Palantir Stock Dips Despite Raised Full-Year Guidance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palantir Stock Dips Despite Raised Full-Year Guidance: What Investors Should Know

Palantir Technologies (PLTR) saw its stock price dip despite the company raising its full-year revenue guidance, leaving many investors scratching their heads. The seemingly contradictory performance highlights the complex interplay of market sentiment, future expectations, and the inherent volatility of the tech sector. Let's delve into the details and explore what this means for Palantir and its investors.

Strong Revenue Growth, Yet Stock Takes a Hit

On [Date of Earnings Release], Palantir announced better-than-expected second-quarter earnings, reporting [Insert Q2 Revenue Figures] in revenue, exceeding analyst predictions. Furthermore, the company boosted its full-year revenue outlook to a range of [Insert Full-Year Revenue Guidance], previously estimated at [Insert Previous Full-Year Revenue Guidance]. This positive news, however, failed to ignite investor enthusiasm, with PLTR shares experiencing a [Percentage] decline in after-hours trading.

Why the Dip? Unpacking Investor Sentiment

Several factors likely contributed to the stock's underwhelming performance despite the raised guidance.

-

Profitability Concerns: While revenue growth is encouraging, Palantir continues to operate at a loss. Investors remain focused on the company's path to profitability, and the current results may not have been deemed sufficient to warrant a significant stock price increase. Concerns surrounding operating margins and the long-term sustainability of the business model likely played a role.

-

Market Volatility: The broader tech sector has experienced considerable volatility in recent months, influenced by macroeconomic factors like rising interest rates and inflation. This overall market downturn might have overshadowed Palantir's positive news, impacting investor confidence across the board.

-

Valuation Concerns: Palantir's valuation remains a point of debate among analysts. Some believe the stock is overvalued relative to its current financial performance, leading to cautiousness among investors. The raised guidance, while positive, may not have been enough to alleviate these valuation concerns.

-

Competition and Market Saturation: The data analytics market is increasingly competitive. Palantir faces pressure from established players and emerging startups, potentially limiting its long-term growth potential in the eyes of some investors.

What's Next for Palantir?

Despite the short-term setback, Palantir's long-term prospects remain a topic of significant discussion. The company's focus on government contracts and its growing presence in the commercial sector offer potential for continued growth. However, investors will be closely monitoring the company's progress towards profitability and its ability to navigate the competitive landscape. Key factors to watch include:

-

Government Contracts: Securing substantial government contracts will remain crucial for Palantir's revenue stream and overall growth trajectory.

-

Commercial Expansion: The success of Palantir's efforts to expand its commercial client base will be a critical indicator of its long-term viability.

-

Profitability Milestones: Investors will closely scrutinize Palantir's progress towards achieving sustainable profitability.

Conclusion:

The dip in Palantir's stock price despite raised full-year guidance underscores the complex factors influencing investor sentiment in the tech sector. While the company reported strong revenue growth, concerns about profitability, market volatility, valuation, and competition likely contributed to the negative market reaction. The coming quarters will be crucial in determining whether Palantir can successfully address these concerns and regain investor confidence. The company's ability to execute its strategic initiatives and deliver on its promises will be vital in shaping its future performance and stock price.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Palantir Stock Dips Despite Raised Full-Year Guidance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Economic Headwinds And Tariffs A Double Threat To Hollywoods Future

May 06, 2025

Economic Headwinds And Tariffs A Double Threat To Hollywoods Future

May 06, 2025 -

Thunder Nuggets Nba Playoffs Key Players And Potential Outcomes

May 06, 2025

Thunder Nuggets Nba Playoffs Key Players And Potential Outcomes

May 06, 2025 -

Urgent Security Alert Leading Global Bank Highlights Widespread Technology Vulnerability

May 06, 2025

Urgent Security Alert Leading Global Bank Highlights Widespread Technology Vulnerability

