OPEC+ Decision Sends Shockwaves Through Oil Market: Prices Plunge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OPEC+ Decision Sends Shockwaves Through Oil Market: Prices Plunge

The global oil market experienced a dramatic downturn today following a surprise announcement from OPEC+ that sent shockwaves across financial markets. The decision, widely viewed as unexpectedly aggressive, has resulted in a significant plunge in oil prices, leaving investors reeling and analysts scrambling to assess the long-term implications.

Unexpected Production Increase Defies Expectations

OPEC+, the alliance of the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, announced a substantial increase in oil production for November. This move directly contradicts the prevailing market sentiment and forecasts which predicted a production decrease or, at best, maintenance of current levels. The unexpected surge in supply has thrown a wrench into the carefully balanced equation of global oil demand and supply, triggering a sharp price correction.

Oil Prices Plummet: A Market in Freefall?

The immediate aftermath of the announcement saw a dramatic freefall in oil prices. Benchmark Brent crude futures plummeted by over [Insert Percentage]% to [Insert Price per barrel], while West Texas Intermediate (WTI) crude futures experienced a similar sharp decline to [Insert Price per barrel]. This represents the [Insert Description: e.g., largest single-day drop in months/years] and has sparked concerns about potential further price volatility.

Analyzing the OPEC+ Decision: Motivations and Implications

The motivations behind OPEC+'s decision remain a subject of intense debate among analysts. Several theories are circulating:

- Increased Supply to Curb Inflation: Some argue that the decision aims to alleviate inflationary pressures by increasing the availability of oil, thereby lowering prices for consumers.

- Pressure from Major Consumers: The move might be a response to pressure from major oil-consuming nations urging increased production to stabilize energy markets and mitigate the ongoing energy crisis.

- Internal Disagreements Within OPEC+: Another theory suggests internal disagreements within the OPEC+ alliance itself might have contributed to this surprising decision.

Regardless of the underlying reasons, the implications are clear:

- Lower Gasoline Prices (Potentially): Consumers could potentially see a reduction in gasoline prices in the coming weeks and months. However, the extent of price decreases will depend on various factors, including refining capacity and distribution costs.

- Impact on Oil-Producing Nations: Oil-producing nations, particularly those heavily reliant on oil revenues, could face significant economic challenges as a result of lower oil prices.

- Uncertainty for Energy Investments: The volatility in the oil market creates uncertainty for energy companies planning future investments in exploration and production.

Looking Ahead: Market Volatility and Uncertainty

The immediate future of the oil market remains uncertain. While the price drop offers some relief to consumers, it also introduces significant risks for businesses and governments. Analysts predict continued market volatility in the coming weeks, with the potential for further price swings depending on global demand, geopolitical events, and any future decisions by OPEC+. The situation warrants close monitoring, and investors are advised to exercise caution.

Keywords: OPEC+, oil prices, oil market, crude oil, Brent crude, WTI crude, oil production, energy crisis, inflation, gasoline prices, energy investment, market volatility, geopolitical risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OPEC+ Decision Sends Shockwaves Through Oil Market: Prices Plunge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

9 3 Victory For Mets Over Cardinals Key Moments And Player Performances May 2 2025

May 06, 2025

9 3 Victory For Mets Over Cardinals Key Moments And Player Performances May 2 2025

