Nvidia's Bullish Outlook: 3 Reasons To Invest In NVDA Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia's Bullish Outlook: 3 Reasons to Invest in NVDA Stock

Nvidia (NVDA) is on a roll. The semiconductor giant recently delivered a blowout earnings report, shattering expectations and sending shockwaves through the tech industry. But beyond the headline numbers, Nvidia's bullish outlook points to a compelling investment opportunity. This isn't just hype; there are solid, fundamental reasons to consider adding NVDA stock to your portfolio.

H2: The AI Boom Fuels Nvidia's Growth

The most significant factor driving Nvidia's success is the explosive growth of artificial intelligence (AI). Nvidia's GPUs (Graphics Processing Units) are the workhorses of AI, powering everything from large language models like ChatGPT to cutting-edge research in autonomous vehicles. The demand for high-performance computing is surging, and Nvidia is perfectly positioned to capitalize. Their data center revenue, heavily influenced by AI demand, soared in the recent quarter, showcasing the power of this trend.

- Increased Demand: The global adoption of AI is accelerating, leading to a massive increase in the demand for Nvidia's high-end GPUs. This is a long-term trend, not a fleeting fad.

- Technological Leadership: Nvidia holds a dominant market share in AI accelerators, giving them a significant competitive advantage. Their technological innovation ensures they stay ahead of the curve.

- Strategic Partnerships: Nvidia is forging strategic partnerships with major cloud providers and AI developers, further solidifying its position in this burgeoning market.

H2: Beyond AI: A Diversified Portfolio

While AI is undeniably Nvidia's current star, the company's success isn't solely reliant on this one sector. Nvidia's diverse portfolio includes gaming, professional visualization, and automotive solutions. This diversification mitigates risk and provides a stable foundation for future growth.

- Gaming Remains Strong: Despite economic headwinds, the gaming market continues to generate significant revenue for Nvidia. The upcoming release of new graphics cards and continued interest in gaming provide a consistent revenue stream.

- Professional Visualization: Architects, designers, and other professionals rely on Nvidia's GPUs for high-performance computing tasks. This segment offers stable growth potential.

- Automotive Revolution: Nvidia's DRIVE platform is at the forefront of the autonomous vehicle revolution. As self-driving technology advances, Nvidia's role in this sector will only become more crucial.

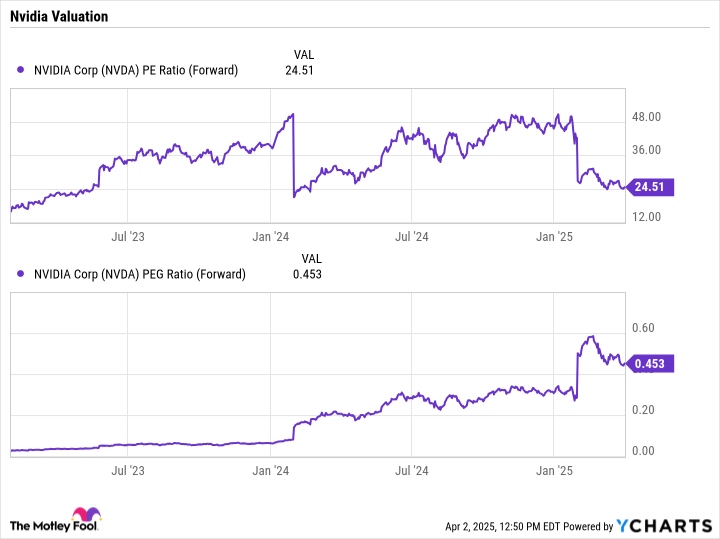

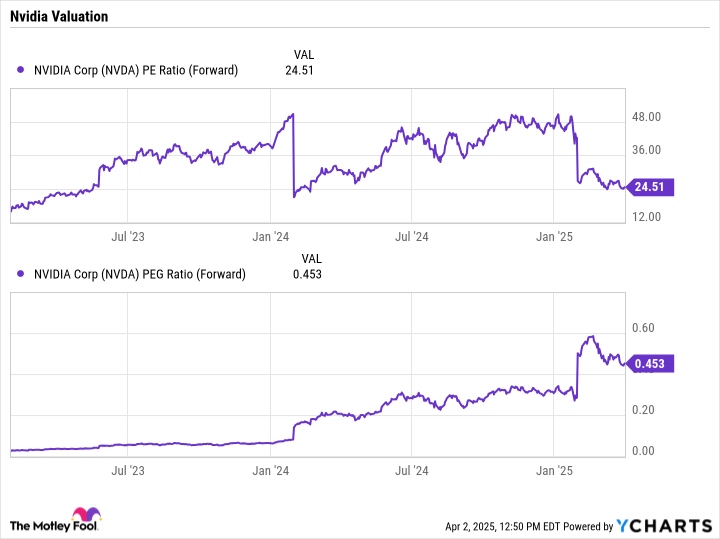

H2: Strong Financial Performance and Future Projections

Nvidia's recent financial performance speaks volumes. The company exceeded earnings expectations, demonstrating strong revenue growth and impressive profitability. Moreover, their future projections are incredibly optimistic, further bolstering investor confidence.

- Exceeding Expectations: Consistently surpassing analyst expectations demonstrates strong execution and a robust business model.

- Positive Future Outlook: Nvidia's management has expressed confidence in continued growth across all its segments, signaling a bright future for the company.

- Solid Financial Position: A strong balance sheet and healthy cash flow provide a safety net and the financial flexibility to pursue further growth opportunities.

H2: Investing in NVDA: Considerations and Risks

While the outlook for Nvidia is overwhelmingly positive, it's crucial to acknowledge potential risks. The semiconductor industry is cyclical, and geopolitical factors could impact supply chains. Furthermore, intense competition could emerge as the AI market matures. However, Nvidia's technological leadership and diversified portfolio mitigate some of these risks.

H2: Conclusion:

Nvidia's bullish outlook, fueled by the AI boom and a diverse product portfolio, makes it a compelling investment opportunity. While risks exist in any investment, the potential for significant long-term growth makes NVDA stock a strong contender for your portfolio. Conduct your own thorough research and consult a financial advisor before making any investment decisions. However, the evidence strongly suggests that Nvidia is well-positioned for continued success in the years to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia's Bullish Outlook: 3 Reasons To Invest In NVDA Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Real Madrid Vs Psg Champions League Quarterfinal Showdown Against English Rivals

Apr 08, 2025

Real Madrid Vs Psg Champions League Quarterfinal Showdown Against English Rivals

Apr 08, 2025 -

Fired Irs Probationary Employees To Return To Work

Apr 08, 2025

Fired Irs Probationary Employees To Return To Work

Apr 08, 2025 -

Gang Of Four Bassist Dave Allen Dies At 69 Remembering A Post Punk Pioneer

Apr 08, 2025

Gang Of Four Bassist Dave Allen Dies At 69 Remembering A Post Punk Pioneer

Apr 08, 2025 -

Saksikan Pertarungan Sengit Jadwal Rrq Dan Onic Di Esl Mobile Masters 2025 Hari Pertama

Apr 08, 2025

Saksikan Pertarungan Sengit Jadwal Rrq Dan Onic Di Esl Mobile Masters 2025 Hari Pertama

Apr 08, 2025 -

65 Million Xrp Liquidated As Trading Volume Hits 10 Billion Correction Intensifies

Apr 08, 2025

65 Million Xrp Liquidated As Trading Volume Hits 10 Billion Correction Intensifies

Apr 08, 2025