Oil Prices Surge Amidst Unexpected OPEC Quota Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Prices Surge Amidst Unexpected OPEC+ Quota Announcement

Global oil prices have skyrocketed following a shock announcement from OPEC+ regarding production quotas. The unexpected move sent shockwaves through the energy markets, leaving analysts scrambling to assess the long-term implications for consumers and the global economy. Crude oil futures experienced their most significant single-day jump in months, raising concerns about inflation and potential economic slowdown.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+), a powerful cartel controlling a significant portion of global oil supply, announced a surprise cut in production quotas, effective immediately. This decision, taken during a virtual meeting, caught many market watchers off guard, as many had anticipated a continuation of the current production levels or even a slight increase. The scale of the cut is substantial, exceeding initial market expectations, and represents a significant tightening of the global oil supply.

OPEC+'s Justification and Market Reaction

OPEC+ cited concerns about global economic uncertainty and weakening demand as the primary justification for its decision. However, analysts remain skeptical, pointing to the significant price increases that immediately followed the announcement as evidence of a strategic move to bolster oil prices and increase revenue for member nations.

The market reacted swiftly and dramatically. Benchmark Brent crude prices surged by over 5%, reaching their highest levels in several months. West Texas Intermediate (WTI) crude, the US benchmark, also saw a significant price jump, reflecting the global impact of the OPEC+ decision. This price surge is likely to have wide-ranging consequences, impacting everything from gasoline prices at the pump to the cost of air travel and shipping.

Impact on Consumers and the Global Economy

The immediate impact of the OPEC+ decision is already being felt by consumers. Gas prices are expected to rise significantly in the coming weeks, potentially exacerbating existing inflationary pressures. This could lead to a decrease in consumer spending and a slowdown in economic growth, particularly in countries heavily reliant on imported oil.

- Higher Transportation Costs: Increased fuel prices will drive up the cost of transportation for goods and services, impacting supply chains and potentially leading to higher prices for consumers.

- Inflationary Pressures: The rise in oil prices will contribute to broader inflationary pressures, potentially forcing central banks to maintain or even increase interest rates to combat rising prices.

- Geopolitical Implications: The OPEC+ decision highlights the continuing geopolitical influence of oil-producing nations and the vulnerability of the global economy to supply disruptions.

What Happens Next?

The long-term consequences of the OPEC+ decision remain uncertain. Analysts are closely monitoring the situation, trying to assess the extent of the price increase and its impact on global economic growth. The response from major consuming nations will be crucial in determining the future trajectory of oil prices. Some countries may consider releasing strategic petroleum reserves to mitigate the impact of the price increase, while others may face difficult choices between economic growth and controlling inflation. The coming weeks and months will be critical in determining the full ramifications of this unexpected OPEC+ announcement. Stay tuned for further updates as this rapidly evolving situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Prices Surge Amidst Unexpected OPEC Quota Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Injury Update Cavaliers Lose Key Players Garland Mobley And Hunter For Game 2

May 07, 2025

Injury Update Cavaliers Lose Key Players Garland Mobley And Hunter For Game 2

May 07, 2025 -

Indiana Pacers Shock Cleveland Cavaliers Haliburtons Clutch Shot Secures Win

May 07, 2025

Indiana Pacers Shock Cleveland Cavaliers Haliburtons Clutch Shot Secures Win

May 07, 2025 -

Is Anthony Edwards The Next Steph Curry Killer Analyst Predictions

May 07, 2025

Is Anthony Edwards The Next Steph Curry Killer Analyst Predictions

May 07, 2025 -

Top 10 Career Goal Leaders In Di Mens College Lacrosse A Statistical Overview

May 07, 2025

Top 10 Career Goal Leaders In Di Mens College Lacrosse A Statistical Overview

May 07, 2025 -

2025 Nba Playoffs Complete Game Summary Warriors Vs Timberwolves May 6th

May 07, 2025

2025 Nba Playoffs Complete Game Summary Warriors Vs Timberwolves May 6th

May 07, 2025

Latest Posts

-

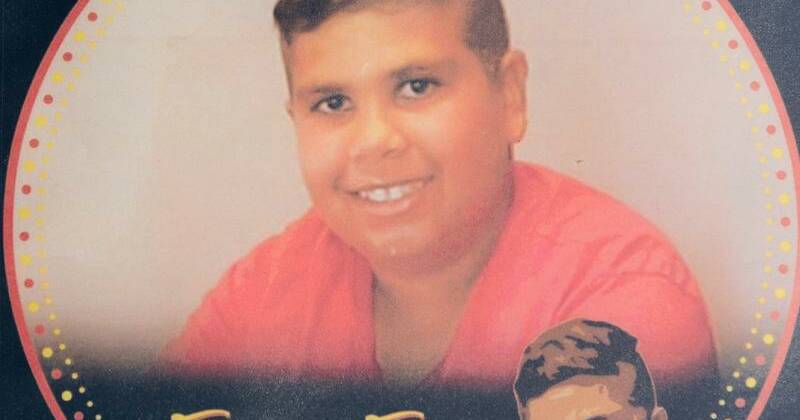

Guilty Verdicts In Trial Of Slain Indigenous Teenager

May 08, 2025

Guilty Verdicts In Trial Of Slain Indigenous Teenager

May 08, 2025 -

Urgent Travel Advisory Taiwan Warns Citizens Against Travel To India Pakistan Border Zone

May 08, 2025

Urgent Travel Advisory Taiwan Warns Citizens Against Travel To India Pakistan Border Zone

May 08, 2025 -

Three Ton Stonehenge Stones A Study Of Potential Source Monuments

May 08, 2025

Three Ton Stonehenge Stones A Study Of Potential Source Monuments

May 08, 2025 -

Denver Nuggets Vs Oklahoma City Thunder Final Score And Game Recap May 7 2025

May 08, 2025

Denver Nuggets Vs Oklahoma City Thunder Final Score And Game Recap May 7 2025

May 08, 2025 -

Behind The Scenes The Making Of Mon Mothmas Defining Andor Speech

May 08, 2025

Behind The Scenes The Making Of Mon Mothmas Defining Andor Speech

May 08, 2025