OPEC Production Cuts Fail To Dampen Oil Prices: A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

OPEC Production Cuts Fail to Dampen Oil Prices: A Market Analysis

Oil prices remain stubbornly high despite OPEC+'s recent decision to slash production, leaving analysts scrambling to understand the market's resilience. The move, announced in April, aimed to bolster prices by reducing global supply. However, the market has reacted surprisingly, with crude oil prices continuing their upward trajectory, defying expectations and raising crucial questions about the future of the energy market.

This unexpected development highlights the complex interplay of factors influencing oil prices, extending beyond simple supply and demand dynamics. Let's delve into the key elements driving this perplexing market behavior.

The Unexpected Resilience of Oil Prices: Why the Cuts Aren't Working as Planned

OPEC+, the alliance of oil-producing nations, had hoped that production cuts of around 1.66 million barrels per day would significantly tighten the market and drive prices higher. Their reasoning centered on the assumption that reduced supply would outweigh increased demand, leading to a price surge. However, several factors have undermined this strategy:

-

Strong Global Demand: Despite economic headwinds in certain regions, global oil demand remains robust. The ongoing recovery in China, the world's largest oil importer, is a major contributing factor. Increased travel and industrial activity continue to fuel demand, offsetting the impact of production cuts.

-

Geopolitical Uncertainty: The ongoing war in Ukraine continues to inject volatility into the energy market. Concerns about supply disruptions from this region, coupled with broader geopolitical tensions, keep investors wary and contribute to price hikes. This uncertainty acts as a powerful price driver, overriding the impact of OPEC+'s actions.

-

Underinvestment in Oil Production: Years of underinvestment in new oil and gas projects have limited the industry's capacity to quickly respond to increased demand. This structural issue contributes to a tighter market, even with the production cuts, leaving prices vulnerable to upward pressure.

-

Speculative Trading: Market speculation plays a significant role in oil price fluctuations. Traders' expectations and their response to geopolitical events and economic indicators can amplify price movements, regardless of the actual supply and demand balance.

What Does the Future Hold for Oil Prices?

Predicting future oil prices is notoriously difficult, given the interplay of these numerous complex factors. However, several analysts predict that prices will remain elevated in the near term. The ongoing geopolitical instability, coupled with strong demand and limited supply capacity, suggests that a significant price correction is unlikely in the short term.

Looking Ahead: The market's reaction to OPEC+'s production cuts underscores the limitations of supply-side interventions in a globalized market characterized by complex dynamics. The focus is now shifting to understanding the long-term implications of underinvestment in oil production and the evolving global energy landscape. Investors and policymakers alike will be closely watching the interplay of demand, geopolitical factors, and speculative trading to anticipate future price movements. The resilience of oil prices in the face of production cuts offers a compelling case study in the unpredictable nature of global commodity markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on OPEC Production Cuts Fail To Dampen Oil Prices: A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Black Dandyism Its Historical Roots And Contemporary Manifestations

May 07, 2025

Black Dandyism Its Historical Roots And Contemporary Manifestations

May 07, 2025 -

First Of Its Kind Mass Production Begins For Outdoor Hip Motion Exoskeletons

May 07, 2025

First Of Its Kind Mass Production Begins For Outdoor Hip Motion Exoskeletons

May 07, 2025 -

Eu Cloud Data Strategy Decentralizations Growing Importance

May 07, 2025

Eu Cloud Data Strategy Decentralizations Growing Importance

May 07, 2025 -

Sucessor De Buffett Greg Abel A Liderar Os Investimentos Da Berkshire Hathaway

May 07, 2025

Sucessor De Buffett Greg Abel A Liderar Os Investimentos Da Berkshire Hathaway

May 07, 2025 -

Black Family Travel Motivations And Impacts Of This Emerging Trend

May 07, 2025

Black Family Travel Motivations And Impacts Of This Emerging Trend

May 07, 2025

Latest Posts

-

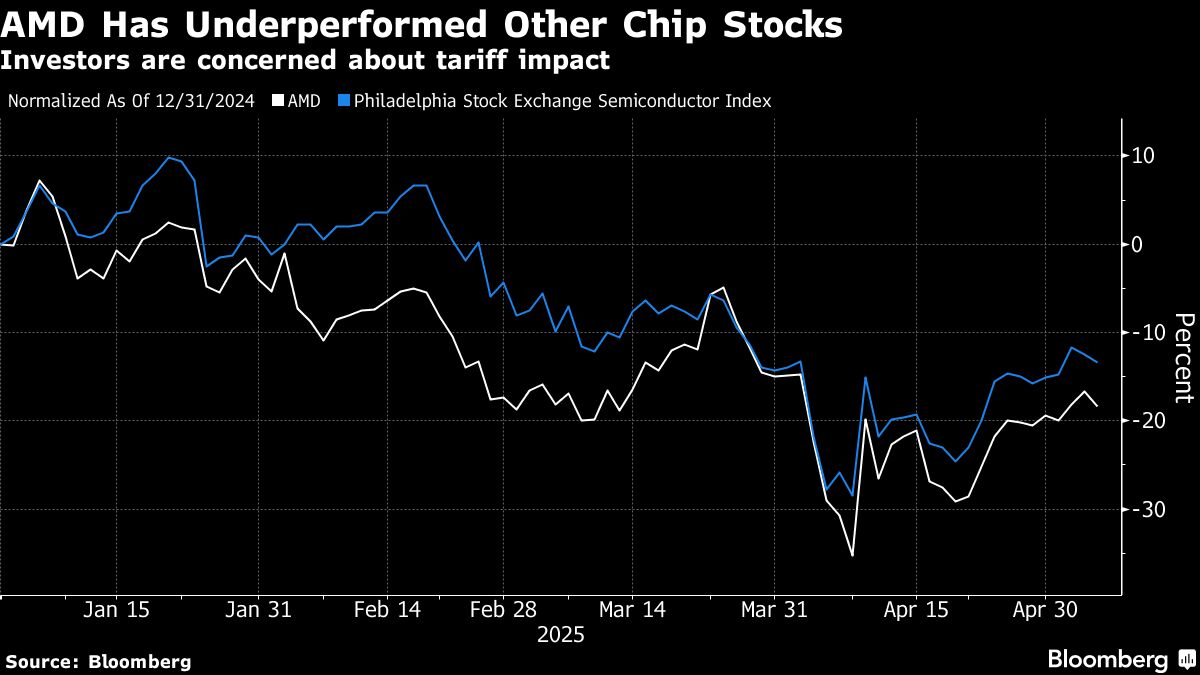

Amds Positive Sales Forecast Navigating The Challenges In China

May 08, 2025

Amds Positive Sales Forecast Navigating The Challenges In China

May 08, 2025 -

Bear Market Bites Arbitrum Arb 10 Fall Raises All Time Low Concerns

May 08, 2025

Bear Market Bites Arbitrum Arb 10 Fall Raises All Time Low Concerns

May 08, 2025 -

Comparing The Karate Kid Films Why The 2010 Version Wins

May 08, 2025

Comparing The Karate Kid Films Why The 2010 Version Wins

May 08, 2025 -

Uk Tightens Student Visa Process Nigerians Pakistanis And Sri Lankans Affected

May 08, 2025

Uk Tightens Student Visa Process Nigerians Pakistanis And Sri Lankans Affected

May 08, 2025 -

Political Pressure Mounts As Xrp Settlement Hopes Fade Bitcoin Update

May 08, 2025

Political Pressure Mounts As Xrp Settlement Hopes Fade Bitcoin Update

May 08, 2025