Oil Market Volatility: Analyzing The Surge Following The OPEC Production Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Market Volatility: Analyzing the Surge Following the OPEC Production Cut

The global oil market is experiencing a period of significant volatility, with prices surging following OPEC+'s surprise announcement of a production cut. This unexpected move has sent shockwaves through the energy sector, leaving investors, consumers, and governments grappling with the implications. Understanding the factors driving this surge and its potential consequences is crucial for navigating the turbulent landscape ahead.

OPEC+'s Bold Move and Market Reaction:

The Organization of the Petroleum Exporting Countries (OPEC), along with its allies (OPEC+), recently announced a significant cut in oil production. This decision, largely spearheaded by Saudi Arabia, aims to bolster oil prices and stabilize the market. However, the market's reaction has been far from uniform. While some analysts predict a sustained price increase, others caution against potential economic repercussions. The immediate impact was a sharp rise in benchmark crude oil prices, the likes of which haven't been seen in recent months. This volatility highlights the precarious balance of supply and demand in the global energy market.

Factors Fueling the Price Surge:

Several factors contribute to the current oil price surge beyond the OPEC+ production cut:

-

Geopolitical Instability: Ongoing conflicts and tensions in various regions, particularly those impacting major oil-producing nations, create uncertainty and drive prices upward. The war in Ukraine continues to play a significant role, disrupting supply chains and impacting global energy security.

-

Increased Global Demand: As the global economy recovers from the pandemic, demand for oil has steadily increased. This rising demand, coupled with the reduced supply due to the production cuts, creates a classic scenario of scarcity driving prices higher.

-

Inflationary Pressures: Global inflation remains a major concern, further complicating the situation. Rising energy costs contribute to broader inflationary pressures, creating a feedback loop that affects both producers and consumers.

-

Speculative Trading: The uncertainty surrounding future oil prices encourages speculative trading, further influencing price fluctuations. Investors bet on potential price movements, adding to the overall volatility.

Potential Consequences and Long-Term Outlook:

The consequences of this oil price surge are far-reaching:

-

Higher Consumer Prices: Increased oil prices inevitably translate into higher prices for gasoline, heating oil, and other goods and services, impacting household budgets and potentially slowing economic growth.

-

Inflationary Risks: Rising energy costs contribute significantly to inflation, posing a challenge for central banks aiming to control price increases.

-

Economic Uncertainty: The volatility in the oil market introduces significant uncertainty into the global economy, making it more challenging for businesses to plan and invest.

-

Geopolitical Implications: The interplay between oil prices and geopolitical stability is complex. High oil prices can exacerbate existing tensions, while price volatility can lead to unpredictable shifts in global power dynamics.

Navigating the Uncertain Future:

The long-term outlook for the oil market remains uncertain. The effectiveness of OPEC+'s production cut in stabilizing prices will depend on a number of factors, including global economic growth, geopolitical developments, and the response of other oil-producing nations. Investors and policymakers alike need to carefully monitor these developments and adapt their strategies accordingly. The current volatility underscores the critical need for diversification of energy sources and investment in renewable energy technologies to mitigate future price shocks. The coming months will be crucial in determining the lasting impact of this recent surge in oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Market Volatility: Analyzing The Surge Following The OPEC Production Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Ncaa Womens Lacrosse Championship Full Bracket Schedule And Results

