Oil Prices Crash: U.S. Crude At Lowest Point Since 2021 After OPEC+ Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Prices Crash: U.S. Crude Plunges to 2021 Lows Following OPEC+ Production Cut

Global oil markets experienced a dramatic downturn today, with U.S. crude oil prices plummeting to their lowest point since 2021 following a surprise announcement from OPEC+. The unexpected decision to significantly curtail oil production sent shockwaves through the energy sector, leaving investors scrambling and raising concerns about potential economic implications.

The price of West Texas Intermediate (WTI) crude, the U.S. benchmark, fell sharply, closing below $70 a barrel – a level not seen since late 2021. Brent crude, the international benchmark, also experienced a significant drop. This dramatic price swing marks a significant reversal from recent market trends and highlights the volatile nature of the global energy landscape.

<h3>OPEC+ Production Cut: The Catalyst for the Crash</h3>

The primary driver behind this oil price crash is the announcement from OPEC+, the alliance of oil-producing nations led by Saudi Arabia and Russia. The group unexpectedly decided to significantly reduce its oil production, a move that many analysts believe is aimed at bolstering prices in the long term. However, the immediate market reaction has been overwhelmingly negative, with prices falling sharply due to concerns about a potential global supply glut.

The decision comes at a time when global economic growth is slowing, and demand for oil is expected to remain relatively subdued. This combination of reduced production and weakening demand has created a perfect storm for falling prices.

<h3>Impact on the Global Economy and Consumers</h3>

The implications of this oil price crash are far-reaching and potentially significant. While lower oil prices are generally good news for consumers, particularly at the gas pump, the sudden and sharp decline could also indicate underlying economic weakness. Furthermore, the decision by OPEC+ could trigger geopolitical tensions, especially given the ongoing war in Ukraine and the complex relationships between oil-producing nations.

- Lower Gas Prices: Consumers in the U.S. and globally can expect to see some relief at the gas pump in the short term.

- Impact on Inflation: Lower oil prices could help to ease inflationary pressures, a welcome development for many economies struggling with rising costs.

- Energy Sector Volatility: The oil and gas industry is likely to experience increased volatility in the coming weeks and months as markets adjust to the new reality.

- Geopolitical Uncertainty: The OPEC+ decision adds another layer of complexity to the already volatile geopolitical landscape.

<h3>Expert Analysis and Market Outlook</h3>

Analysts are divided on the long-term implications of this oil price crash. Some believe the OPEC+ move is a strategic maneuver designed to support prices in the longer term, arguing that the current price drop is temporary. Others warn that this could signal a more prolonged period of lower prices, potentially impacting investment in the energy sector and leading to further economic uncertainty.

The coming weeks will be crucial in determining the true impact of this sudden shift in the oil market. Investors and consumers alike will be closely watching for any signs of stabilization or further price drops. The situation remains fluid and warrants continuous monitoring. This unexpected development underscores the unpredictable nature of the global energy market and its influence on the global economy. Further updates will be provided as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Prices Crash: U.S. Crude At Lowest Point Since 2021 After OPEC+ Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rio Grande Do Sul Operacoes Da Gerdau Interrompidas Devido A Fortes Chuvas

