On-Chain Evidence Reveals How Tether's USDT Compliance Issues Facilitate Crime

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

On-Chain Evidence Reveals How Tether's USDT Compliance Issues Facilitate Crime

Tether's USDT, a leading stablecoin, faces renewed scrutiny as on-chain analysis exposes potential links to illicit activities. Concerns over its compliance practices are raising alarm bells within the cryptocurrency community and regulatory bodies alike.

The cryptocurrency market, known for its volatility and anonymity, is increasingly under the microscope. While offering potential benefits like borderless transactions and decentralized finance (DeFi), it also serves as a fertile ground for illegal activities. A recent surge in on-chain analysis has brought renewed attention to Tether (USDT), the world’s largest stablecoin, and its potential role in facilitating crime. This article delves into the findings and explores the implications for the future of cryptocurrency regulation.

The Growing Concerns Around Tether's USDT

Tether, pegged to the US dollar, promises stability in the turbulent crypto world. However, its reserves and compliance practices have been under intense scrutiny for years. Critics question the transparency of its backing, raising concerns about its ability to maintain its $1 peg during periods of market stress. This lack of transparency, coupled with evidence of its use in various illicit activities, is raising significant red flags.

On-Chain Analysis: Unveiling the Links to Crime

Researchers and analysts are increasingly using blockchain analysis to uncover suspicious activities. Recent investigations have identified instances where large volumes of USDT were traced to known money laundering operations, ransomware attacks, and other criminal enterprises. The anonymity offered by cryptocurrencies, combined with the perceived lack of robust oversight of USDT, makes it an attractive tool for criminals.

- Money Laundering: The ease with which USDT can be transferred across borders and exchanged for other cryptocurrencies makes it a prime vehicle for money laundering. On-chain data has revealed complex transactions designed to obscure the origin and destination of funds.

- Ransomware Attacks: Ransomware gangs are increasingly demanding payment in cryptocurrencies, with USDT being a popular choice due to its perceived stability and liquidity. Tracing the flow of USDT following ransomware attacks has provided compelling evidence of its use in facilitating these criminal activities.

- Sanctions Evasion: The decentralized nature of cryptocurrencies and the relative lack of regulation in some jurisdictions make it challenging to enforce sanctions. USDT's use in jurisdictions with weak anti-money laundering (AML) and know-your-customer (KYC) regulations raises concerns about its potential for sanctions evasion.

The Regulatory Response and Future Implications

The findings from on-chain analysis are pushing regulators to take a closer look at stablecoins and their role in the broader cryptocurrency ecosystem. Increased scrutiny of Tether's compliance practices is inevitable, and stricter regulations are likely to follow. This includes enhanced AML/KYC procedures, greater transparency regarding reserve holdings, and potentially even limitations on the use of USDT in certain transactions.

What Does This Mean for the Future of Cryptocurrency?

The ongoing investigation into Tether's USDT highlights the critical need for greater transparency and regulation within the cryptocurrency space. While blockchain technology offers transformative potential, its inherent anonymity can be exploited by criminals. The future of cryptocurrency likely hinges on striking a balance between fostering innovation and preventing its misuse for illicit activities. Strengthening compliance frameworks, enhancing transparency, and implementing robust AML/KYC measures are essential steps in building a more secure and trustworthy cryptocurrency ecosystem. The continued use of on-chain analysis will be crucial in uncovering and preventing future abuses. The implications for both the cryptocurrency market and regulatory bodies are profound, and the coming years will likely see significant developments in this area.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on On-Chain Evidence Reveals How Tether's USDT Compliance Issues Facilitate Crime. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stanley Cup Playoffs Golden Knights Offensive Drought Ends Season

