Palo Alto Networks Vs. Nvidia: Which Nasdaq Sell-Off Stock To Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palo Alto Networks vs. Nvidia: Which Nasdaq Sell-Off Stock to Buy?

The recent Nasdaq sell-off has left many investors wondering where to park their money. Two tech giants, Palo Alto Networks and Nvidia, have emerged as potential buys, but choosing between them requires careful consideration. Both companies offer compelling investment opportunities, but their strengths lie in different sectors, making the decision highly dependent on individual investment strategies and risk tolerance. This article will delve into a comparative analysis of Palo Alto Networks and Nvidia, helping you determine which stock aligns best with your portfolio goals.

Understanding the Market Context: The Nasdaq Dip and Tech Stock Volatility

Before diving into the specifics of Palo Alto Networks and Nvidia, it's crucial to understand the current market climate. The recent dip in the Nasdaq reflects broader economic concerns, including rising interest rates and inflation. However, this downturn also presents opportunities for savvy investors to acquire high-growth stocks at potentially discounted prices. Both Palo Alto Networks and Nvidia, while experiencing some price corrections, remain strong players in their respective markets.

Palo Alto Networks: Cybersecurity Dominance

Palo Alto Networks (PANW) is a cybersecurity leader, offering a comprehensive suite of solutions including next-generation firewalls, cloud security, and threat intelligence. The company's consistent growth and strong market position make it an attractive investment.

Key Strengths of Palo Alto Networks:

- Strong Market Position: PANW holds a leading position in the rapidly expanding cybersecurity market, benefiting from increasing demand for robust security solutions.

- Recurring Revenue Model: A significant portion of PANW's revenue comes from subscription-based services, providing predictable and stable cash flow.

- Consistent Growth: The company has demonstrated a history of consistent revenue and earnings growth.

- Focus on Innovation: PANW continuously invests in research and development, ensuring it stays ahead of evolving cyber threats.

Potential Risks of Palo Alto Networks:

- High Valuation: PANW's stock price reflects its strong performance, potentially making it vulnerable to market corrections.

- Competition: The cybersecurity market is competitive, with several established players and emerging startups vying for market share.

