OCBC Bank: 2025 Guidance Unchanged Despite Economic Headwinds In Singapore

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OCBC Bank: 2025 Guidance Remains Unchanged Despite Singapore's Economic Headwinds

Singapore, [Date of Publication] – OCBC Bank, one of Singapore's largest financial institutions, has reaffirmed its 2025 guidance despite growing concerns about the nation's economic outlook. This unwavering confidence, announced [mention date and source of announcement, e.g., during their Q[Quarter] earnings call], stands in contrast to a more cautious sentiment permeating other sectors within the Singaporean economy. The decision underscores OCBC's robust financial position and its strategic approach to navigating uncertain times.

The bank's steadfast commitment to its 2025 targets highlights its resilience in the face of challenges like rising inflation, global uncertainties, and a potential slowdown in Singapore's growth. While acknowledging the headwinds, OCBC executives emphasized the bank's diversified business model and strong risk management practices as key factors contributing to their continued optimism.

<h3>Navigating the Economic Storm: OCBC's Strategic Approach</h3>

OCBC's 2025 guidance, which includes [mention key targets, e.g., specific growth targets, return on equity goals etc.], remains unchanged. This reflects a strategic approach built on several pillars:

- Diversified Revenue Streams: OCBC’s diverse portfolio, spanning across various segments including consumer banking, corporate banking, and wealth management, mitigates the risk associated with reliance on any single sector. This diversification provides a buffer against potential economic downturns.

- Strong Capital Position: A robust capital base and liquidity position enable OCBC to weather economic fluctuations and continue supporting its clients and investments.

- Disciplined Risk Management: OCBC's rigorous risk management framework allows for proactive identification and mitigation of potential threats, ensuring the stability of the bank's operations.

- Focus on Digital Transformation: Investment in digital technologies and innovation is enabling OCBC to enhance efficiency, improve customer experience, and adapt to changing market demands.

<h3>Singapore's Economic Landscape: A Challenging Environment</h3>

Singapore's economy is facing a confluence of challenges. Global inflation remains stubbornly high, impacting consumer spending and business investment. The global slowdown is also affecting Singapore's export-oriented economy. These factors, combined with geopolitical uncertainties, create a complex and challenging environment for businesses operating in Singapore.

However, OCBC's unwavering 2025 guidance suggests a belief in the long-term resilience of the Singaporean economy and the bank's ability to capitalize on opportunities even within this challenging landscape.

<h3>Analyst Reactions and Market Outlook</h3>

Analysts have offered mixed reactions to OCBC's announcement. [Mention specific analyst opinions and their reasoning if available. Include sources]. While some express cautious optimism, others highlight the inherent risks associated with maintaining ambitious targets during a period of economic uncertainty.

The market's response to OCBC's announcement will be closely watched. The share price [mention current share price and recent trends if available] reflects investor sentiment towards the bank's prospects and its ability to deliver on its 2025 targets.

<h3>Conclusion: A Test of Resilience</h3>

OCBC Bank's decision to maintain its 2025 guidance in the face of significant economic headwinds in Singapore represents a bold statement of confidence. The coming years will be a crucial test of the bank's strategic approach and its ability to navigate the complexities of the current economic climate. Whether OCBC can successfully weather this storm and achieve its ambitious targets remains to be seen, making this a compelling story to follow for investors and economic observers alike. The success or failure of OCBC’s strategy will likely serve as a benchmark for other financial institutions operating within the Singaporean market and beyond.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OCBC Bank: 2025 Guidance Unchanged Despite Economic Headwinds In Singapore. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

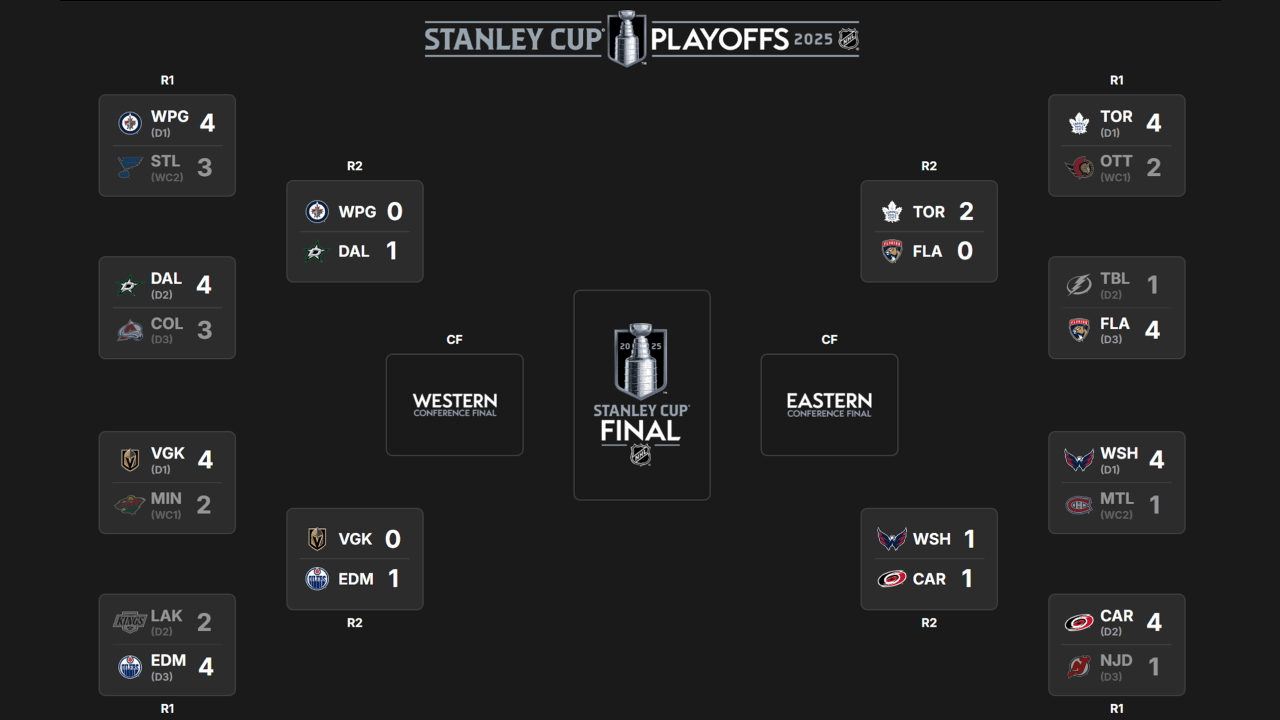

Where To Watch 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025

Where To Watch 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025 -

Winning Set For Life Numbers Announced Thursday May 8th 10k Monthly Jackpot

May 09, 2025

Winning Set For Life Numbers Announced Thursday May 8th 10k Monthly Jackpot

May 09, 2025 -

Kanye Wests Explosive New Song Accusations Against Kardashians And Bank Details

May 09, 2025

Kanye Wests Explosive New Song Accusations Against Kardashians And Bank Details

May 09, 2025 -

Nintendo Switch 2 Pre Orders Open Check These Retailers Now

May 09, 2025

Nintendo Switch 2 Pre Orders Open Check These Retailers Now

May 09, 2025 -

Andor And The Genocide Narrative A Deeper Dive

May 09, 2025

Andor And The Genocide Narrative A Deeper Dive

May 09, 2025