OKX Hit With $1.2M Malta Fine For AML Violations Following US Penalty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OKX Hit with €1.2 Million Malta Fine for AML Violations Following US Penalty

Crypto exchange OKX is facing further regulatory heat, receiving a hefty €1.2 million fine from the Maltese authorities for anti-money laundering (AML) violations. This penalty follows a separate, though related, action taken by the US Treasury's Office of Foreign Assets Control (OFAC) earlier this year. The combined penalties underscore the increasing scrutiny faced by cryptocurrency exchanges globally and highlight the critical importance of robust AML/KYC (Know Your Customer) compliance programs.

Malta's Financial Intelligence Analysis Unit (FIAU) Takes Action:

The FIAU announced the €1.2 million fine, citing multiple breaches of Malta's AML/CFT (Combating the Financing of Terrorism) regulations. While specific details remain limited, the FIAU's statement emphasizes OKX's failure to adequately implement and maintain effective AML/KYC procedures. This suggests deficiencies in customer due diligence, transaction monitoring, and potentially, suspicious activity reporting. The fine reflects the seriousness of these violations and serves as a warning to other crypto platforms operating within Malta's regulatory framework.

The Connection to the US OFAC Penalty:

The Maltese fine comes on the heels of a significant penalty imposed by the US OFAC. In March 2024, OKX was fined for apparent violations of US sanctions related to dealings with sanctioned entities. While the specifics of the OFAC case remain partially undisclosed, it's clear that both penalties highlight systemic weaknesses in OKX's compliance infrastructure. This suggests a pattern of regulatory non-compliance, extending beyond geographical boundaries.

What This Means for the Crypto Industry:

This dual penalty serves as a stark reminder of the evolving regulatory landscape for cryptocurrency exchanges. Governments worldwide are increasingly focusing on AML/KYC compliance within the crypto space, aiming to curb illicit activities such as money laundering and terrorist financing.

- Increased Regulatory Scrutiny: Expect a rise in enforcement actions against crypto companies that fail to meet rigorous AML/KYC standards.

- Higher Compliance Costs: Exchanges will likely face increasing costs associated with implementing and maintaining robust compliance programs.

- Impact on User Experience: More stringent KYC procedures may impact user onboarding and transaction speeds.

- The Importance of Proactive Compliance: Crypto companies must prioritize proactive compliance strategies to mitigate future regulatory risks.

OKX's Response:

OKX has yet to issue a comprehensive public statement addressing the Maltese fine. However, previous statements regarding the OFAC penalty indicated a commitment to improving their compliance measures. The efficacy of these improvements will be under close scrutiny by both regulators and the wider crypto community.

Looking Ahead:

The combined penalties against OKX represent a significant development in the ongoing effort to regulate the cryptocurrency industry. It underscores the critical need for crypto platforms to prioritize AML/KYC compliance and proactively address regulatory risks. Failure to do so will likely result in hefty fines and potentially more severe consequences. The case sets a precedent for other exchanges, emphasizing the importance of robust, transparent, and globally compliant operational practices. The future of cryptocurrency regulation hinges on the industry's ability to demonstrate its commitment to preventing financial crime.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OKX Hit With $1.2M Malta Fine For AML Violations Following US Penalty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Llama 2 On Workers Ai Metas Powerful Language Model Gets Easier To Use