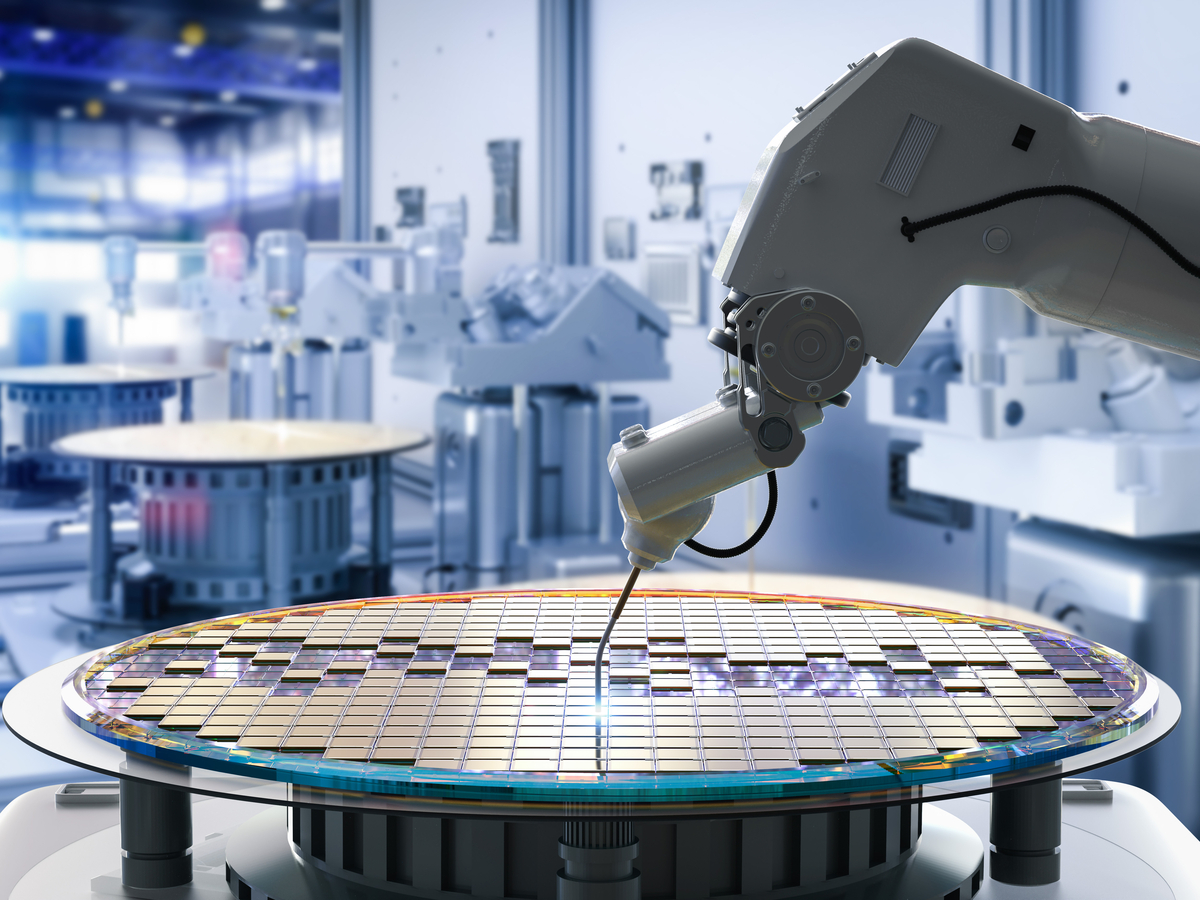

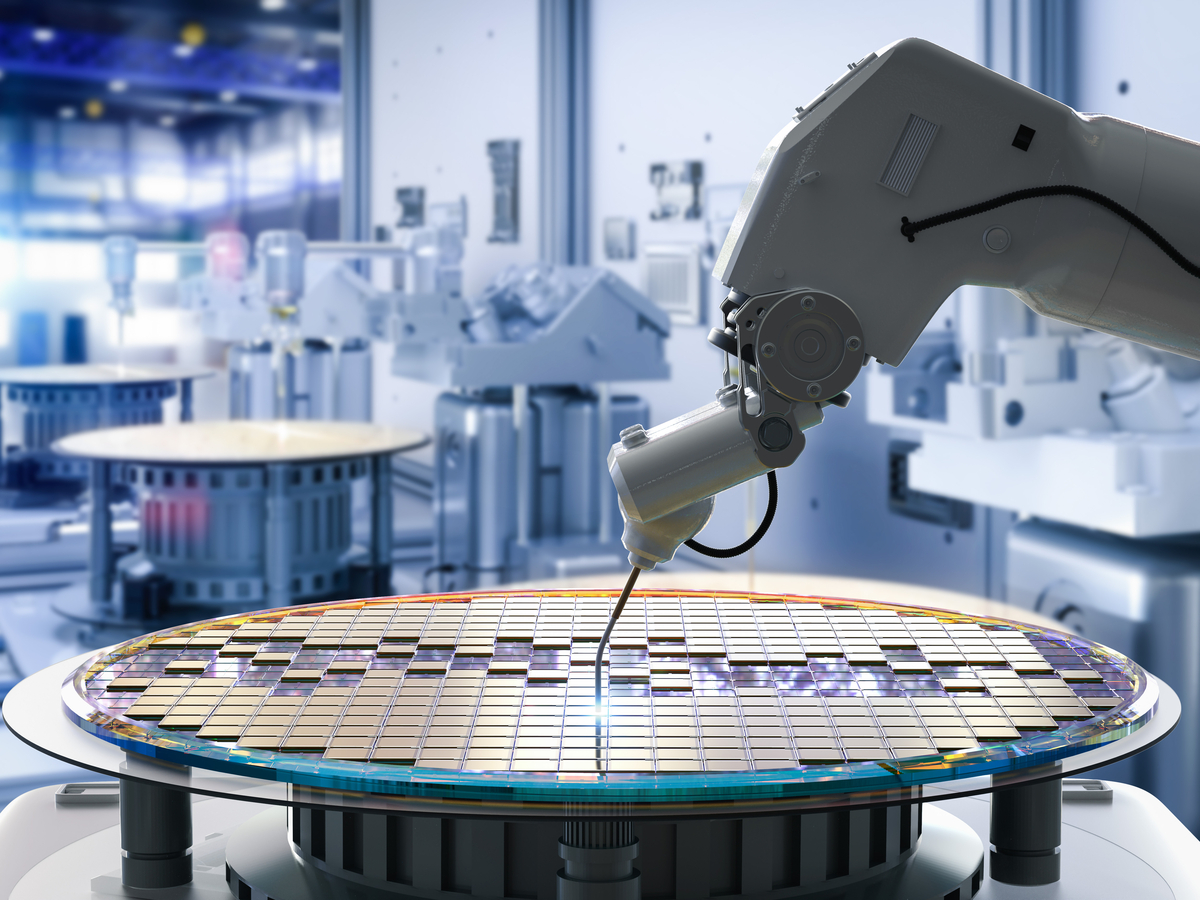

Nvidia: The Powerhouse of AI and Graphics Processing

Nvidia (NVDA) is a dominant force in the graphics processing unit (GPU) market, with its products powering everything from gaming PCs to high-performance computing (HPC) and artificial intelligence (AI) applications. The explosive growth of AI has significantly boosted NVDA's stock price, making it a highly sought-after investment.

Key Strengths of Nvidia:

- Dominance in GPU Market: NVDA holds a commanding position in the GPU market, particularly in the high-growth AI segment.

- AI Growth Catalyst: The increasing adoption of AI across various industries is a major driver of NVDA's growth.

- Data Center Business: NVDA's data center business is expanding rapidly, fueling significant revenue growth.

- Strong Brand Recognition: NVDA enjoys strong brand recognition and a loyal customer base.

Potential Risks of Nvidia:

- High Dependence on AI: NVDA's growth is significantly tied to the continued growth of the AI market, making it susceptible to potential slowdowns.

- Supply Chain Challenges: Like many tech companies, NVDA faces potential supply chain disruptions.

- Valuation Concerns: Similar to PANW, NVDA's high valuation might make it susceptible to market corrections.

Palo Alto Networks vs. Nvidia: The Verdict

Choosing between Palo Alto Networks and Nvidia ultimately depends on your investment horizon and risk tolerance.

-