May 06, 2025 -

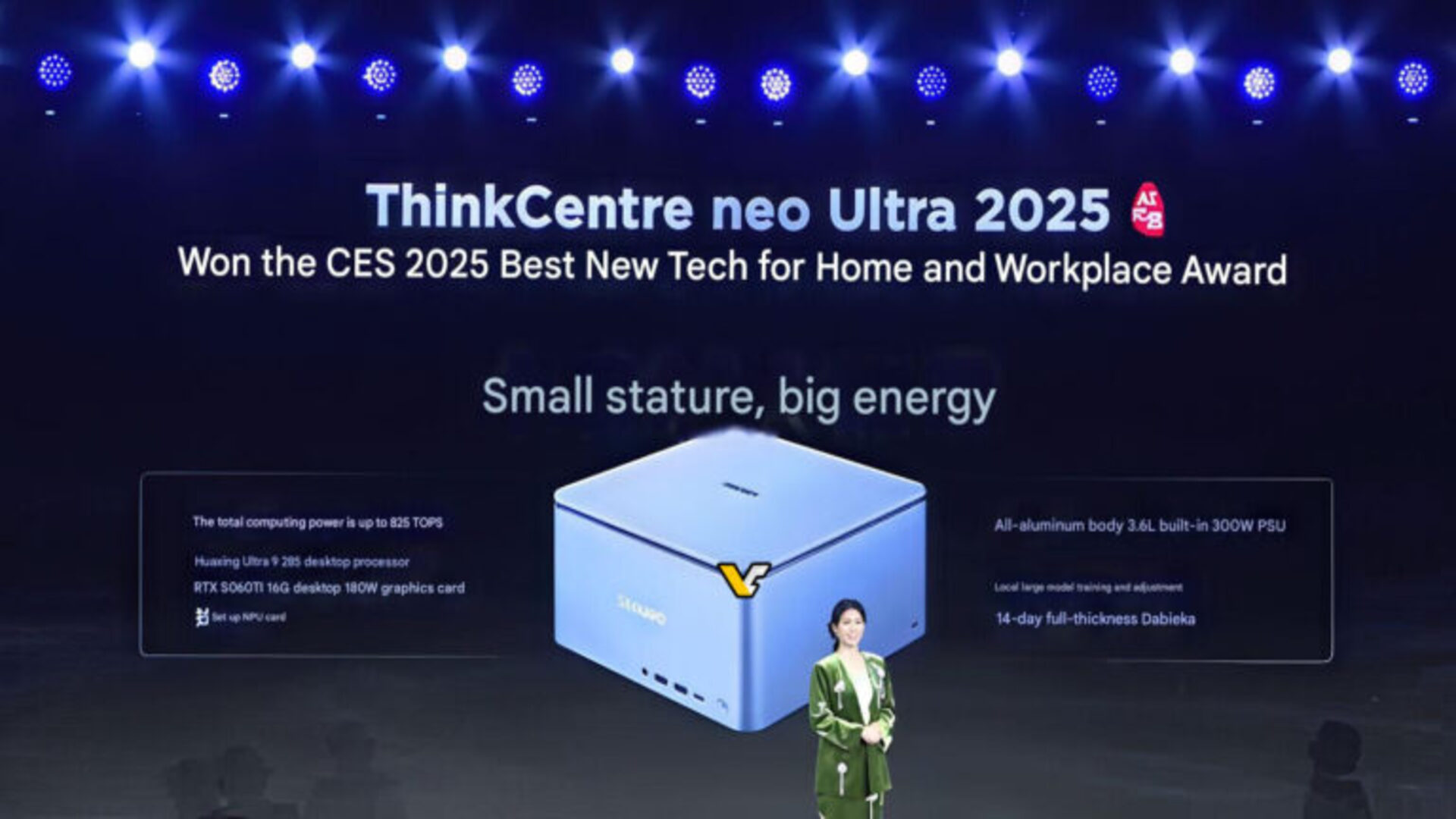

Ge Force Rtx 5060 Ti And High End Intel Cpu Lenovos Answer To The Mac Studio

May 06, 2025

Ge Force Rtx 5060 Ti And High End Intel Cpu Lenovos Answer To The Mac Studio

May 06, 2025 -

Tech Titans Clash Altman And Musks Pursuit Of The Perfect Everything App

May 06, 2025

Tech Titans Clash Altman And Musks Pursuit Of The Perfect Everything App

May 06, 2025 -

Impact Of Chinese Tourist Visa Abuse On Malaysian Small Businesses

May 06, 2025

Impact Of Chinese Tourist Visa Abuse On Malaysian Small Businesses

May 06, 2025 -

Gigabyte Aorus Master 16 A Powerful Gaming Laptop But Is It Too Loud

May 06, 2025

Gigabyte Aorus Master 16 A Powerful Gaming Laptop But Is It Too Loud

May 06, 2025

Latest Posts

-

Krakens Sting Operation Unmasking North Korean State Sponsored Hackers

May 07, 2025

Krakens Sting Operation Unmasking North Korean State Sponsored Hackers

May 07, 2025 -

Nyt Wordle May 5th Solution And Helpful Hints For Puzzle 1416

May 07, 2025

Nyt Wordle May 5th Solution And Helpful Hints For Puzzle 1416

May 07, 2025 -

Giants Dominate Rockies In 9 3 Victory Mlb Gameday Highlights

May 07, 2025

Giants Dominate Rockies In 9 3 Victory Mlb Gameday Highlights

May 07, 2025 -

Lost Soviet Spacecraft Set For Earths Atmospheric Re Entry

May 07, 2025

Lost Soviet Spacecraft Set For Earths Atmospheric Re Entry

May 07, 2025 -

Sister Wives Janelle Brown Garrisons Last Moments Before Tragic Death

May 07, 2025

Sister Wives Janelle Brown Garrisons Last Moments Before Tragic Death

May 07, 2025