Oil Market Defies OPEC: Prices Surge After Production Quota Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Market Defies OPEC: Prices Surge After Production Quota Announcement

Global oil prices defied expectations and surged following OPEC+'s announcement of maintained production quotas. The decision, made during a highly anticipated meeting, sent shockwaves through the market, leaving analysts scrambling to explain the unexpected price jump. This unexpected surge highlights the complex interplay of factors influencing the global oil market, beyond simple supply and demand dynamics.

OPEC+ Sticks to its Guns: Maintaining Production Quotas

The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+), representing a significant portion of global oil production, opted to maintain their existing production quotas. This decision, seemingly counterintuitive given the current global economic climate and fluctuating demand, surprised many market observers who predicted a production increase. The announcement, made on [Date of announcement], immediately sparked a wave of speculation and trading activity.

Reasons Behind the Price Surge: Beyond OPEC's Decision

While OPEC+'s decision to maintain production quotas played a role, the price surge is a result of a confluence of factors:

-

Geopolitical Instability: Ongoing geopolitical tensions in key oil-producing regions continue to fuel uncertainty and drive up prices. The war in Ukraine, in particular, remains a significant wildcard, impacting supply chains and global energy security. This uncertainty acts as a significant price driver, independent of OPEC's decisions.

-

Stronger-than-Expected Demand: Global demand for oil has proven to be more resilient than anticipated, particularly from emerging economies. This increased consumption, combined with constrained supply, has created a tighter market, pushing prices upward.

-

Strategic Stockpiling: Concerns about future supply disruptions are leading to increased strategic stockpiling by various nations, further reducing available oil in the immediate market and contributing to higher prices.

-

Speculative Trading: The unexpected nature of OPEC+'s decision fueled significant speculative trading, further contributing to the price increase. Market volatility often magnifies the impact of even minor shifts in supply and demand.

Impact on Consumers and the Global Economy:

The price surge is likely to have significant ramifications for consumers worldwide, leading to higher gasoline prices and increased energy costs. This could impact inflation and overall economic growth, particularly in countries heavily reliant on oil imports. The increased cost of energy also translates to higher prices for numerous goods and services across the supply chain.

Looking Ahead: Uncertainty Remains King

The future trajectory of oil prices remains uncertain. While OPEC+'s decision provides some clarity in terms of production quotas, geopolitical instability and fluctuating demand continue to present major risks. Analysts will closely monitor developments in key oil-producing regions and global economic indicators to gain insights into future price movements. The short-term outlook points to continued price volatility, making this a period of high uncertainty for both producers and consumers.

Keywords: Oil prices, OPEC, OPEC+, oil market, crude oil, production quotas, geopolitical instability, global economy, energy prices, gasoline prices, supply and demand, inflation, economic growth, energy security, speculative trading, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Market Defies OPEC: Prices Surge After Production Quota Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Knicks Vs Celtics Box Score For May 7 2025 Game