May 16, 2025

Stanley Cup Playoffs Golden Knights Offensive Drought Ends Season

May 16, 2025 -

Rio Grande Do Sul Gerdau Suspende Atividades Apos Desastres Naturais

May 16, 2025

Rio Grande Do Sul Gerdau Suspende Atividades Apos Desastres Naturais

May 16, 2025 -

Beyond Fox Erin Andrews Bold New Collaboration With Tom Brady Explained

May 16, 2025

Beyond Fox Erin Andrews Bold New Collaboration With Tom Brady Explained

May 16, 2025 -

A New Chapter In Politics Election Sequel With Payne And Witherspoon

May 16, 2025

A New Chapter In Politics Election Sequel With Payne And Witherspoon

May 16, 2025 -

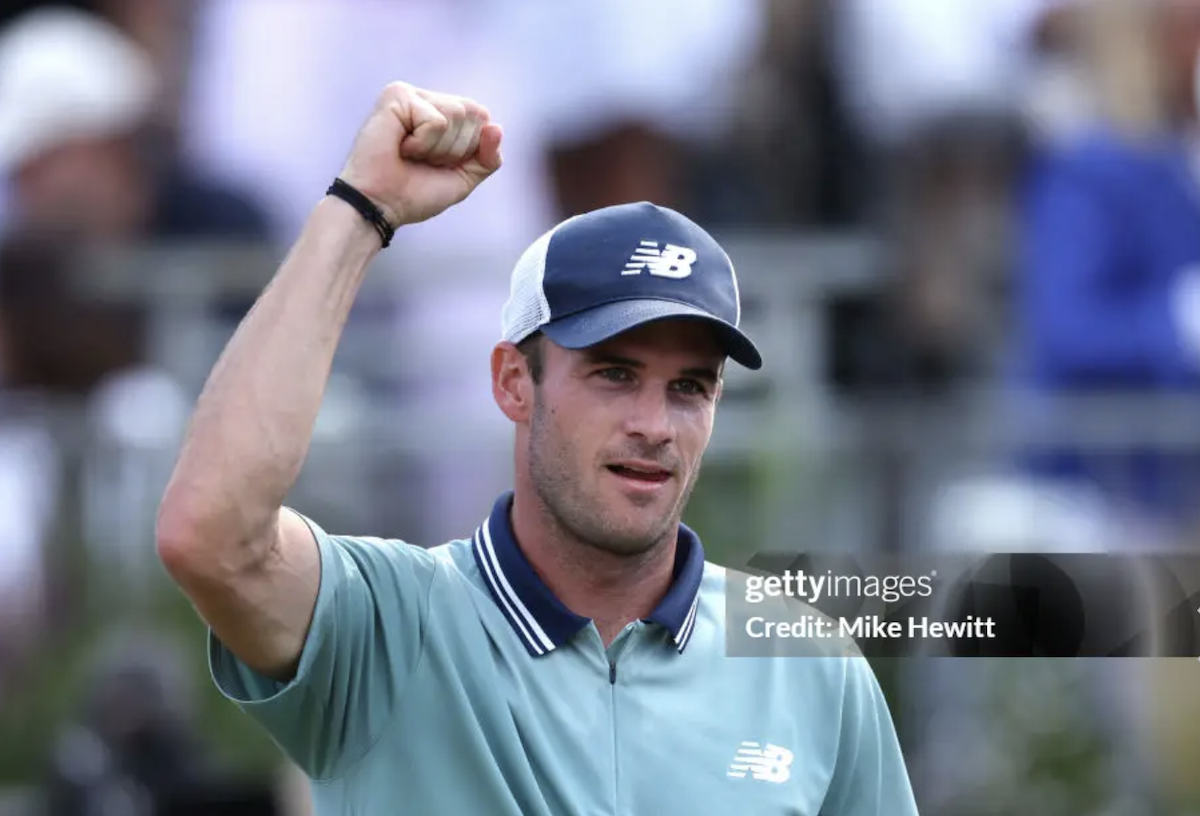

Can Paul Upset Hurkacz Rome Qf Match Preview

May 16, 2025

Can Paul Upset Hurkacz Rome Qf Match Preview

May 16, 2025