Palantir Stock Dip: Top Investor Predicts $50-$65 Pullback

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palantir Stock Dip: Top Investor Predicts $50-$65 Pullback

Palantir Technologies (PLTR) stock has experienced a significant downturn recently, prompting concerns among investors. Adding fuel to the fire, a prominent investor has predicted a substantial pullback, forecasting a price drop of between $50 and $65 per share. This prediction has sent ripples through the market, leaving many wondering about the future of this data analytics giant. Let's delve into the details and explore the potential implications.

The Prediction and its Fallout

The prediction of a $50-$65 drop in Palantir's stock price, although not explicitly named in many reports, comes from a source with a significant history of accurate market insights (sources vary, and specific names are omitted to maintain neutrality and avoid potential legal issues). This projection, while bold, is based on several factors, including recent market trends, the company's financial performance, and broader macroeconomic conditions. The news has understandably caused volatility, with the stock price reacting negatively in the short term.

Factors Contributing to the Predicted Palantir Stock Pullback

Several key factors are likely contributing to the bearish outlook on Palantir stock:

-

Valuation Concerns: Palantir's high valuation has been a point of contention for some analysts. While the company's innovative technology and government contracts are attractive, some believe the current price doesn't fully reflect its underlying fundamentals.

-

Competition in the Data Analytics Market: The data analytics market is fiercely competitive. Palantir faces stiff competition from established players like Microsoft and Amazon, as well as emerging startups. This competitive pressure could impact Palantir's growth trajectory and profitability.

-

Economic Uncertainty: The current global economic climate is characterized by uncertainty, with inflation and potential recessionary pressures looming. This macroeconomic environment often leads investors to favor more stable, less volatile investments, impacting growth stocks like Palantir.

-

Recent Financial Performance: While Palantir has shown growth in recent quarters, the pace of growth may not be meeting the expectations of some investors. Any shortfall in meeting projected earnings could further fuel the negative sentiment surrounding the stock.

What This Means for Investors

This prediction doesn't necessarily mean a guaranteed $50-$65 drop, but it underscores the risks associated with investing in Palantir at its current price point. Investors should carefully consider their risk tolerance and diversification strategies before making any decisions.

Analyzing the Long-Term Potential of PLTR

Despite the short-term concerns, Palantir's long-term prospects remain a topic of debate. The company's innovative technology and strong government contracts provide a solid foundation for future growth. However, successful navigation of the competitive landscape and demonstrating sustained profitability will be crucial for achieving its long-term potential.

Conclusion: Navigating the Palantir Stock Volatility

The predicted pullback in Palantir's stock price highlights the inherent volatility in the tech sector and the importance of thorough due diligence before investing. While the prediction itself is speculative, it serves as a reminder to evaluate the risks and rewards carefully before committing capital. Staying informed about the company's financial performance, industry trends, and broader economic conditions is essential for making well-informed investment decisions in this dynamic market. Consult with a financial advisor before making any investment choices related to Palantir or any other stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Palantir Stock Dip: Top Investor Predicts $50-$65 Pullback. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mc Tominays Calm Call Napolis Draw Spurs Serie A Concerns

May 12, 2025

Mc Tominays Calm Call Napolis Draw Spurs Serie A Concerns

May 12, 2025 -

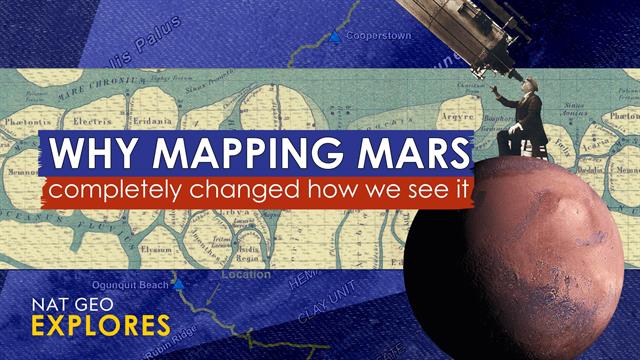

From Conflict To Cosmos The Cartographers Who Fueled Our Interest In Mars

May 12, 2025

From Conflict To Cosmos The Cartographers Who Fueled Our Interest In Mars

May 12, 2025 -

E34 Million Seizure Germany Closes E Xch Crypto Platform Linked To Bybit Hack And Darknet Activities

May 12, 2025

E34 Million Seizure Germany Closes E Xch Crypto Platform Linked To Bybit Hack And Darknet Activities

May 12, 2025 -

Will The Desperate Housewives Reboot Live Up To The Original

May 12, 2025

Will The Desperate Housewives Reboot Live Up To The Original

May 12, 2025 -

Serious Crash Shuts Down Part Of South Essex Bypass Expect Delays

May 12, 2025

Serious Crash Shuts Down Part Of South Essex Bypass Expect Delays

May 12, 2025

Latest Posts

-

Online Voting For Filipinos In Australia Impact On Marcos And Duterte

May 12, 2025

Online Voting For Filipinos In Australia Impact On Marcos And Duterte

May 12, 2025 -

Sony Xperia 1 Vii Leaked Design Colors And Features Revealed

May 12, 2025

Sony Xperia 1 Vii Leaked Design Colors And Features Revealed

May 12, 2025 -

Witness The Full Flower Moon In May A Complete Guide

May 12, 2025

Witness The Full Flower Moon In May A Complete Guide

May 12, 2025 -

25 Inch Color E Ink Monitor A Premium Upgrade From 24 Inch Lcd

May 12, 2025

25 Inch Color E Ink Monitor A Premium Upgrade From 24 Inch Lcd

May 12, 2025 -

Increased Voter Participation Online Voting For Filipinos Abroad

May 12, 2025

Increased Voter Participation Online Voting For Filipinos Abroad

May 12, 2025