Outdated Crypto Tax Laws: How 2014 Regulations Fail Modern Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Outdated Crypto Tax Laws: How 2014 Regulations Fail Modern Investors

The cryptocurrency market has exploded since its inception, evolving from a niche interest to a global phenomenon impacting millions. Yet, the tax laws governing this digital asset landscape remain largely stuck in the past, specifically clinging to outdated regulations from 2014 that are ill-equipped to handle the complexities of modern crypto investing. This disconnect creates significant challenges for investors and necessitates urgent reform.

The 2014 IRS Guidance: A Foundation Built on Sand

In 2014, the IRS issued guidance classifying Bitcoin and other cryptocurrencies as "property" for tax purposes. While seemingly straightforward, this classification fails to account for the nuanced nature of modern crypto transactions. This outdated framework struggles to address the intricacies of:

-

Staking and Lending: The rise of decentralized finance (DeFi) has introduced staking and lending protocols, generating passive income in the form of rewards. The 2014 guidelines offer little clarity on how to properly tax these yields, leading to potential discrepancies and increased audit risk for investors.

-

NFT Transactions: Non-Fungible Tokens (NFTs) represent a burgeoning market with unique tax implications. Are NFTs considered collectibles, investments, or something else entirely? The lack of specific guidance leaves investors grappling with uncertainty and potential tax liabilities.

-

DeFi Yield Farming: The complex nature of DeFi yield farming, involving multiple transactions and various tokens, presents a significant challenge for accurate tax reporting. The current regulations are simply insufficient to capture the multifaceted nature of these activities.

The Consequences of Antiquated Regulations

The mismatch between the dynamic crypto market and the static 2014 tax framework leads to several significant problems:

-

Increased Compliance Burden: Navigating the complexities of crypto taxation requires specialized knowledge and often necessitates hiring expensive tax professionals, placing an undue burden on individual investors.

-

Uncertainty and Risk: The lack of clear guidance fosters uncertainty, increasing the risk of unintentional non-compliance and potential penalties. Investors are left to interpret ambiguous rules, leading to inconsistent reporting and potential legal issues.

-

Hindered Innovation: The current regulatory ambiguity discourages wider adoption and innovation within the crypto space. Uncertainty surrounding taxation creates a barrier to entry for both individual investors and businesses operating in the crypto ecosystem.

The Urgent Need for Modernized Crypto Tax Laws

It's clear that the current crypto tax framework is unsustainable. The rapid evolution of the cryptocurrency landscape demands a comprehensive overhaul of the 2014 regulations. Lawmakers need to:

-

Develop Clearer Guidelines: Provide specific guidance on how to tax various crypto activities, including staking, lending, NFT transactions, and DeFi yield farming.

-

Streamline Reporting Processes: Simplify the tax reporting process for crypto transactions, potentially through the development of specialized tax software or integration with existing tax platforms.

-

Promote Education and Awareness: Increase public awareness of crypto tax regulations through educational campaigns and resources, empowering investors to make informed decisions.

Looking Ahead: A Call for Action

The outdated crypto tax laws are not only causing headaches for investors but also hindering the growth and development of the entire cryptocurrency industry. A swift and comprehensive reform is crucial to fostering a fair, transparent, and thriving crypto ecosystem. Without decisive action from lawmakers, the current situation will continue to create unnecessary complexity, risk, and ultimately, stifle innovation in a rapidly evolving market. The future of crypto taxation depends on bridging this gap between antiquated regulations and the dynamic reality of the modern crypto landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Outdated Crypto Tax Laws: How 2014 Regulations Fail Modern Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

