Nvidia's Future: A 5-Year Stock Price Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nvidia's Future: A 5-Year Stock Price Forecast – Riding the AI Wave?

Nvidia's meteoric rise has captivated investors, transforming it from a graphics card giant into a leading force in artificial intelligence. But what does the future hold for NVDA stock? Can this blistering pace continue over the next five years? This in-depth analysis explores the factors influencing Nvidia's stock price and offers a considered forecast.

The AI Revolution: Nvidia's Core Strength

Nvidia's dominance in the AI sector is undeniable. Its GPUs, particularly the A100 and H100, are the workhorses powering the current AI boom, fueling everything from generative AI models like ChatGPT to cutting-edge research in autonomous vehicles and high-performance computing (HPC). This isn't just a temporary trend; AI is rapidly becoming ubiquitous, solidifying Nvidia's position as a key beneficiary.

Key Factors Influencing Nvidia's Stock Price (2024-2028)

Several factors will significantly impact Nvidia's stock price trajectory over the next five years:

-

Continued AI Adoption: The widespread adoption of AI across various industries remains the biggest driver. Increased demand for high-performance computing solutions directly translates to higher Nvidia revenue and, consequently, a higher stock price.

-

Competition: While currently dominant, Nvidia faces growing competition from AMD and Intel, who are aggressively investing in their own AI chip development. The intensity of this competition will be a crucial determinant of Nvidia's market share and future growth.

-

Supply Chain Issues: Global supply chain disruptions can impact Nvidia's ability to meet the surging demand for its products. Any significant delays or shortages could negatively affect the stock price.

-

Regulatory Scrutiny: Increased regulatory scrutiny regarding antitrust and data privacy concerns could also impact Nvidia's growth trajectory. Navigating these complexities effectively will be crucial for maintaining investor confidence.

-

Economic Conditions: Macroeconomic factors, such as inflation and recessionary pressures, will inevitably influence investor sentiment and overall market performance, indirectly affecting Nvidia's stock price.

Nvidia Stock Price Forecast (2024-2028): A Cautious Optimism

Predicting stock prices with certainty is impossible. However, based on current trends and the factors outlined above, we can propose a cautious yet optimistic forecast:

-

2024: Continued strong growth driven by AI adoption, potentially leading to a price range of $300-$400 per share.

-

2025-2026: Moderate growth, with potential price consolidation around $400-$500, as competition intensifies and macroeconomic factors come into play.

-

2027-2028: Continued growth fueled by further advancements in AI and new market opportunities could see the price range between $500-$700. This is contingent upon successful navigation of competitive and regulatory challenges.

Disclaimer: This forecast is purely speculative and should not be considered financial advice. Investing in the stock market carries inherent risks, and individual investors should conduct their own thorough research before making any investment decisions.

Conclusion:

Nvidia's future looks bright, fueled by the unstoppable rise of artificial intelligence. While challenges undoubtedly exist, its current market leadership and strong technological capabilities position it well for continued growth. However, investors must remain aware of the risks and volatility associated with the tech sector and consider diversification as part of a well-rounded investment strategy. The next five years will be crucial in determining whether Nvidia can fully capitalize on the AI revolution and maintain its current momentum.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nvidia's Future: A 5-Year Stock Price Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Middleweight Battle Whittaker Faces De Ridder In Abu Dhabi Ufc Main Event

May 12, 2025

Middleweight Battle Whittaker Faces De Ridder In Abu Dhabi Ufc Main Event

May 12, 2025 -

Estado De Emergencia No Rs Balanco Das Chuvas Revela 75 Mortes E Perdas Incalculaveis

May 12, 2025

Estado De Emergencia No Rs Balanco Das Chuvas Revela 75 Mortes E Perdas Incalculaveis

