Oil Prices Surge: US-China Trade Talks Fuel Commodity Market Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Prices Surge: US-China Trade Talks Fuel Commodity Market Rally

Global oil prices experienced a significant jump today, fueled by renewed optimism surrounding US-China trade negotiations. The benchmark Brent crude surged by over 2%, reaching its highest point in several weeks, while West Texas Intermediate (WTI) also saw substantial gains. This dramatic rally isn't isolated; it's part of a broader upswing in the commodity market, reflecting growing confidence in a potential de-escalation of the ongoing trade war.

The positive sentiment stems from reports suggesting that both the US and China are making progress towards a "phase one" trade deal. While no concrete agreement has been finalized, the recent flurry of positive pronouncements from both sides has injected much-needed confidence into global markets, impacting everything from oil and soybeans to metals and agricultural products.

What's Driving the Oil Price Surge?

Several factors are contributing to the current oil price rally:

- Trade War Optimism: The most significant driver is the improved outlook on US-China trade relations. Reduced trade tensions translate to increased global demand for commodities, including oil, as businesses feel more secure about future economic growth.

- OPEC+ Production Cuts: The ongoing production cuts implemented by the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) are continuing to support prices. These cuts are aimed at balancing supply and demand, preventing a potential oil glut.

- Geopolitical Concerns: While trade optimism is the primary driver, lingering geopolitical uncertainties in the Middle East continue to play a supporting role. Concerns about supply disruptions in key oil-producing regions often contribute to price volatility.

- Weakening Dollar: A slightly weaker US dollar also contributes to higher oil prices, as oil is priced in dollars. A weaker dollar makes oil cheaper for buyers using other currencies, boosting demand.

Implications for Consumers and the Global Economy

The surge in oil prices has significant implications for consumers and the global economy. Higher oil prices can lead to increased transportation costs, impacting the prices of goods and services. Inflationary pressures could emerge if the rally is sustained. However, the positive effects of a potential trade deal could outweigh the negative impacts of higher oil prices, boosting overall economic growth.

Looking Ahead: Uncertainty Remains

While the current market sentiment is positive, it's crucial to acknowledge that significant uncertainty remains. The details of a potential US-China trade deal are still being negotiated, and any unforeseen setbacks could quickly reverse the current positive momentum. Furthermore, geopolitical risks and fluctuations in global demand could continue to impact oil prices in the coming weeks and months.

Investors and market analysts will be closely monitoring developments in the US-China trade talks and other geopolitical factors to gauge the long-term trajectory of oil prices. The coming weeks will be critical in determining whether this rally represents a sustained upward trend or a temporary blip in the ongoing volatility of the global commodity market. Stay tuned for further updates as this dynamic situation continues to unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Prices Surge: US-China Trade Talks Fuel Commodity Market Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

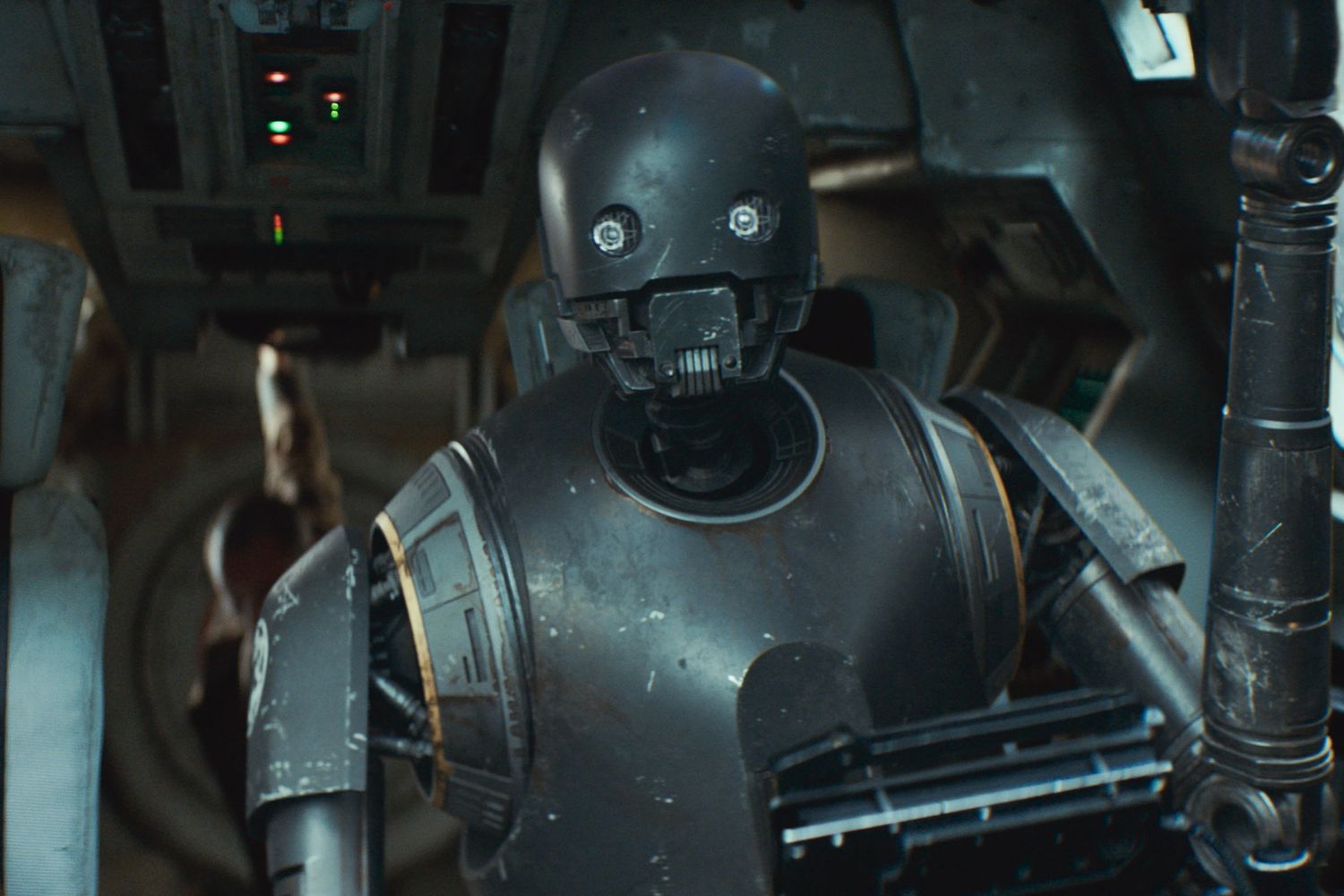

Tony Gilroy On The Andor Episode That Never Was A K 2 So Horror Story

May 09, 2025

Tony Gilroy On The Andor Episode That Never Was A K 2 So Horror Story

May 09, 2025 -

New Whoop Fitness Tracker Features Price And Performance Analysis

May 09, 2025

New Whoop Fitness Tracker Features Price And Performance Analysis

May 09, 2025 -

Swelling Hives And Severe Reactions Prompt Urgent Crisp Packet Recall In Uk

May 09, 2025

Swelling Hives And Severe Reactions Prompt Urgent Crisp Packet Recall In Uk

May 09, 2025 -

Top Secretarys Shock Resignation What We Know

May 09, 2025

Top Secretarys Shock Resignation What We Know

May 09, 2025 -

Collectible Alert Metal Marios Hot Wheels Debut This Summer

May 09, 2025

Collectible Alert Metal Marios Hot Wheels Debut This Summer

May 09, 2025