For investors seeking a more stable, established company with a strong recurring revenue model, Palo Alto Networks might be a better fit. Its position in the crucial cybersecurity sector offers relative stability compared to the more volatile AI market.

-

For investors with a higher risk tolerance and a longer-term perspective, Nvidia's potential for explosive growth in the AI sector is undeniably attractive. However, this higher growth potential comes with increased volatility.

Ultimately, thorough due diligence, considering your personal investment goals, and consulting with a financial advisor are crucial before making any investment decisions. The information provided here is for informational purposes only and not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Palo Alto Networks Vs. Nvidia: Which Nasdaq Sell-Off Stock To Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mass Brawl Disrupts Saints And Power Afl Match Hogans Controversial Act

Apr 07, 2025

Mass Brawl Disrupts Saints And Power Afl Match Hogans Controversial Act

Apr 07, 2025 -

Brinker A Rising Star In Defense Technology 2025 Predictions

Apr 07, 2025

Brinker A Rising Star In Defense Technology 2025 Predictions

Apr 07, 2025 -

Dihajar Tarif Trump Strategi Cerdas China Selamatkan Ekonomi

Apr 07, 2025

Dihajar Tarif Trump Strategi Cerdas China Selamatkan Ekonomi

Apr 07, 2025 -

La Angels Rout Cleveland Guardians A Night Of Offensive Power

Apr 07, 2025

La Angels Rout Cleveland Guardians A Night Of Offensive Power

Apr 07, 2025 -

New Tron Ares Teaser Showcases Ai Powered Sci Fi Combat

Apr 07, 2025

New Tron Ares Teaser Showcases Ai Powered Sci Fi Combat

Apr 07, 2025