May 06, 2025 -

Astros Vs Brewers A Deep Dive Into The Blanco Myers Pitching Matchup

May 06, 2025

Astros Vs Brewers A Deep Dive Into The Blanco Myers Pitching Matchup

May 06, 2025 -

Canvas Meets Code Exploring The Intersection Of Art And Technology In Nyc

May 06, 2025

Canvas Meets Code Exploring The Intersection Of Art And Technology In Nyc

May 06, 2025

Latest Posts

-

Dissecting The Oklahoma City Thunder Identifying Key Issues

May 06, 2025

Dissecting The Oklahoma City Thunder Identifying Key Issues

May 06, 2025 -

Mlb Betting Adames Home Run Odds For Cubs Game May 5th

May 06, 2025

Mlb Betting Adames Home Run Odds For Cubs Game May 5th

May 06, 2025 -

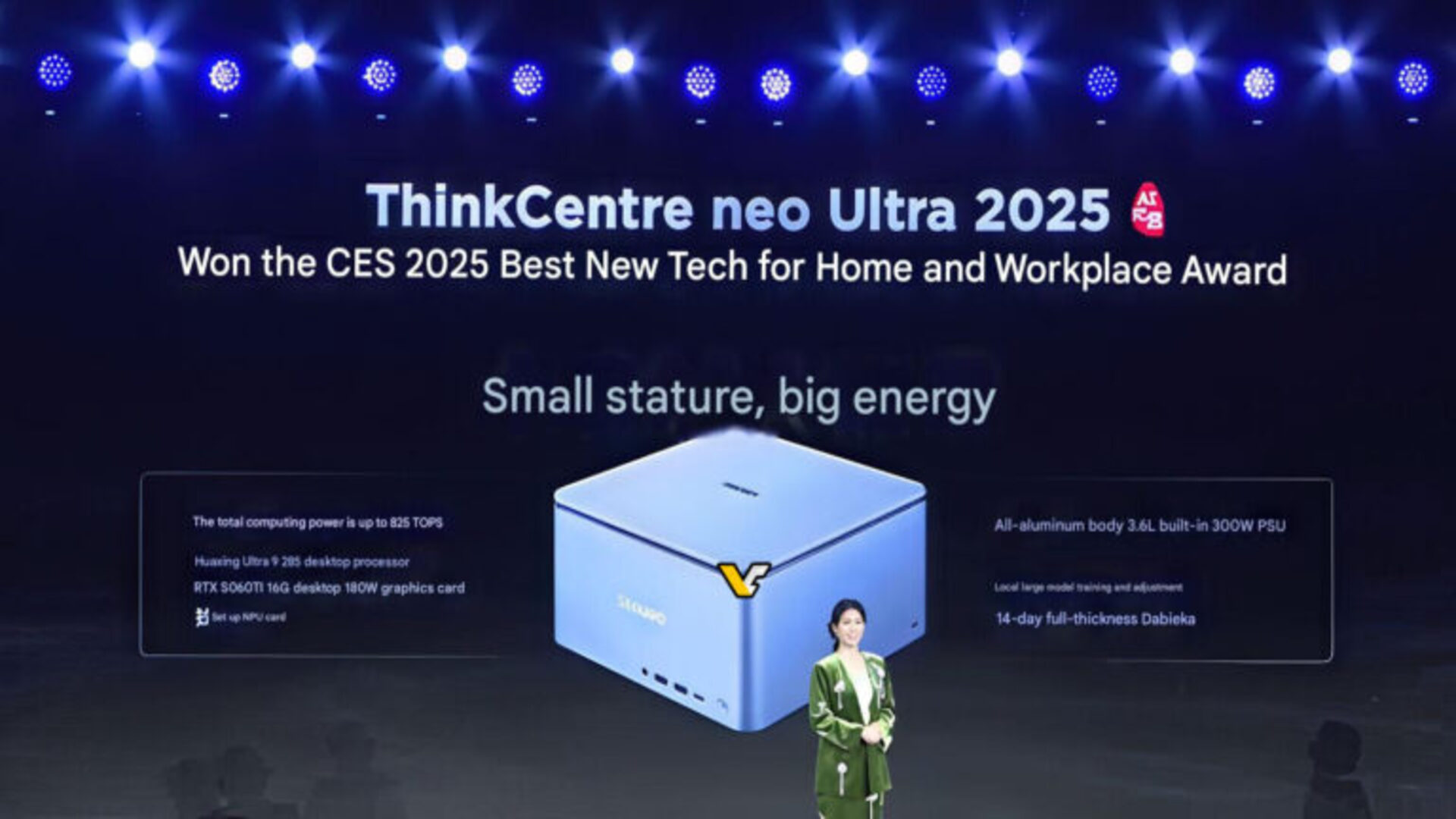

Lenovos New Intel Powered Workstation A Direct Competitor To Apples Mac Studio

May 06, 2025

Lenovos New Intel Powered Workstation A Direct Competitor To Apples Mac Studio

May 06, 2025 -

Space X Starbase New Flame Trench Complete Next Steps In Starship Development

May 06, 2025

Space X Starbase New Flame Trench Complete Next Steps In Starship Development

May 06, 2025 -

Playoffs Can Gilgeous Alexander And The Thunder Overcome The Nuggets Experience

May 06, 2025

Playoffs Can Gilgeous Alexander And The Thunder Overcome The Nuggets Experience

May 06, 2025