May 12, 2025 -

Atletico De Madrid Vs Real Sociedad Resultado Goles Y Analisis Del 4 0

May 12, 2025

Atletico De Madrid Vs Real Sociedad Resultado Goles Y Analisis Del 4 0

May 12, 2025 -

Ryan Masons West Brom Move A Significant Obstacle Emerges

May 12, 2025

Ryan Masons West Brom Move A Significant Obstacle Emerges

May 12, 2025 -

Queensland Labor Takes Action Mp Expelled Following Domestic Violence Claims

May 12, 2025

Queensland Labor Takes Action Mp Expelled Following Domestic Violence Claims

May 12, 2025

Latest Posts

-

Actor Simu Liu Proposes To Allison Hsu In Paris

May 12, 2025

Actor Simu Liu Proposes To Allison Hsu In Paris

May 12, 2025 -

Panama Ports Li Ka Shings Retirement Fails To Douse The Flames Of Controversy

May 12, 2025

Panama Ports Li Ka Shings Retirement Fails To Douse The Flames Of Controversy

May 12, 2025 -

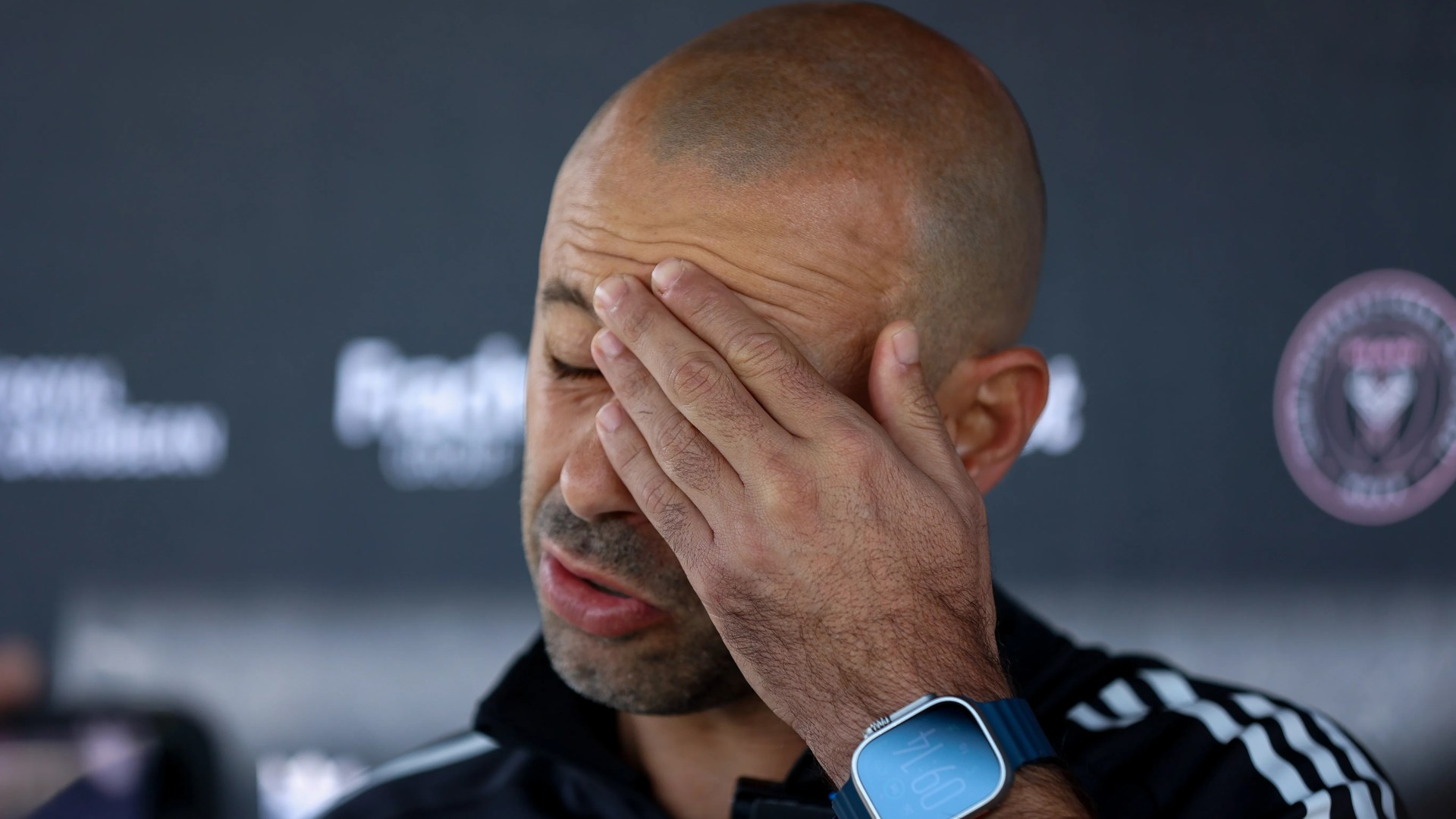

David Beckham Under Fire Mascheranos Job On The Line Following Messis Historic Loss

May 12, 2025

David Beckham Under Fire Mascheranos Job On The Line Following Messis Historic Loss

May 12, 2025 -

Conte Urges Calm Amidst Napolis Tense Scudetto Race

May 12, 2025

Conte Urges Calm Amidst Napolis Tense Scudetto Race

May 12, 2025 -

Thunders Ugly Game 4 Win Who Won Who Lost Against The Nuggets

May 12, 2025

Thunders Ugly Game 4 Win Who Won Who Lost Against The Nuggets

May 12, 2025