: If the concerns raised by the initial downgrade are validated by further market analysis or financial reports, more sell ratings could follow, potentially leading to a more substantial price correction.

- Consolidation and Stabilization: The stock price may consolidate around its current level, allowing investors to assess the situation and reassess the company's long-term prospects.

- Resilience and Continued Growth: Nvidia's strong competitive position and continued innovation in the AI space could overcome the current concerns, leading to a resumption of growth.

Investor Sentiment and Market Reaction:

The market's reaction to the recent downgrade will be a key indicator of future price movements. Close monitoring of investor sentiment, trading volume, and analyst commentary is crucial for navigating this period of uncertainty.

Conclusion:

The future of Nvidia's stock remains uncertain. While the recent downgrade is a cause for concern, it's crucial to consider the broader context and evaluate the validity of the arguments presented. Investors should conduct thorough due diligence, considering both the bullish and bearish perspectives before making any investment decisions. The coming weeks and months will be critical in determining whether this was a temporary setback or the beginning of a more significant shift in the market's perception of Nvidia. Stay tuned for further updates and analysis as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Stock Forecast: Will More Sell Ratings Follow The Recent Downgrade?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

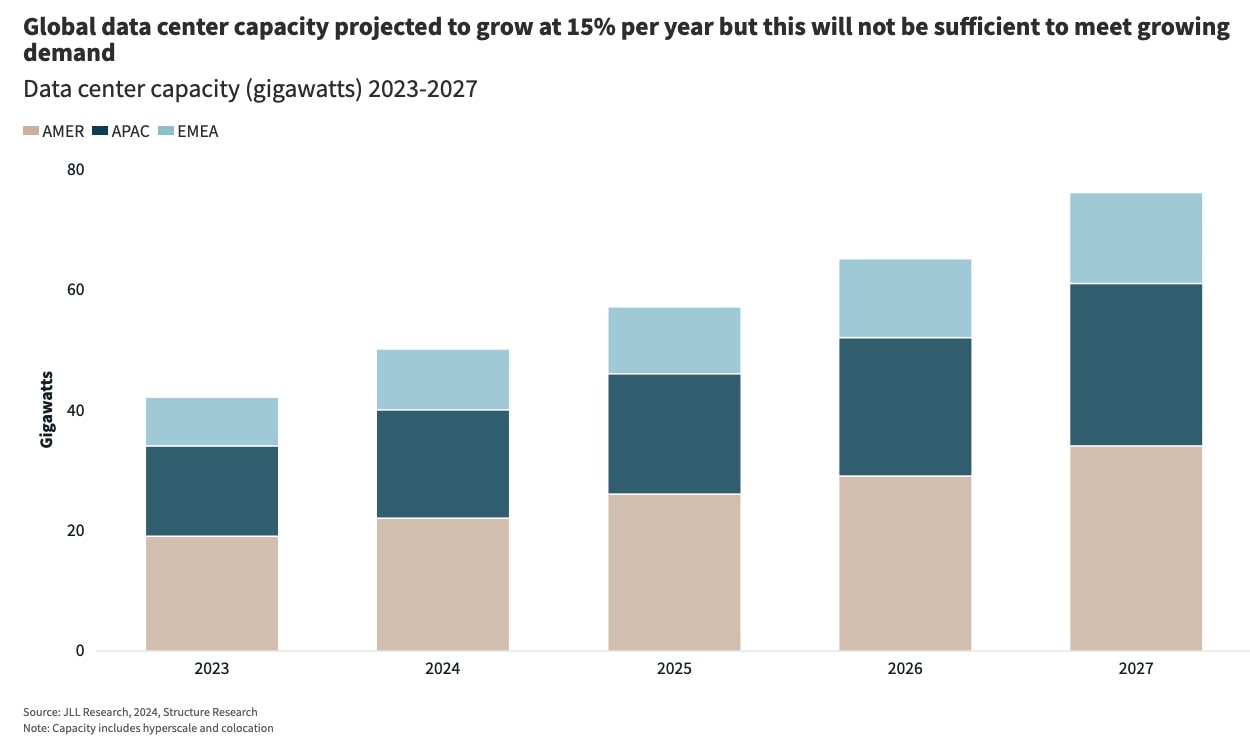

Amazon And Microsoft Adjust Strategies But Global Ai Data Center Expansion Remains Strong

May 12, 2025

Amazon And Microsoft Adjust Strategies But Global Ai Data Center Expansion Remains Strong