May 06, 2025

Rio Grande Do Sul Operacoes Da Gerdau Interrompidas Devido A Fortes Chuvas

May 06, 2025 -

Opec Supply Surge Oil Prices Plummet Amidst Global Market Glut

May 06, 2025

Opec Supply Surge Oil Prices Plummet Amidst Global Market Glut

May 06, 2025 -

Okc Thunders Isaiah Hartenstein On Clippers Vs Nuggets Playoff Series Reaction

May 06, 2025

Okc Thunders Isaiah Hartenstein On Clippers Vs Nuggets Playoff Series Reaction

May 06, 2025 -

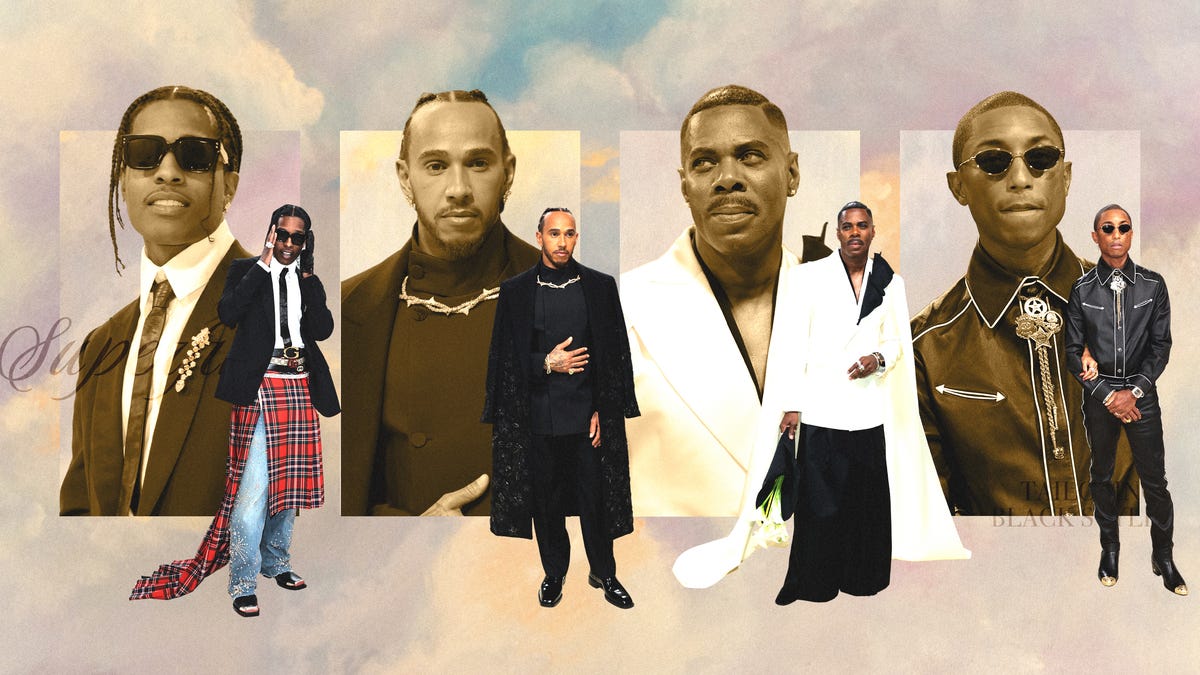

Live Coverage Met Gala 2025 Fashion Celebrities And More

May 06, 2025

Live Coverage Met Gala 2025 Fashion Celebrities And More

May 06, 2025 -

Is Willy Adames A Good Home Run Prop Bet Tonight Against The Cubs

May 06, 2025

Is Willy Adames A Good Home Run Prop Bet Tonight Against The Cubs

May 06, 2025

Latest Posts

-

Met Gala 2025 Rihannas Pregnancy Reveal Steals The Show

May 06, 2025

Met Gala 2025 Rihannas Pregnancy Reveal Steals The Show

May 06, 2025 -

Is Bitcoins Btc Bull Cycle Over Conclusive Chart Analysis

May 06, 2025

Is Bitcoins Btc Bull Cycle Over Conclusive Chart Analysis

May 06, 2025 -

Knicks Celtics Playoffs Jrue Holidays Game 1 Participation Confirmed

May 06, 2025

Knicks Celtics Playoffs Jrue Holidays Game 1 Participation Confirmed

May 06, 2025 -

Celtics Knicks Prediction Form Guide Head To Head And Betting Odds

May 06, 2025

Celtics Knicks Prediction Form Guide Head To Head And Betting Odds

May 06, 2025 -

Self Driving Tesla Revolutionizes Texas Statewide Robotaxi Approval Announced

May 06, 2025

Self Driving Tesla Revolutionizes Texas Statewide Robotaxi Approval Announced

May 06, 2025