Apr 07, 2025

Llama 2 On Workers Ai Metas Powerful Language Model Gets Easier To Use

Apr 07, 2025 -

Mid April Deadline Irs Rehires Probationary Employees

Apr 07, 2025

Mid April Deadline Irs Rehires Probationary Employees

Apr 07, 2025 -

Tron Ares Teaser Trailer Hints At A Bleak Ai Driven Future

Apr 07, 2025

Tron Ares Teaser Trailer Hints At A Bleak Ai Driven Future

Apr 07, 2025 -

The Greens Gambit Challenging Unfair Stadium Rules

Apr 07, 2025

The Greens Gambit Challenging Unfair Stadium Rules

Apr 07, 2025 -

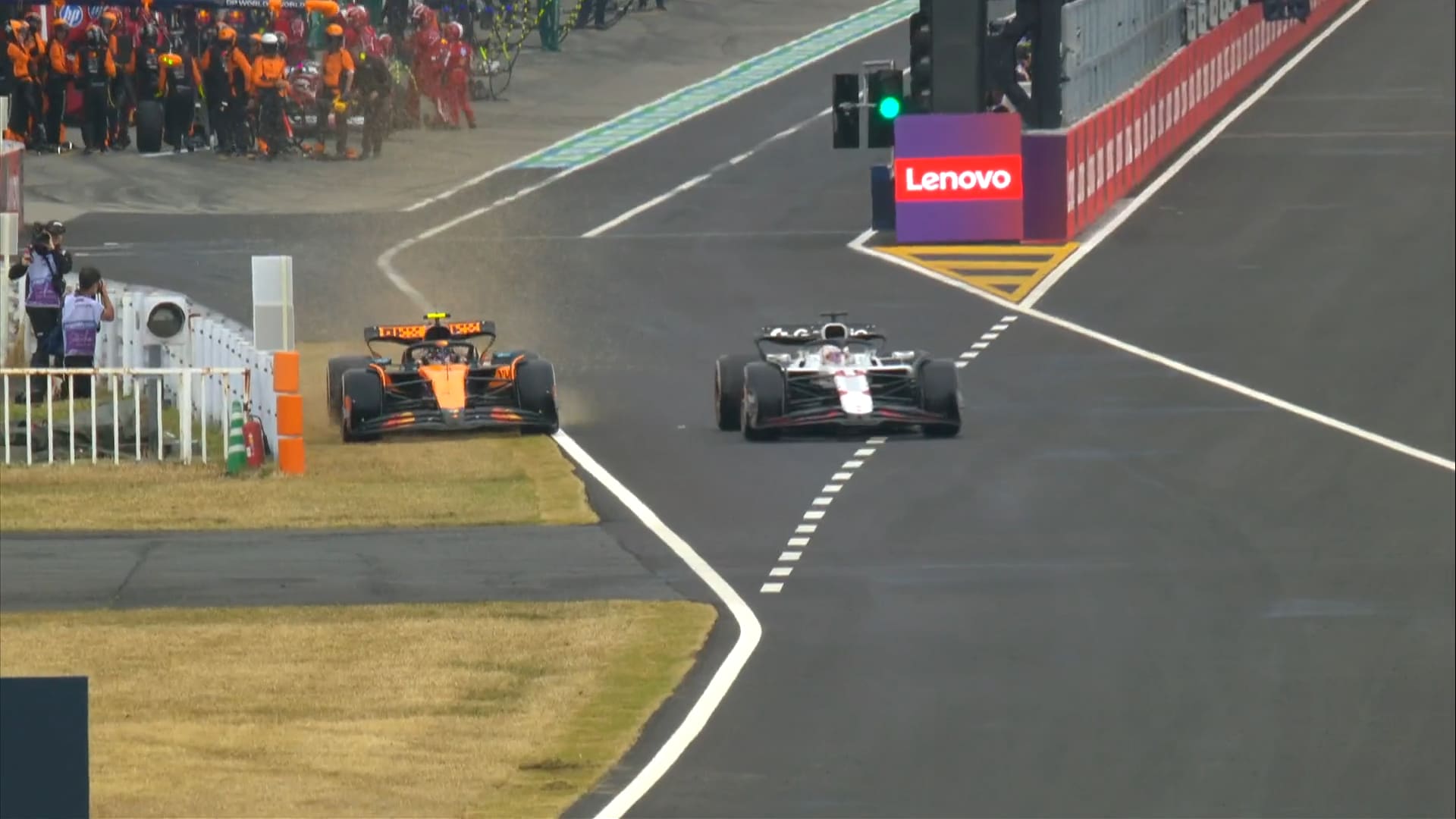

Live 2025 Japanese Grand Prix F1 Race Coverage And Results

Apr 07, 2025

Live 2025 Japanese Grand Prix F1 Race Coverage And Results

Apr 07, 2025