Nvidia Stock Outlook: 5-Year Projection And Investment Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia Stock Outlook: 5-Year Projection and Investment Implications

Nvidia (NVDA), the undisputed king of graphics processing units (GPUs), has experienced meteoric growth, fueled by the explosive demand for AI, gaming, and data centers. But what does the future hold for this tech giant? This article delves into the Nvidia stock outlook, offering a 5-year projection and exploring the investment implications for both seasoned investors and newcomers.

Nvidia's Dominance: A Foundation for Future Growth

Nvidia's current success isn't a fluke. Their dominance stems from several key factors:

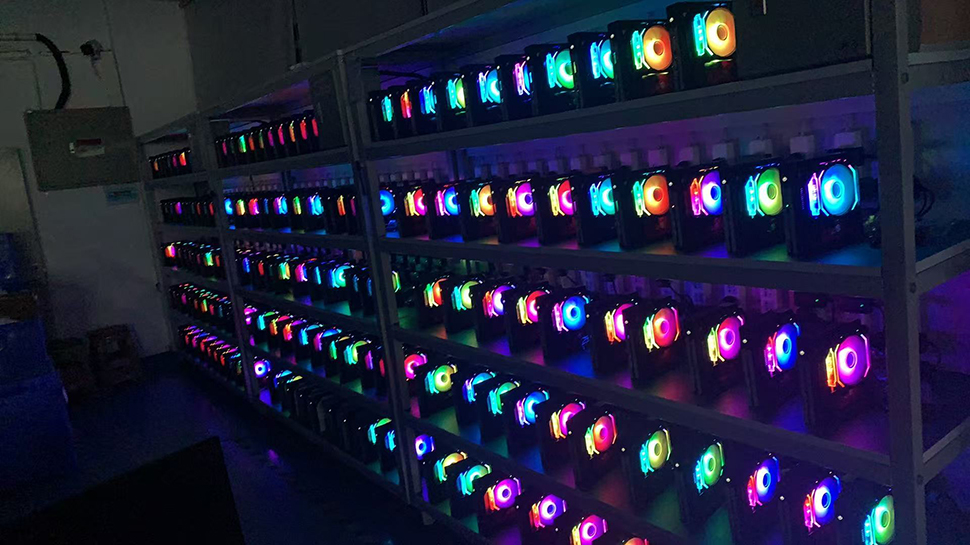

- AI Revolution: The rise of artificial intelligence, particularly generative AI, is a primary driver of Nvidia's growth. Their high-performance GPUs are crucial for training and deploying large language models (LLMs) and other AI applications. This demand shows no signs of slowing down.

- Gaming Market Leadership: Nvidia continues to hold a significant market share in the gaming industry, providing high-end GPUs for enthusiasts and gamers worldwide. The continued growth of the gaming market ensures a steady revenue stream.

- Data Center Expansion: Beyond gaming and AI, Nvidia's data center business is booming. Their GPUs are essential for high-performance computing (HPC) in various industries, from finance to scientific research. This diversification strengthens their overall position.

5-Year Nvidia Stock Projection: Cautious Optimism

Predicting stock prices is inherently risky, and no projection is guaranteed. However, considering Nvidia's current trajectory and market trends, a cautiously optimistic 5-year outlook seems reasonable. Several factors contribute to this:

- Continued AI Adoption: The long-term adoption of AI across various sectors will likely drive sustained demand for Nvidia's hardware. This presents a significant opportunity for growth.

- Innovation and R&D: Nvidia's commitment to research and development ensures they remain at the forefront of technological advancements. This continuous innovation is crucial for maintaining their competitive edge.

- Global Market Expansion: Expanding into new markets and forging strategic partnerships will further contribute to Nvidia's revenue growth.

However, potential challenges exist:

- Competition: While currently dominant, Nvidia faces competition from AMD and other players in the GPU market. Increased competition could put pressure on margins.

- Economic Slowdown: A global economic downturn could impact consumer spending on gaming hardware and enterprise investment in data centers.

- Supply Chain Disruptions: Global supply chain issues could affect the production and availability of Nvidia's products.

Investment Implications: Balancing Risk and Reward

Investing in Nvidia presents both significant potential rewards and inherent risks. Before investing, consider:

- Your Risk Tolerance: Nvidia's stock is known for its volatility. Only invest what you can afford to lose.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

- Long-Term Perspective: Investing in Nvidia is a long-term strategy. Short-term fluctuations should be expected.

