Nvidia's Explosive Growth: 3 Reasons To Buy And Hold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia's Explosive Growth: 3 Reasons to Buy and Hold

Nvidia's stock has been on a meteoric rise, leaving many investors wondering if the party's over or if there's still room for growth. While no investment is without risk, Nvidia's current trajectory, fueled by several key factors, presents a compelling case for a buy-and-hold strategy. Let's delve into three crucial reasons why this tech giant remains a strong contender for long-term investment.

1. The Unstoppable AI Revolution: Nvidia at the Helm

The current surge in artificial intelligence (AI) is undeniably transforming industries, and Nvidia is at the forefront of this revolution. Their high-performance GPUs (Graphics Processing Units) are the workhorses powering the vast majority of AI training and inference workloads. From massive language models like ChatGPT to groundbreaking advancements in medical imaging and autonomous vehicles, Nvidia's chips are essential.

- Dominant Market Share: Nvidia holds a commanding lead in the AI accelerator market, making them the go-to provider for researchers, developers, and businesses alike. This market dominance translates to significant revenue streams and substantial pricing power.

- Data Center Growth: The demand for powerful computing infrastructure to support AI is exploding, and Nvidia's data center business is experiencing phenomenal growth. This segment is a key driver of Nvidia's overall performance and is expected to continue its upward trajectory for years to come.

- Future-Proof Technology: Nvidia continues to innovate, pushing the boundaries of GPU technology and developing cutting-edge solutions specifically designed for the demands of AI and high-performance computing (HPC). This commitment to research and development ensures they remain at the forefront of the industry.

2. Beyond AI: A Diversified Portfolio for Sustainable Growth

While AI is currently Nvidia's star performer, the company isn't putting all its eggs in one basket. Their diverse portfolio includes:

- Gaming: Nvidia's GeForce GPUs continue to dominate the gaming market, providing a stable and reliable revenue stream. The ongoing popularity of gaming ensures continued demand for their high-performance graphics cards.

- Professional Visualization: From architecture and design to medical imaging and scientific research, Nvidia's professional visualization solutions cater to a broad range of industries. This segment provides a consistent source of revenue, less volatile than the rapidly evolving AI landscape.

- Automotive: Nvidia's DRIVE platform is making significant strides in the autonomous vehicle market, offering a pathway to future growth in a potentially massive sector. As self-driving technology matures, Nvidia's involvement could yield substantial returns.

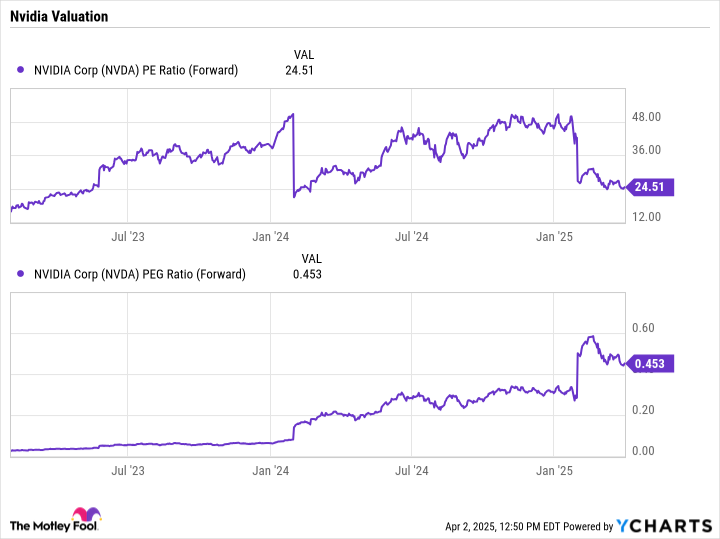

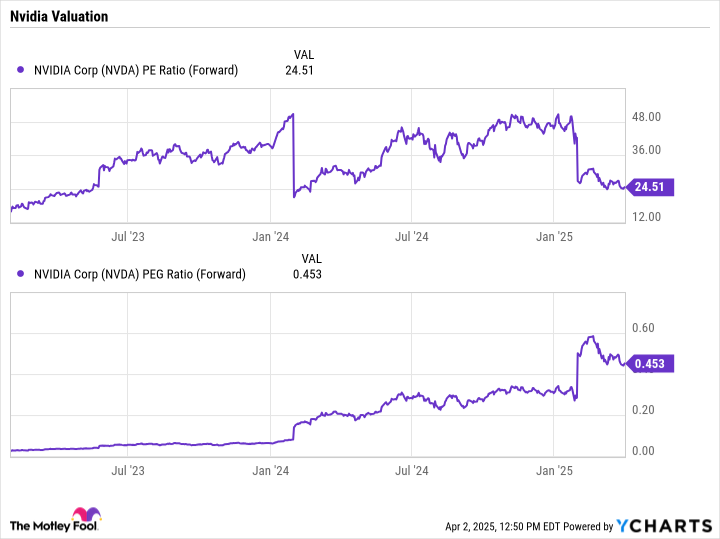

3. Strong Financials and Management Expertise

Nvidia's financial performance consistently exceeds expectations, demonstrating a robust and well-managed company. Their strong balance sheet and consistent profitability further bolster the case for long-term investment. The company's leadership team is also widely respected for its strategic vision and execution capabilities.

Investing in Nvidia: Considerations and Cautions

While the outlook for Nvidia is positive, it’s crucial to remember that investing in the stock market always involves risk. The current high valuation of Nvidia's stock means there's a potential for correction. Furthermore, the rapid pace of technological advancement means that unforeseen competition or disruptive technologies could impact future performance. It's crucial to conduct thorough research and consider your own risk tolerance before making any investment decisions. Consult with a financial advisor for personalized guidance.

Conclusion:

Nvidia's explosive growth is driven by its dominant position in the rapidly expanding AI market, its diversified product portfolio, and strong financial performance. While risks exist, the long-term outlook for the company remains promising, making it a compelling buy-and-hold opportunity for investors with a long-term perspective and an appetite for technology stocks. However, always remember to diversify your portfolio and invest responsibly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia's Explosive Growth: 3 Reasons To Buy And Hold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ipl 2025 Marsh Achieves 50 Joining Exclusive Club With Kohli Warner And Gayle

Apr 08, 2025

Ipl 2025 Marsh Achieves 50 Joining Exclusive Club With Kohli Warner And Gayle

Apr 08, 2025 -

Tesla Cybertruck Range Extender Project Cancelled

Apr 08, 2025

Tesla Cybertruck Range Extender Project Cancelled

Apr 08, 2025 -

Starships Role In The Future Of Global Cargo Logistics And Fuel Efficiency

Apr 08, 2025

Starships Role In The Future Of Global Cargo Logistics And Fuel Efficiency

Apr 08, 2025 -

Ufficiale Evani Guida La Sampdoria Inizia Una Nuova Era

Apr 08, 2025

Ufficiale Evani Guida La Sampdoria Inizia Una Nuova Era

Apr 08, 2025 -

Utica Canucks Vs Laval Rocket Primeaus Performance Steals A Point

Apr 08, 2025

Utica Canucks Vs Laval Rocket Primeaus Performance Steals A Point

Apr 08, 2025