Oil Market Update: 3% Price Increase Driven By European And Chinese Demand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Market Update: 3% Price Increase Driven by Soaring European and Chinese Demand

The global oil market experienced a significant surge today, with crude oil prices climbing by 3%—a dramatic shift attributed primarily to unexpectedly strong demand from Europe and China. This marks a considerable turnaround from the recent period of relative price stability and underscores the complex interplay of global economic factors influencing energy markets.

European Energy Crisis Fuels Demand: The ongoing energy crisis in Europe continues to be a major driver of the price increase. With Russia significantly reducing natural gas supplies, European nations are scrambling for alternative energy sources, leading to a heightened reliance on oil for heating, electricity generation, and industrial processes. This increased demand has outstripped expectations, putting upward pressure on global oil prices. Analysts predict this trend will continue throughout the winter months unless significant alternative energy solutions are implemented.

China's Reopening and Economic Recovery: China's reopening after stringent COVID-19 lockdowns is also playing a crucial role. The country's resurgence in economic activity has fueled a sharp rise in oil consumption, exceeding pre-pandemic levels. Increased industrial production, transportation, and personal consumption are all contributing to this surge in demand. This unexpected jump in Chinese oil demand has caught many market analysts off guard, adding further momentum to the price increase.

Geopolitical Instability Remains a Factor: While European and Chinese demand are the primary drivers of the current price spike, the ongoing geopolitical instability in various parts of the world remains a significant underlying factor. Concerns about potential supply disruptions, particularly in regions with significant oil production, often contribute to price volatility and investor uncertainty. This adds another layer of complexity to the already dynamic oil market.

What This Means for Consumers: The 3% price increase is likely to translate into higher costs for consumers across the globe. The impact will be felt most acutely in transportation, heating costs, and the price of various goods and services reliant on oil-based products. Governments and businesses will need to carefully monitor the situation and develop strategies to mitigate the effects of this price surge on their respective economies.

Looking Ahead: Uncertainty and Volatility Persist: While the current price increase is primarily driven by increased demand, the future trajectory of oil prices remains uncertain. Several factors could influence prices in the coming weeks and months, including:

- The severity of the European winter: A particularly harsh winter could further exacerbate the energy crisis and drive up demand.

- The pace of China's economic recovery: Any slowdown in China's economic growth could moderate oil demand.

- Further geopolitical developments: Unexpected geopolitical events could significantly impact oil supply and prices.

Experts predict continued volatility in the oil market, urging consumers and businesses to prepare for potential price fluctuations. Careful monitoring of global economic indicators and geopolitical events will be crucial in navigating this dynamic landscape. The increased demand from Europe and China presents a significant challenge to the global energy market, highlighting the urgent need for diverse and sustainable energy solutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Market Update: 3% Price Increase Driven By European And Chinese Demand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Curry Leads Warriors To Victory Over Rockets In Nba Playoffs

May 07, 2025

Curry Leads Warriors To Victory Over Rockets In Nba Playoffs

May 07, 2025 -

Playoff Thriller Curry And Warriors Triumph Over Rockets In Nba Postseason

May 07, 2025

Playoff Thriller Curry And Warriors Triumph Over Rockets In Nba Postseason

May 07, 2025 -

Golden State Warriors Vs Minnesota Timberwolves May 6 2025 Key Stats And Game Chart

May 07, 2025

Golden State Warriors Vs Minnesota Timberwolves May 6 2025 Key Stats And Game Chart

May 07, 2025 -

Open Ais World Brain Project Sam Altmans Gamble On The Future Of Artificial Intelligence

May 07, 2025

Open Ais World Brain Project Sam Altmans Gamble On The Future Of Artificial Intelligence

May 07, 2025 -

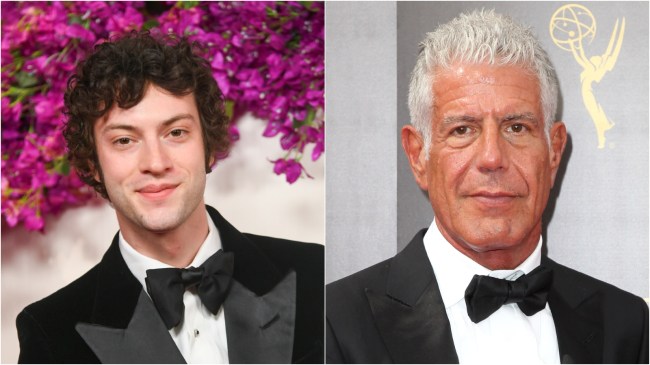

Anthony Bourdain Biopic Tony A Method Acting Approach

May 07, 2025

Anthony Bourdain Biopic Tony A Method Acting Approach

May 07, 2025

Latest Posts

-

Analyzing The Strategies Trump And Bidens Facebook Ad Targeting Of Older Women

May 07, 2025

Analyzing The Strategies Trump And Bidens Facebook Ad Targeting Of Older Women

May 07, 2025 -

Volatile Trading Session Markets Down Ahead Of Us Federal Reserve Announcement

May 07, 2025

Volatile Trading Session Markets Down Ahead Of Us Federal Reserve Announcement

May 07, 2025 -

Miyagi Do Karate Examining The Philosophy And Legacy Of A Legendary Sensei

May 07, 2025

Miyagi Do Karate Examining The Philosophy And Legacy Of A Legendary Sensei

May 07, 2025 -

Houston Rockets What Game 7 Revealed About Their Potential

May 07, 2025

Houston Rockets What Game 7 Revealed About Their Potential

May 07, 2025 -

Decentralization A Key Driver For The Future Of Eu Cloud Infrastructure

May 07, 2025

Decentralization A Key Driver For The Future Of Eu Cloud Infrastructure

May 07, 2025