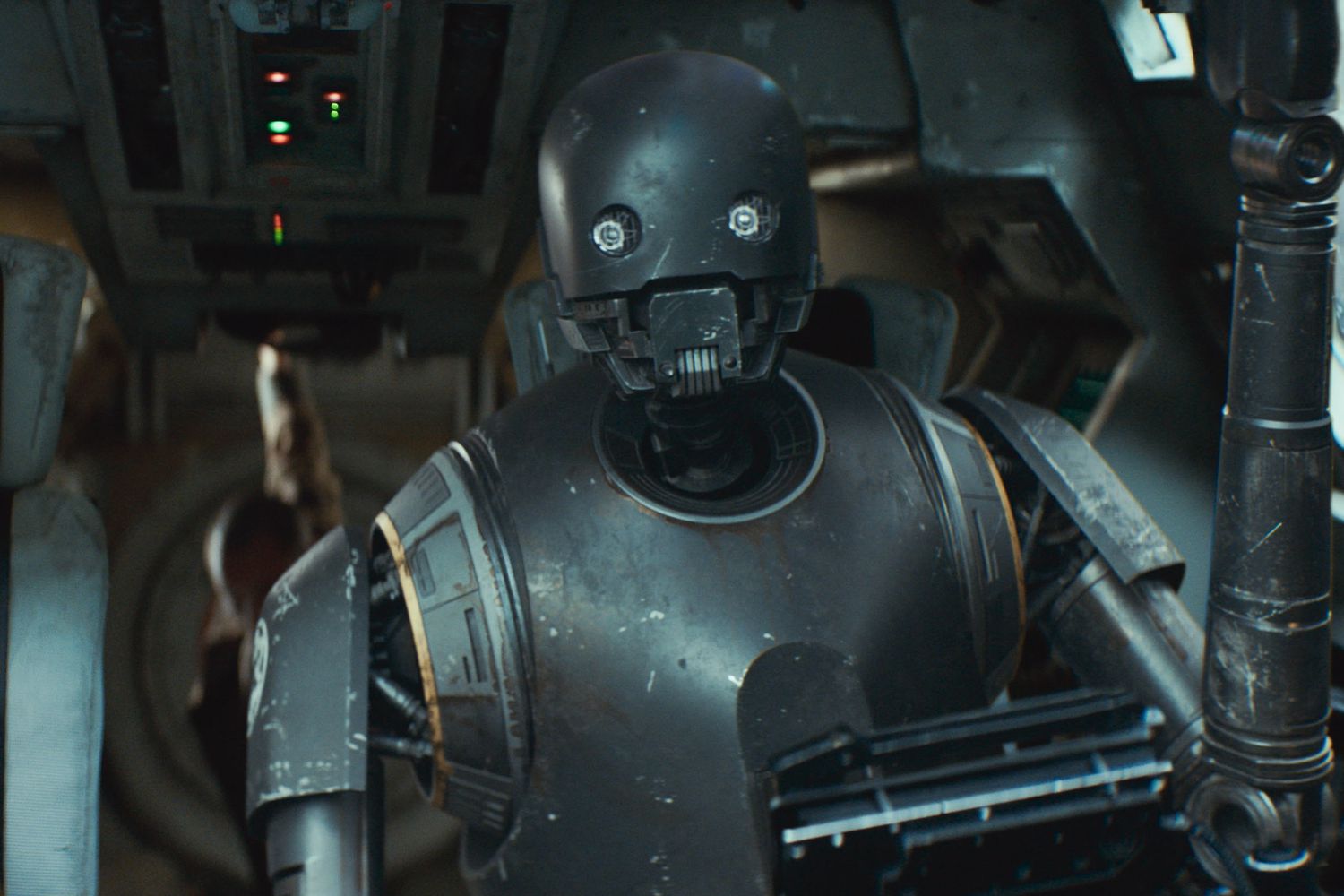

Unseen Andor Details Emerge On Scrapped K 2 So Horror Arc

May 10, 2025

Unseen Andor Details Emerge On Scrapped K 2 So Horror Arc

May 10, 2025 -

Indias Action Against Misinformation X To Remove 8 000 Accounts

May 10, 2025

Indias Action Against Misinformation X To Remove 8 000 Accounts

May 10, 2025 -

Shohei Ohtanis Mammoth Contract Agent On His Clients Decision

May 10, 2025

Shohei Ohtanis Mammoth Contract Agent On His Clients Decision

May 10, 2025 -

Major Crisp Recall Possible Health Risk Prompts Urgent Warning

May 10, 2025

Major Crisp Recall Possible Health Risk Prompts Urgent Warning

May 10, 2025 -

U S China Trade Deal Hopes Lift Oil Prices Higher

May 10, 2025

U S China Trade Deal Hopes Lift Oil Prices Higher

May 10, 2025

Latest Posts

-

Singapore Welcomes Seas New Digital Finance Hub

May 10, 2025

Singapore Welcomes Seas New Digital Finance Hub

May 10, 2025 -

Golden State Warriors Minnesota Timberwolves Box Score And Playoff Highlights May 8 2025

May 10, 2025

Golden State Warriors Minnesota Timberwolves Box Score And Playoff Highlights May 8 2025

May 10, 2025 -

Stauffer Highlights Kanes Value Significant Impact Debated

May 10, 2025

Stauffer Highlights Kanes Value Significant Impact Debated

May 10, 2025 -

Steve Kerr Receives Backing From Magic Johnson During High Stakes Playoffs

May 10, 2025

Steve Kerr Receives Backing From Magic Johnson During High Stakes Playoffs

May 10, 2025 -

Bitcoin Boosts Bhutan 248 M Investment Funds Innovative National Tourism Payments

May 10, 2025

Bitcoin Boosts Bhutan 248 M Investment Funds Innovative National Tourism Payments

May 10, 2025