May 12, 2025 -

Padres Rewrite History Books With Offensive Outburst Behind Koleks Shutout

May 12, 2025

Padres Rewrite History Books With Offensive Outburst Behind Koleks Shutout

May 12, 2025 -

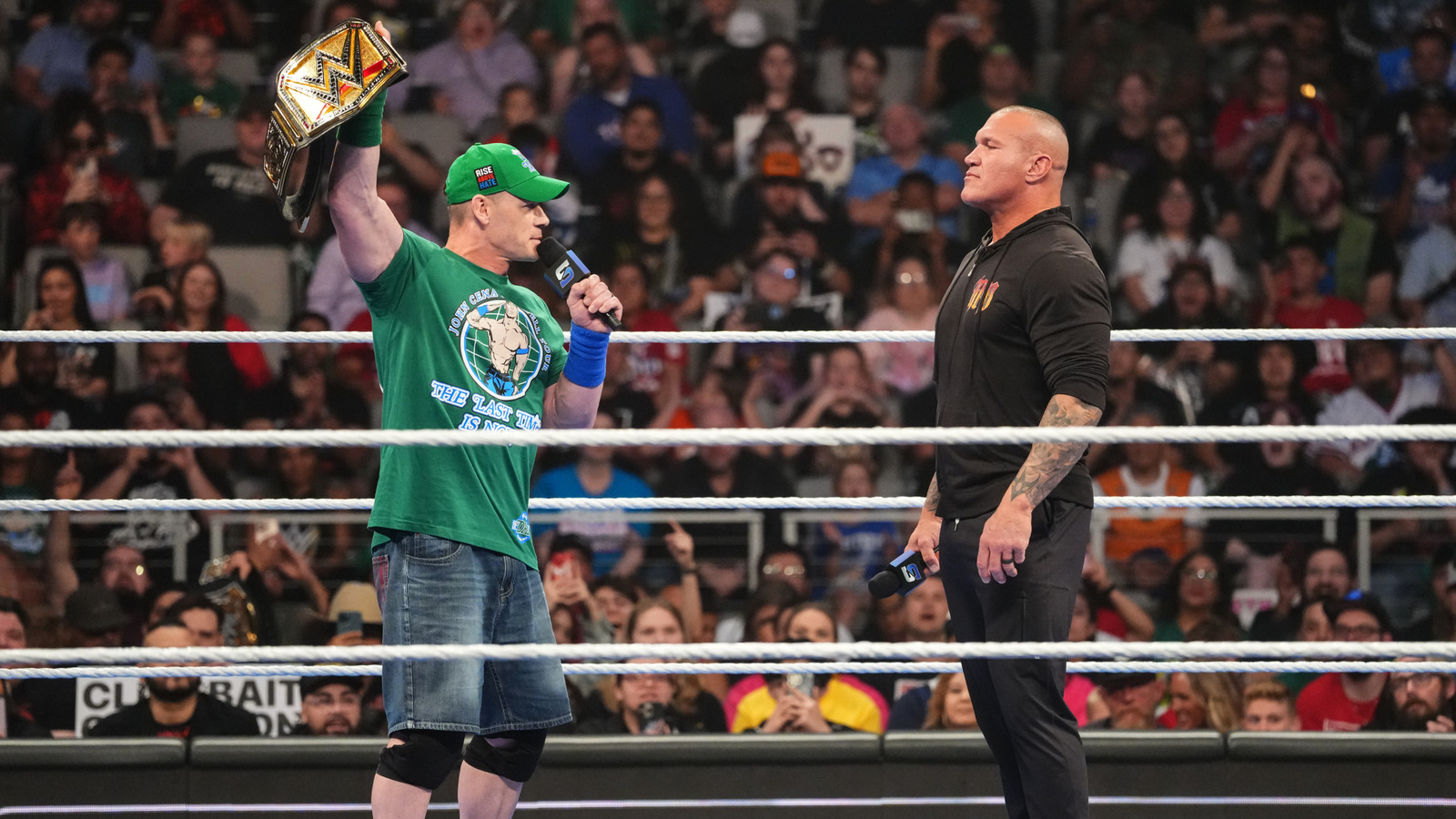

Wwe Backlash 2024 Results Four Championships On The Line Mc Afee Vs Gunther

May 12, 2025

Wwe Backlash 2024 Results Four Championships On The Line Mc Afee Vs Gunther

May 12, 2025 -

Human Vs Machine Massive Job Losses At Ibm And Crowd Strike Due To Ai Automation

May 12, 2025

Human Vs Machine Massive Job Losses At Ibm And Crowd Strike Due To Ai Automation

May 12, 2025 -

21 0 Blowout Rockies Season Plummets To New Depth Against Padres

May 12, 2025

21 0 Blowout Rockies Season Plummets To New Depth Against Padres

May 12, 2025

Latest Posts

-

Major Incident On South Essex Bypass Road Closure And Extensive Traffic Delays

May 12, 2025

Major Incident On South Essex Bypass Road Closure And Extensive Traffic Delays

May 12, 2025 -

Taylan May Breaks Silence Next Weeks Rugby League Comeback Confirmed

May 12, 2025

Taylan May Breaks Silence Next Weeks Rugby League Comeback Confirmed

May 12, 2025 -

Nyt Connections Game 700 Hints And Solutions For May 11

May 12, 2025

Nyt Connections Game 700 Hints And Solutions For May 11

May 12, 2025 -

Cricket World Mourns Ashes Legend Bob Cowper A Legacy Remembered

May 12, 2025

Cricket World Mourns Ashes Legend Bob Cowper A Legacy Remembered

May 12, 2025 -

Getting To Know Stars Name S Fiancee Family Details And Financial Profile

May 12, 2025

Getting To Know Stars Name S Fiancee Family Details And Financial Profile

May 12, 2025