Oracle Of Omaha's Apple Move: 13% Stake Reduction Detailed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oracle of Omaha's Apple Move: A 13% Stake Reduction Detailed

Warren Buffett's Berkshire Hathaway sheds significant Apple holdings, sparking market speculation.

The investment world is buzzing after Berkshire Hathaway, the investment conglomerate led by the legendary Warren Buffett, revealed a significant reduction in its Apple stake. The Oracle of Omaha's move, a decrease of approximately 13%, has sent ripples through the market, prompting analysts to dissect the reasons behind this strategic shift. This detailed analysis explores the implications of this substantial sale and what it could mean for both Berkshire Hathaway and Apple's future.

A $29 Billion Sell-Off: The Numbers Behind the Headlines

Berkshire Hathaway's recent 13% reduction in its Apple holdings represents a substantial divestment, estimated to be around $29 billion. This isn't a minor adjustment; it's a bold move from an investor known for his long-term, buy-and-hold strategy. The exact timing and specifics of the sales remain somewhat opaque, typical of Berkshire's relatively private investment practices. However, SEC filings confirmed the significant reduction, sparking immediate market reaction.

Why the Change? Deciphering Buffett's Strategy

While Buffett himself hasn't offered a definitive explanation, several theories are circulating among financial experts. These include:

-

Portfolio Diversification: Buffett's long-standing strategy involves diversifying across various sectors. This significant Apple reduction might signal a reallocation of capital into other promising investment opportunities. Berkshire Hathaway may be looking to capitalize on emerging technologies or other undervalued assets.

-

Market Timing: While less characteristic of Buffett's long-term approach, some analysts suggest the move reflects a strategic assessment of the current market conditions. A potential economic downturn or concerns about Apple's future growth could have influenced this decision.

-

Profit-Taking: With Apple stock performing strongly over the years, a portion of the sale could simply represent strategic profit-taking. Locking in substantial gains allows Berkshire Hathaway to reinvest those funds elsewhere.

-

Risk Management: Reducing exposure to a single, albeit highly successful, stock is a fundamental aspect of risk management. Diversification minimizes the impact of potential downturns in any specific sector.

Implications for Apple and Berkshire Hathaway

This significant sell-off undeniably impacts both companies. For Apple, it signifies a decrease in institutional investor confidence, although the impact on the stock price remains to be fully seen. The scale of the sale, however, is unlikely to significantly alter Apple's overall market standing.

For Berkshire Hathaway, the move reflects an ongoing evolution of its investment strategy. While Apple remains a substantial holding, this reduction shows a willingness to adapt and adjust its portfolio based on market dynamics and long-term strategic goals.

Looking Ahead: What's Next for the Oracle of Omaha?

The market awaits further clarity on Berkshire Hathaway's future investment plans. Will we see more significant divestments? Or will this Apple sale mark a temporary shift before a return to the company's characteristic long-term holding strategy? Only time will tell. However, one thing is certain: the Oracle of Omaha’s moves will continue to be closely scrutinized by investors worldwide. The reduction in Apple shares undoubtedly represents a notable chapter in Berkshire Hathaway’s investment history and will continue to fuel discussions and analysis within the financial community. This development reinforces the dynamic and ever-evolving nature of the investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oracle Of Omaha's Apple Move: 13% Stake Reduction Detailed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stephen A Smith On Okc Thunder Western Conference Finals And Championship Chances

May 23, 2025

Stephen A Smith On Okc Thunder Western Conference Finals And Championship Chances

May 23, 2025 -

Nba Playoffs Betting Odds Minnesotas Series Win Ends 19 Year Drought

May 23, 2025

Nba Playoffs Betting Odds Minnesotas Series Win Ends 19 Year Drought

May 23, 2025 -

Confirmed Elle Fanning And More Join The Cast Of Upcoming Hunger Games Prequel

May 23, 2025

Confirmed Elle Fanning And More Join The Cast Of Upcoming Hunger Games Prequel

May 23, 2025 -

Last Ipl Final In June A Comprehensive Look At Tournament Dates

May 23, 2025

Last Ipl Final In June A Comprehensive Look At Tournament Dates

May 23, 2025 -

Lynx 89 75 Victory Game Recap From May 18 2025

May 23, 2025

Lynx 89 75 Victory Game Recap From May 18 2025

May 23, 2025

Latest Posts

-

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

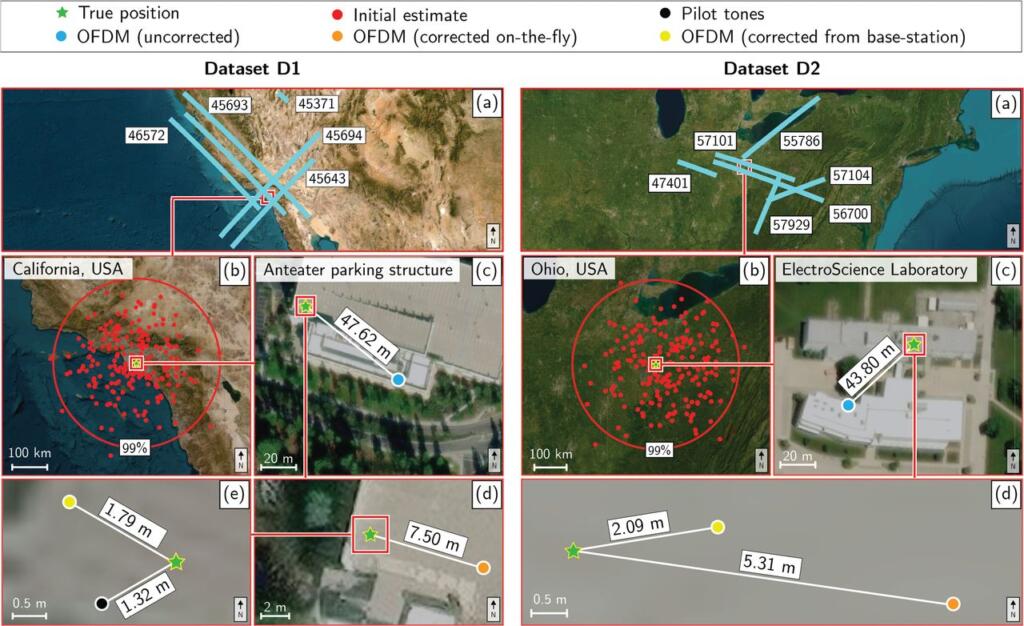

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025 -

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025