- Consult a Financial Advisor: Seek professional advice before making any significant investment decisions.

Conclusion:

Nvidia's future looks bright, driven by the burgeoning AI market and its strong presence in gaming and data centers. While a 5-year projection is speculative, a continued period of growth seems plausible. However, investors should carefully consider the potential risks and align their investment strategy with their risk tolerance and financial goals. Thorough research and possibly consulting a financial advisor are essential before investing in Nvidia or any other stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia Stock Outlook: 5-Year Projection And Investment Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Announcing The Winner The Millennial Canon Bracket Concludes

May 12, 2025

Announcing The Winner The Millennial Canon Bracket Concludes

May 12, 2025 -

Chinese Firm Preps Amd Ryzen Ai Max 395 Mini Workstations Mass Production Imminent

May 12, 2025

Chinese Firm Preps Amd Ryzen Ai Max 395 Mini Workstations Mass Production Imminent

May 12, 2025 -

Philippine Midterm Elections Online Voting For Filipinos In Australia

May 12, 2025

Philippine Midterm Elections Online Voting For Filipinos In Australia

May 12, 2025 -

Deceived By A Celebrity My Story Involving Bondi Vet Chris Brown

May 12, 2025

Deceived By A Celebrity My Story Involving Bondi Vet Chris Brown

May 12, 2025 -

Indias Global Influence Perception Vs Reality

May 12, 2025

Indias Global Influence Perception Vs Reality

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

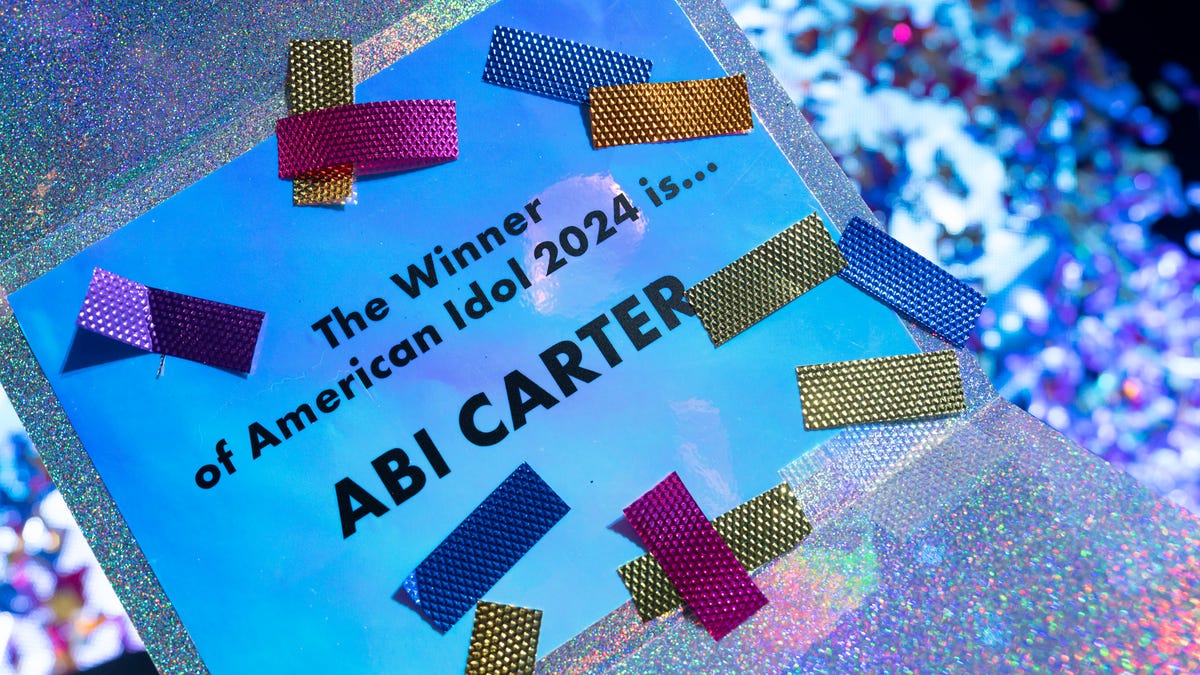

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025