May 07, 2025

2025 Ncaa Womens Lacrosse Championship Full Bracket Schedule And Results

May 07, 2025 -

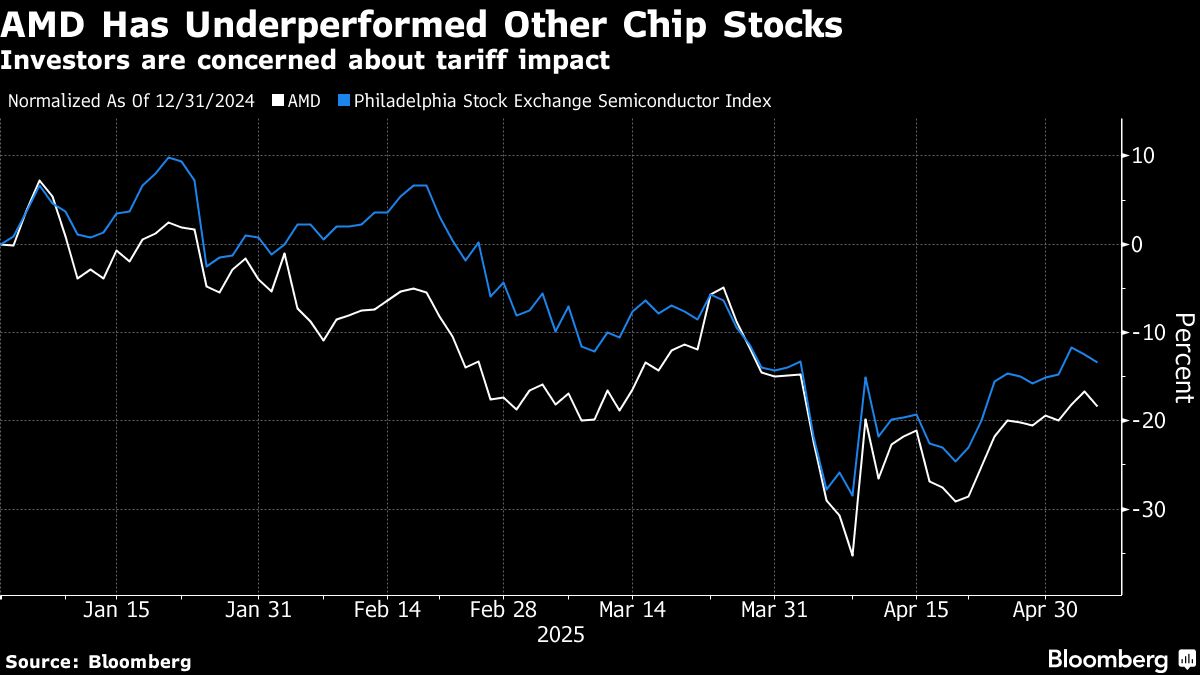

Amd Bullish On Sales Growth But China Concerns Temper Enthusiasm

May 07, 2025

Amd Bullish On Sales Growth But China Concerns Temper Enthusiasm

May 07, 2025 -

Foreign Filmmakers Face 100 Tariff Under Trumps Plan

May 07, 2025

Foreign Filmmakers Face 100 Tariff Under Trumps Plan

May 07, 2025 -

Cleveland Cavaliers Face Game 2 Without Star Players Garland Mobley And Hunter

May 07, 2025

Cleveland Cavaliers Face Game 2 Without Star Players Garland Mobley And Hunter

May 07, 2025 -

Game 7 Aftermath Westbrooks Salt Rubbing Celebration Stirs Controversy

May 07, 2025

Game 7 Aftermath Westbrooks Salt Rubbing Celebration Stirs Controversy

May 07, 2025

Latest Posts

-

Analyzing The Strategies Trump And Bidens Facebook Ad Targeting Of Older Women

May 07, 2025

Analyzing The Strategies Trump And Bidens Facebook Ad Targeting Of Older Women

May 07, 2025 -

Volatile Trading Session Markets Down Ahead Of Us Federal Reserve Announcement

May 07, 2025

Volatile Trading Session Markets Down Ahead Of Us Federal Reserve Announcement

May 07, 2025 -

Miyagi Do Karate Examining The Philosophy And Legacy Of A Legendary Sensei

May 07, 2025

Miyagi Do Karate Examining The Philosophy And Legacy Of A Legendary Sensei

May 07, 2025 -

Houston Rockets What Game 7 Revealed About Their Potential

May 07, 2025

Houston Rockets What Game 7 Revealed About Their Potential

May 07, 2025 -

Decentralization A Key Driver For The Future Of Eu Cloud Infrastructure

May 07, 2025

Decentralization A Key Driver For The Future Of Eu Cloud Infrastructure

May 07, 2025