May 08, 2025

Knicks Vs Celtics Box Score For May 7 2025 Game

May 08, 2025 -

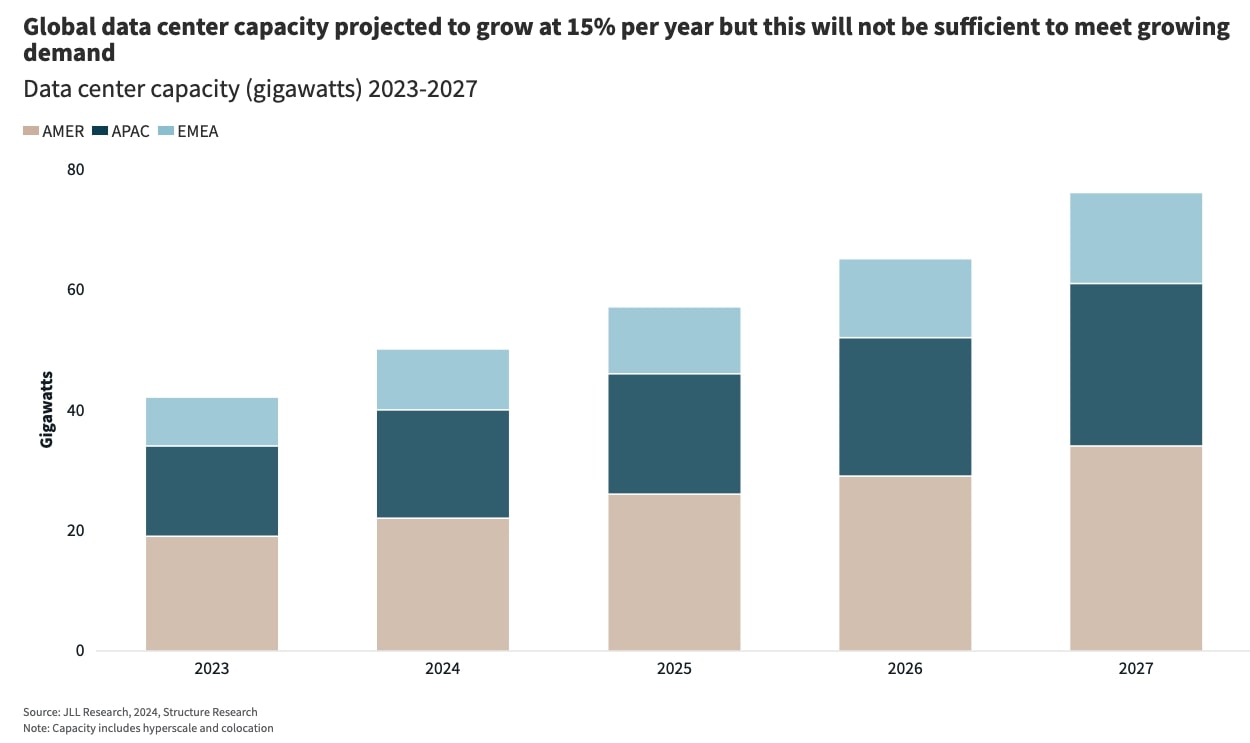

Despite Cloud Giants Strategies Global Ai Data Center Capacity Expands

May 08, 2025

Despite Cloud Giants Strategies Global Ai Data Center Capacity Expands

May 08, 2025 -

Oklahoma City Thunder Jaylin Williams Strong Case For Increased Playing Time

May 08, 2025

Oklahoma City Thunder Jaylin Williams Strong Case For Increased Playing Time

May 08, 2025 -

Fight Or Flight Gameplay Graphics And Story Review

May 08, 2025

Fight Or Flight Gameplay Graphics And Story Review

May 08, 2025 -

Josh Hartnetts Career Resurgence His Most Unconventional Film Yet

May 08, 2025

Josh Hartnetts Career Resurgence His Most Unconventional Film Yet

May 08, 2025

Latest Posts

-

Australian Election And Politics Rudd Critiques Trumps Bluey Tax Faruqis Bold Prediction On Bandt

May 08, 2025

Australian Election And Politics Rudd Critiques Trumps Bluey Tax Faruqis Bold Prediction On Bandt

May 08, 2025 -

Ligue Des Champions Hakimi Loue Les Qualites D Entraineur De Luis Enrique

May 08, 2025

Ligue Des Champions Hakimi Loue Les Qualites D Entraineur De Luis Enrique

May 08, 2025 -

World Record Set On Final Destination Bloodlines Set Oldest Person Set Afire

May 08, 2025

World Record Set On Final Destination Bloodlines Set Oldest Person Set Afire

May 08, 2025 -

Bonne Nouvelle Regardez La Finale De Ligue Des Champions Psg Inter Sur M6

May 08, 2025

Bonne Nouvelle Regardez La Finale De Ligue Des Champions Psg Inter Sur M6

May 08, 2025 -

Albanese Set To Axe Two Ministers Cabinet Reshuffle Speculation Mounts

May 08, 2025

Albanese Set To Axe Two Ministers Cabinet Reshuffle Speculation Mounts

May 08, 2025