Nvidia's First Sell Rating: A Sign Of More Negative Sentiment To Come?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia's First Sell Rating: A Sign of More Negative Sentiment to Come?

Nvidia (NVDA), the tech giant that has driven much of the AI boom, has received its first "sell" rating from a major Wall Street firm in months. This unexpected move has sent ripples through the market, sparking debate about whether this is an isolated incident or a harbinger of more negative sentiment to come for the once-unstoppable stock. The question on everyone's mind: is the Nvidia party finally over?

The sell rating, issued by [Insert Brokerage Firm Name Here], cited concerns about [Insert Specific Reasons Cited by Brokerage Firm – e.g., valuation, slowing data center growth, increased competition] as key factors driving their bearish outlook. This contrasts sharply with the overwhelmingly positive sentiment that has surrounded NVDA for much of the past year, fueled by the explosive growth of the AI sector and Nvidia's dominant position in GPU technology.

Is this a temporary setback or a turning point?

While a single sell rating shouldn't trigger panic selling, it's crucial to consider the context. Nvidia's stock price has experienced a meteoric rise, making it vulnerable to profit-taking and corrections. The recent sell rating could be a catalyst for investors who have been waiting for an opportunity to cash in on their profits.

Furthermore, the reasons cited by the brokerage firm warrant attention. If the concerns about [Reiterate key concerns mentioned previously – e.g., valuation, slowing growth, competition] are valid, they could represent significant headwinds for Nvidia in the coming quarters.

What are the potential implications?

- Valuation Concerns: Nvidia's current valuation is undeniably high, leaving some analysts questioning its sustainability given potential slowing growth. The sell rating highlights this risk.

- Competition: The GPU market is becoming increasingly competitive, with AMD and other players making significant strides. Increased competition could erode Nvidia's market share and impact future revenue growth.

- Economic Slowdown: A broader economic slowdown could also dampen demand for Nvidia's products, particularly in the data center market.

What to watch for in the coming weeks and months:

Investors should carefully monitor several key indicators:

- Q[Insert Quarter] Earnings Report: Nvidia's upcoming earnings report will be crucial in gauging the company's performance and validating or refuting the concerns raised by the brokerage firm. Pay close attention to guidance for future quarters.

- Analyst Reactions: The response of other analysts to the sell rating will be significant. A trend of downgrades could indicate a broader shift in sentiment.

- Market Reaction: The overall market reaction to the sell rating and future news will be a key indicator of investor confidence in Nvidia.

Conclusion:

While one sell rating doesn't automatically signal the end of Nvidia's remarkable run, it does serve as a cautionary tale. The concerns raised by the brokerage firm warrant careful consideration, and investors should approach Nvidia stock with a degree of caution. The coming weeks and months will be critical in determining whether this is a temporary blip or a sign of more negative sentiment to come. Investors should remain vigilant and rely on their own due diligence before making any investment decisions. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia's First Sell Rating: A Sign Of More Negative Sentiment To Come?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investor Relief As Us And China Make Headway In Trade Negotiations

May 13, 2025

Investor Relief As Us And China Make Headway In Trade Negotiations

May 13, 2025 -

Design And Color Options Revealed In Latest Sony Xperia 1 Vii Leak

May 13, 2025

Design And Color Options Revealed In Latest Sony Xperia 1 Vii Leak

May 13, 2025 -

Post May 28th Outlook Ai Semiconductor Stock Investment Opportunities

May 13, 2025

Post May 28th Outlook Ai Semiconductor Stock Investment Opportunities

May 13, 2025 -

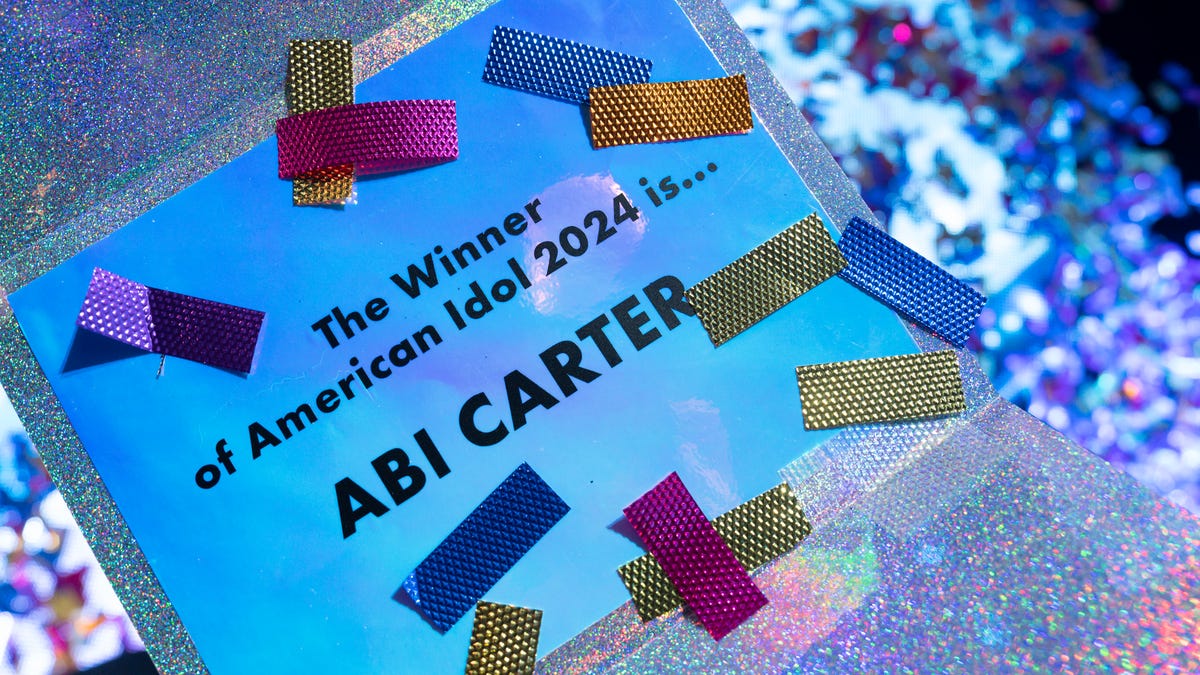

Watch American Idol Season 23 Top 7 Date Time And Streaming Details

May 13, 2025

Watch American Idol Season 23 Top 7 Date Time And Streaming Details

May 13, 2025 -

The Digital Divide Examining Distrust In Online Voting Among Ofws

May 13, 2025

The Digital Divide Examining Distrust In Online Voting Among Ofws

May 13, 2025

Latest Posts

-

Greg Abel Assume O Leme Dos Investimentos Da Berkshire Sucessao De Buffett Definida

May 13, 2025

Greg Abel Assume O Leme Dos Investimentos Da Berkshire Sucessao De Buffett Definida

May 13, 2025 -

Panama Ports Dispute Li Ka Shings Retirement Doesnt Explain The High Stakes

May 13, 2025

Panama Ports Dispute Li Ka Shings Retirement Doesnt Explain The High Stakes

May 13, 2025 -

Trump Xi Agree To 90 Day Trade War Pause

May 13, 2025

Trump Xi Agree To 90 Day Trade War Pause

May 13, 2025 -

Is Apple Rescuing Google Examining Their Strategic Partnership

May 13, 2025

Is Apple Rescuing Google Examining Their Strategic Partnership

May 13, 2025 -

Episode 3 Why Scientific Research Matters Even In War

May 13, 2025

Episode 3 Why Scientific Research Matters Even In War

May 13, 2025