On-Chain Data Confirms Bitcoin Bull Market Resurgence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

On-Chain Data Confirms Bitcoin Bull Market Resurgence: Is This the Start of a New Cycle?

Bitcoin's price action has been making headlines, but is it truly a bull market resurgence, or just another fleeting pump? The answer, according to recent on-chain data analysis, is pointing towards a significant shift in market sentiment and a potential sustained upward trend. This isn't just speculation; concrete metrics are painting a compelling picture of renewed bullish activity.

Key On-Chain Indicators Pointing Towards a Bull Run:

Several key on-chain metrics are converging to suggest a powerful narrative of Bitcoin's resurgence. These indicators, often favored by seasoned crypto investors, provide a more nuanced understanding of market health than simply looking at price alone. Let's examine some of the most compelling evidence:

-

Increased Network Activity: Transaction volumes and active addresses are significantly higher than previously seen in the recent bear market period. This suggests increased investor participation and confidence in the asset. A surge in on-chain activity often precedes significant price increases, indicating a growing demand and adoption of Bitcoin.

-

Accumulation by Large Holders: Data reveals whales and large institutional investors are actively accumulating Bitcoin. This accumulation, often considered a bullish signal, points towards a belief that the price will rise significantly in the future. Their strategic buying behavior is a strong indicator of confidence in the long-term outlook.

-

Reduced Selling Pressure: The number of Bitcoin being sold at a loss has decreased substantially. This indicates a growing conviction among holders, reducing the likelihood of a sudden price crash. Less selling pressure equates to stronger price support.

-

Rising Miner Revenue: Bitcoin miners, often early adopters and strong indicators of market sentiment, are seeing an increase in their revenue. This suggests a healthy network and strong demand for the asset.

What Does This Mean for Investors?

The confluence of these positive on-chain signals suggests a significant shift in the Bitcoin market. However, it's crucial to remember that no indicator is foolproof, and market volatility remains a defining characteristic of cryptocurrencies.

While this data paints a bullish picture, it's vital for investors to remain cautious and manage risk appropriately. A diversified portfolio and a thorough understanding of personal risk tolerance remain crucial.

The Future of Bitcoin's Bull Market:

The question remains: how long will this bull market last? While on-chain data provides strong evidence for a resurgence, several external factors could influence the market's trajectory. Macroeconomic conditions, regulatory changes, and overall investor sentiment all play a role.

Staying Informed is Key:

Keeping a close eye on on-chain metrics, along with broader market news, is essential for navigating the ever-changing landscape of the Bitcoin market. Regularly consulting reputable sources and understanding the nuances of on-chain analysis will empower investors to make informed decisions. This resurgence confirms the inherent volatility, but the data strongly suggests a renewed period of bullish activity for Bitcoin. The future of Bitcoin's price remains uncertain, but the current on-chain data paints a compelling picture of a significant upward trend.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on On-Chain Data Confirms Bitcoin Bull Market Resurgence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nick Jonass Met Gala Antics Did Priyanka Chopras Hat Steal The Show

May 16, 2025

Nick Jonass Met Gala Antics Did Priyanka Chopras Hat Steal The Show

May 16, 2025 -

Amphibious Warfare Takes Center Stage Uks Appointment Of A Marine To Lead The Navy Challenges China

May 16, 2025

Amphibious Warfare Takes Center Stage Uks Appointment Of A Marine To Lead The Navy Challenges China

May 16, 2025 -

Erin Andrews Leaves Fox The Story Behind Her Unexpected Move With Tom Brady

May 16, 2025

Erin Andrews Leaves Fox The Story Behind Her Unexpected Move With Tom Brady

May 16, 2025 -

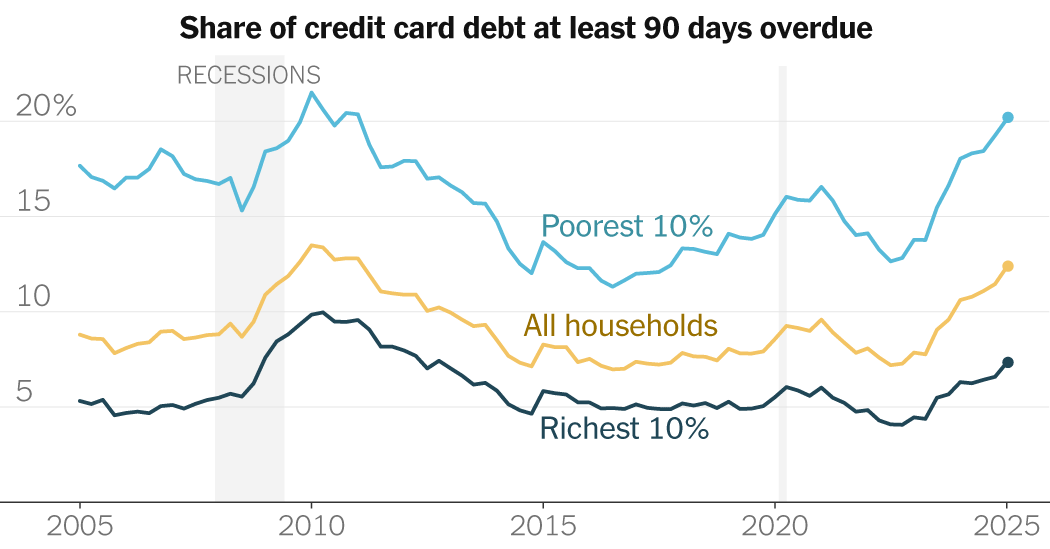

Trumps Tariffs Are Consumers Feeling The Pinch

May 16, 2025

Trumps Tariffs Are Consumers Feeling The Pinch

May 16, 2025 -

Toyotas All Electric C Hr A Compact Suv Heads To Us Markets

May 16, 2025

Toyotas All Electric C Hr A Compact Suv Heads To Us Markets

May 16, 2025